Can Stellar bounce again? XLM returns to crucial retest zone

26.07.2025 18:00 2 min. read Kosta Gushterov

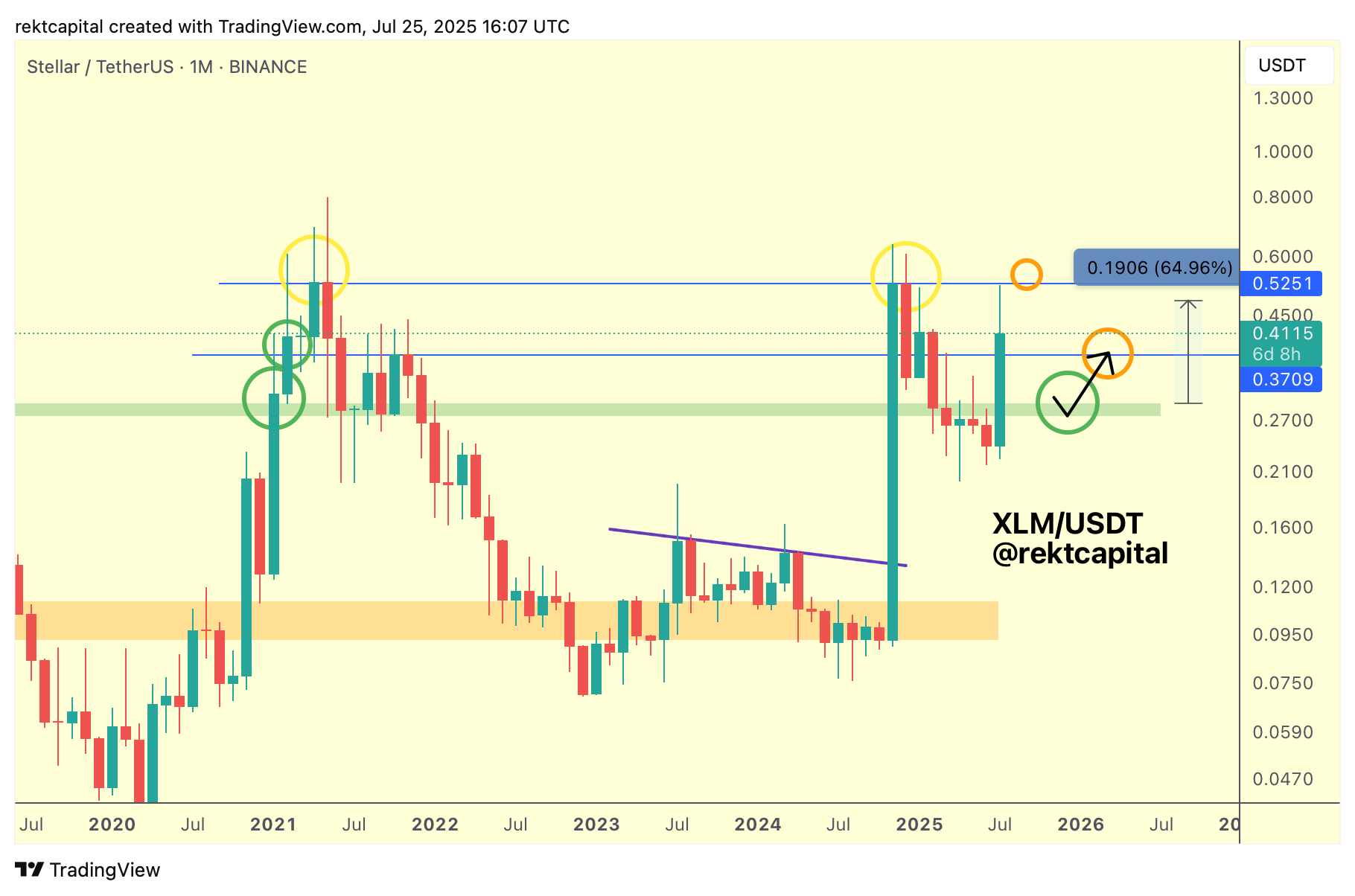

Stellar (XLM) is once again approaching a decisive technical moment after facing a familiar rejection at the $0.52 resistance zone.

According to crypto analyst RektCapital, the altcoin may soon revisit the $0.37 level, a historical area that has played a critical role in past market cycles.

XLM recently rallied over +64% after breaking out from a long-term weekly downtrending channel, a move that energized bullish sentiment across its trading pairs. However, as RektCapital noted in his previous Altcoin Newsletter, the $0.52 resistance remains a major obstacle—one that has turned away Stellar multiple times in the past.

The latest rejection at this level closely mirrors price behavior seen during late 2020 and early 2021. In those cycles, a successful retest of support led to a fresh rally and a second attempt at the range high. In contrast, failed retests—such as those observed in late 2024—were followed by deeper downside moves.

With Stellar now hovering just above the $0.37 mark, the market’s attention turns to whether this level can hold as support. A confirmed retest would align with bullish historical precedents and potentially launch XLM back toward the $0.52 high. However, volatility during such a move could still lead to downside wicks before stability resumes.

RektCapital emphasizes the importance of context in interpreting these moves. While history doesn’t guarantee a repeat, it often rhymes—making this current retest attempt a pivotal technical moment for Stellar bulls and bears alike.

Traders will be watching closely as XLM’s next steps could either reignite the breakout or signal renewed consolidation if $0.37 fails to hold.

-

1

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

2

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

3

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

15.07.2025 19:00 2 min. read

XRP Eyes Next Target as Bullish Crossover Sparks 560% Surge

XRP is back in the spotlight after crypto analyst EGRAG CRYPTO highlighted a powerful historical pattern on the weekly timeframe—the bullish crossover of the 21 EMA and 55 SMA.

Top 5 Most Trending Cryptocurrencies Today: Zora, Pudgy Penguins, SUI and More

Crypto markets are buzzing with momentum as several altcoins post double-digit gains and surging volumes.

Sui Price Jumps 14% to $4.26 amid ETF Hopes

Sui (SUI) surged 14% in the past 24 hours, reaching $4.26 as bullish technical patterns, Bitcoin’s rebound, and renewed ETF speculation pushed the altcoin higher.

HBAR Mirrors 2021 Cycle as Key Breakout Test Approaches

Hedera Hashgraph (HBAR) is closely tracking its 2021 price behavior, according to crypto analyst Rekt Capital.

-

1

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

2

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

3

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

15.07.2025 19:00 2 min. read