Robert Kiyosaki Warns: ETFs Aren’t The Real Thing

26.07.2025 7:00 2 min. read Kosta Gushterov

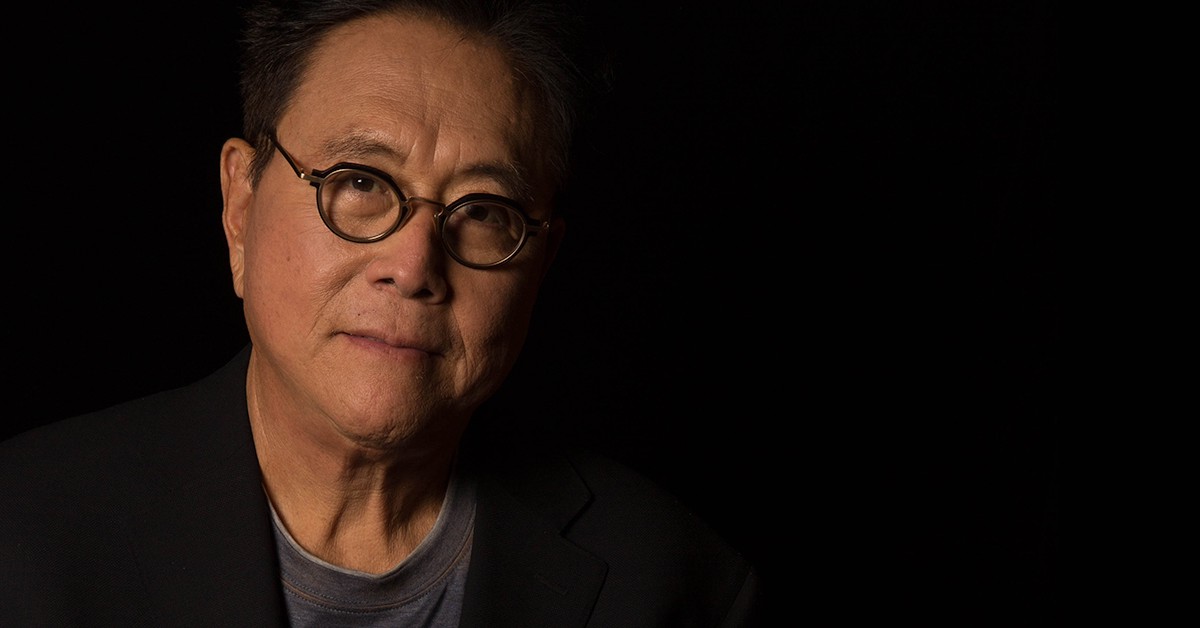

Renowned author and financial educator Robert Kiyosaki has issued a word of caution to everyday investors relying too heavily on exchange-traded funds (ETFs).

In a recent post, Kiyosaki acknowledged that ETFs make investing more accessible to the average person, particularly in assets like gold, silver, and Bitcoin. However, he warned that paper-based investments may fall short in times of real economic stress.

“For the average investor I recommend: Gold ETFs, Silver ETFs, and Bitcoin ETFs,” Kiyosaki stated. Yet he quickly added, “An ETF is like having a picture of a gun for personal defense.”

The Rich Dad Poor Dad author emphasized that while ETFs can provide exposure to hard assets, they are not a substitute for holding the physical commodity or digital asset. He used the analogy of owning a photograph of a gun instead of a real one—illustrating the potential danger in assuming paper assets offer the same protection as their tangible counterparts.

“Sometimes it’s best to have real gold, silver, Bitcoin, and a gun,” he advised, underscoring the value of tangible ownership during uncertain times.

Kiyosaki concluded by encouraging investors to understand when it’s appropriate to hold ETFs and when physical assets are necessary. “If you know the differences, and how to use them… you’re better than average.”

Kiyosaki has long been a proponent of hard assets and Bitcoin as a hedge against inflation, fiat currency devaluation, and systemic risk. His latest remarks come at a time when interest in Bitcoin ETFs has surged globally, raising questions about whether retail investors may be lulled into a false sense of security by exposure that is ultimately custodial and paper-based.

-

1

Trump Imposes 50% Tariff on Brazil: Political Tensions and Censorship at the Center

10.07.2025 7:00 2 min. read -

2

Key Crypto Events to Watch in the Next Months

20.07.2025 22:00 2 min. read -

3

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

08.07.2025 8:30 2 min. read -

4

UAE Regulators Dismiss Toncoin Residency Rumors

07.07.2025 11:12 2 min. read -

5

Ripple Selects BNY Mellon as Custodian for RLUSD Stablecoin Reserves

09.07.2025 15:28 2 min. read

Two Upcoming Decisions Could Shake Crypto Markets This Week

The final days of July could bring critical developments that reshape investor sentiment and influence the next leg of the crypto market’s trend.

Winklevoss Slams JPMorgan for Blocking Gemini’s Banking Access

Tyler Winklevoss, co-founder of crypto exchange Gemini, has accused JPMorgan of retaliating against the platform by freezing its effort to restore banking services.

Bitwise CIO: The Four-Year Crypto Cycle is Breaking Down

The classic four-year crypto market cycle—long driven by Bitcoin halvings and boom-bust investor behavior—is losing relevance, according to Bitwise CIO Matt Hougan.

Strategy to Raise Another $2.47 Billion for Bitcoin Acquisition

Strategy the company formerly known as MicroStrategy, has announced the pricing of a new $2.47 billion capital raise through its initial public offering of Variable Rate Series A Perpetual Stretch Preferred Stock (STRC).

-

1

Trump Imposes 50% Tariff on Brazil: Political Tensions and Censorship at the Center

10.07.2025 7:00 2 min. read -

2

Key Crypto Events to Watch in the Next Months

20.07.2025 22:00 2 min. read -

3

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

08.07.2025 8:30 2 min. read -

4

UAE Regulators Dismiss Toncoin Residency Rumors

07.07.2025 11:12 2 min. read -

5

Ripple Selects BNY Mellon as Custodian for RLUSD Stablecoin Reserves

09.07.2025 15:28 2 min. read