Strategy’s $71B in Bitcoin Now Ranks Among Top 10 S&P 500 Treasuries

19.07.2025 19:30 2 min. read Kosta Gushterov

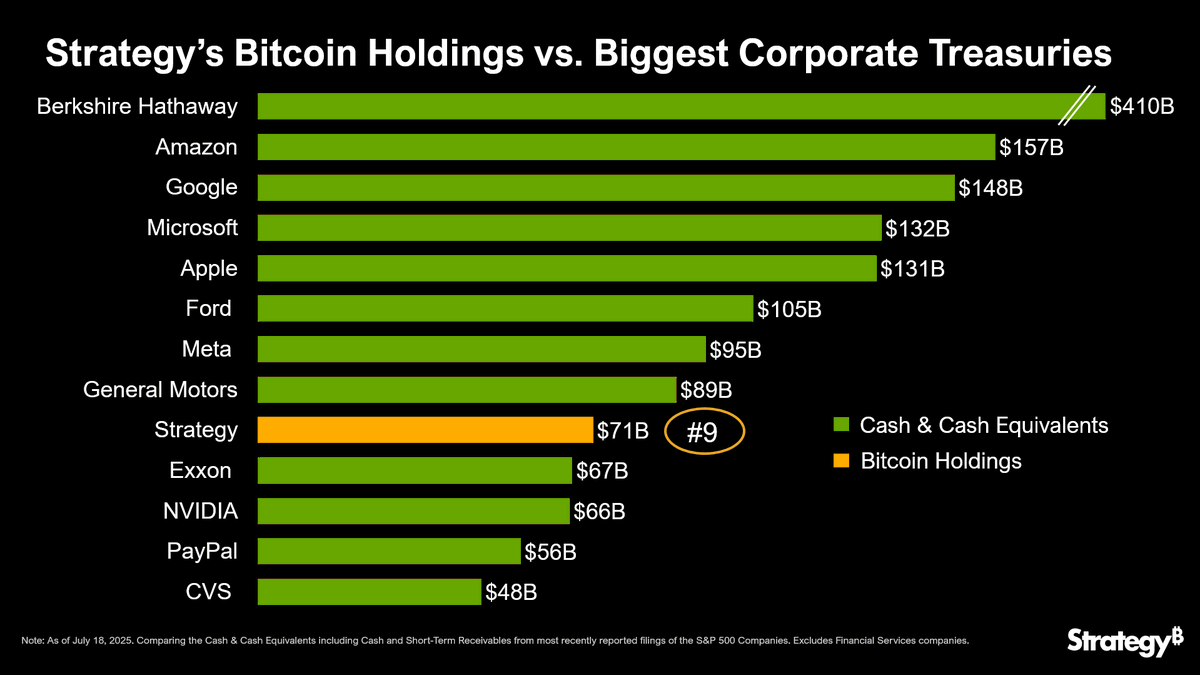

Seems like Strategy has officially broken into the top 10 S&P 500 corporate treasuries with its massive $71 billion in Bitcoin holdings—ranking 9th overall and leapfrogging major firms like Exxon, NVIDIA, and PayPal.

The update, visualized in a chart shared by Cointelegraph, compares Strategy’s Bitcoin treasury directly against the cash reserves of the biggest U.S. companies as of July 18, 2025.

While traditional corporate treasuries are still dominated by cash and equivalents, Strategy stands out as the only firm in the top 10 whose reserve is entirely held in Bitcoin. This places it just behind General Motors ($89B) and Meta ($95B), and well ahead of Exxon ($67B), NVIDIA ($66B), and PayPal ($56B). CVS rounds out the list with $48B in cash.

A Bitcoin-Only Treasury Approach

Topping the treasury leaderboard is Warren Buffett’s Berkshire Hathaway with a staggering $410 billion in cash, followed by Amazon ($157B), Google ($148B), Microsoft ($132B), and Apple ($131B). These giants continue to hold conservative liquid assets, but Strategy’s contrarian move into Bitcoin has not gone unnoticed.

The chart also highlights the diversification Strategy brings to the S&P 500 financial structure. With no short-term receivables or fiat cash equivalents reported, the company’s entire liquidity strategy is built around Bitcoin—a bold signal of long-term conviction in the asset’s future performance and value preservation qualities.

Institutional Crypto Adoption Gains Momentum

Strategy’s position reflects more than just aggressive crypto accumulation—it represents a strategic realignment of treasury philosophy. By converting large portions of capital into Bitcoin rather than traditional instruments, the firm aims to hedge against inflation and fiat depreciation while positioning itself as a Bitcoin-first enterprise.

The milestone also reinforces the growing institutional embrace of Bitcoin in 2025. As digital assets gain broader recognition, more firms may follow Strategy’s example—diversifying their balance sheets and gaining exposure to decentralized, scarce assets with asymmetric upside potential. Whether this approach will inspire imitators or remain a bold outlier remains to be seen, but for now, Strategy has secured its place among America’s biggest treasuries—with Bitcoin at the core.

-

1

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

30.06.2025 15:00 2 min. read -

2

UniCredit to Launch Structured Product Tied to BlackRock’s Spot Bitcoin ETF

01.07.2025 17:53 1 min. read -

3

10,000 Dormant Bitcoin Moved After 14 Years: Volatility Ahead?

04.07.2025 20:00 2 min. read -

4

Second Largest Bank in Spain Rolls out in-app Bitcoin and Ethereum Trading

07.07.2025 15:30 2 min. read -

5

Saylor’s Strategy Halts Bitcoin Buying After Historic Accumulation

07.07.2025 17:00 2 min. read

Tim Draper Predicts Bitcoin Will Replace U.S. Dollar

Tim Draper isn’t just betting on Bitcoin—he’s forecasting the death of the U.S. dollar.

UK to Sell Almost $7B in Seized Bitcoin as Treasury Eyes Crypto Boost

The United Kingdom’s Home Office is preparing to liquidate a massive cache of seized cryptocurrency—at least $7 billion worth of Bitcoin—according to a new report by The Telegraph.

Crypto’s Top Narratives in Focus, According to AI

A fresh breakdown from CoinMarketCap’s AI-powered narrative tracker reveals the four most influential crypto trends currently shaping the market: BTCFi & DePIN, U.S. regulatory breakthroughs, AI agent economies, and real-world asset (RWA) tokenization.

How Much Bitcoin You’ll Need to Retire in 2035

A new chart analysis offers a striking projection: how much Bitcoin one would need to retire comfortably by 2035 in different countries—assuming continued BTC price appreciation and 7% inflation adjustment.

-

1

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

30.06.2025 15:00 2 min. read -

2

UniCredit to Launch Structured Product Tied to BlackRock’s Spot Bitcoin ETF

01.07.2025 17:53 1 min. read -

3

10,000 Dormant Bitcoin Moved After 14 Years: Volatility Ahead?

04.07.2025 20:00 2 min. read -

4

Second Largest Bank in Spain Rolls out in-app Bitcoin and Ethereum Trading

07.07.2025 15:30 2 min. read -

5

Saylor’s Strategy Halts Bitcoin Buying After Historic Accumulation

07.07.2025 17:00 2 min. read