BlackRock’s Ethereum ETF Surpasses $10B, Becomes 3rd Fastest in History

24.07.2025 17:28 2 min. read Kosta Gushterov

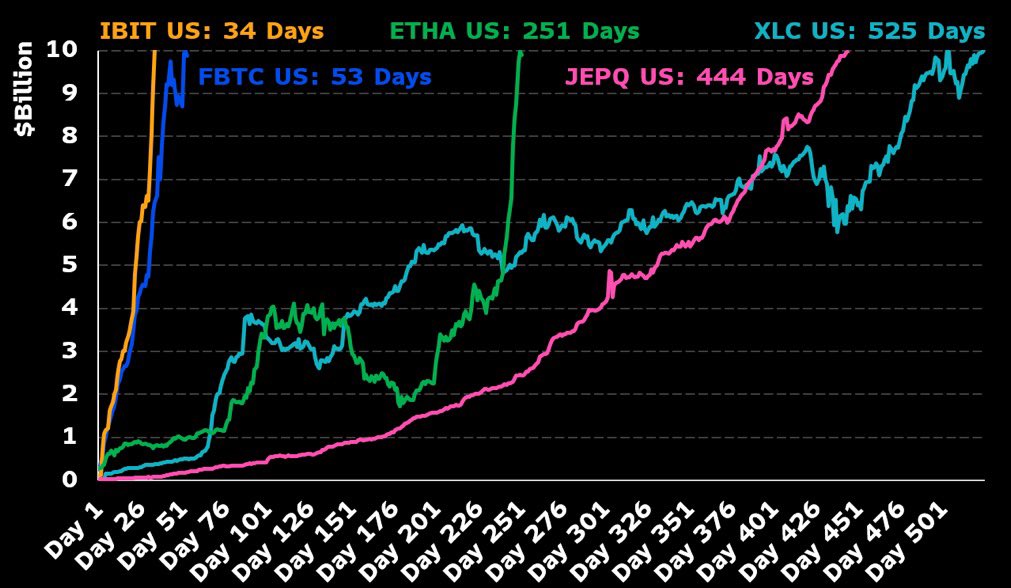

BlackRock’s Ethereum ETF, $ETHA, has officially crossed the $10 billion asset mark, doing so in just 251 days, according to newly released data.

This achievement makes it the third fastest ETF in history to reach the milestone, trailing only behind the Bitcoin ETFs $IBIT (34 days) and $FBTC (53 days).

The chart highlights $ETHA’s meteoric rise, showing how it outpaced traditional ETFs like $JEPI and $XLC, which took 444 and 525 days, respectively, to reach the same level of assets under management (AUM).

Ethereum demand surges amid ETF momentum

BlackRock’s success with $ETHA reflects the growing institutional appetite for Ethereum exposure, especially after regulatory clarity and Ethereum ETF approvals earlier this year.

The ETF’s rapid capital inflow signals strong conviction in Ethereum as more than just a digital asset—positioning it as a serious infrastructure layer for Web3, DeFi, and tokenized real-world assets.

$ETHA’s explosive growth also comes amid broader strength in the crypto market, with Ethereum’s price hovering near multi-month highs and outperforming Bitcoin on several institutional metrics.

ETF race intensifies between crypto and TradFi giants

BlackRock’s $ETHA now joins $IBIT (iShares Bitcoin ETF) and $FBTC (Fidelity Bitcoin ETF) at the top of the ETF leaderboard, signaling a shift in capital markets where crypto-native funds are scaling faster than legacy sector ETFs.

As Ethereum ETF products continue to gain traction, analysts expect even more inflows in Q3 and Q4, potentially pushing AUM beyond $15 billion by year-end—especially if ETH’s price momentum continues alongside altcoin season.

-

1

Top 10 Trending Altcoins Right Now, According to CoinGecko Data

13.07.2025 17:30 3 min. read -

2

Ethereum and Solana 2025 Update: Upgrades, Growth, and What’s next

12.07.2025 14:30 2 min. read -

3

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

4

XRP Surges Toward $3: Main Factors Driving the Rally

16.07.2025 12:18 2 min. read -

5

Stellar (XLM) Surges 60% in 7 Days Amid Breakout and Partnerships

17.07.2025 14:33 2 min. read

Altcoin Breakout: ResearchCoin, Electroneum, and REI Network Lead The Rally

A wave of bullish momentum is sweeping through smaller-cap altcoins, with ResearchCoin (RSC), Electroneum (ETN), and REI Network (REI) all recording substantial 24-hour gains.

ETF Speculation and Legal Clarity Renew Optimism for XRP and Solana

XRP is drawing fresh investor attention as optimism builds around its legal standing and potential exchange-traded products (ETPs).

Ethereum: What The Last Move Tells us About the Next One

Ethereum is showing strength in the face of broader market weakness, holding firm even as Bitcoin and other major assets trend downward.

PENGU Price Eyes Bounce From Key Support Level – What’s Next?

Pudgy Penguins’ native token $PENGU is attracting renewed attention from traders after showing consistent support at a key technical level.

-

1

Top 10 Trending Altcoins Right Now, According to CoinGecko Data

13.07.2025 17:30 3 min. read -

2

Ethereum and Solana 2025 Update: Upgrades, Growth, and What’s next

12.07.2025 14:30 2 min. read -

3

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

4

XRP Surges Toward $3: Main Factors Driving the Rally

16.07.2025 12:18 2 min. read -

5

Stellar (XLM) Surges 60% in 7 Days Amid Breakout and Partnerships

17.07.2025 14:33 2 min. read