Altcoins Gain Momentum as Bitcoin Dominance Drops to 61.6%

17.07.2025 15:30 2 min. read Kosta Gushterov

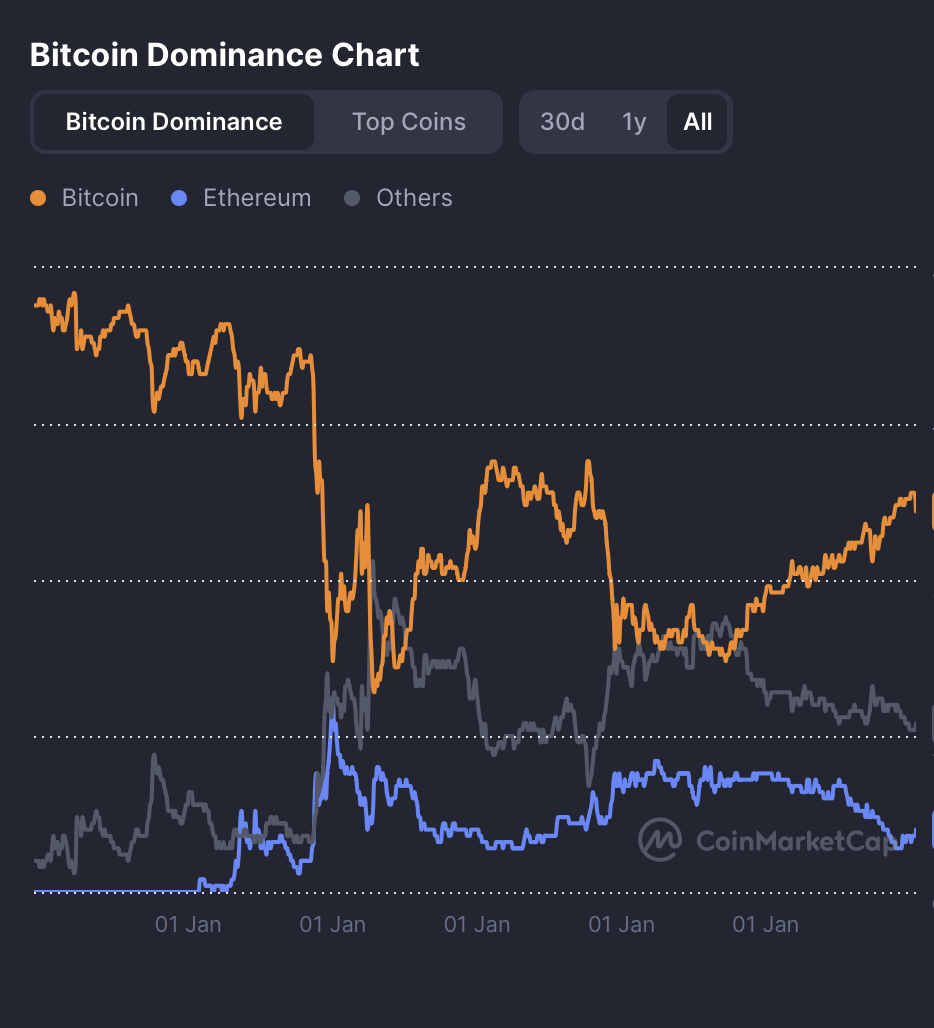

The cryptocurrency market is experiencing a notable shift in capital flows as Bitcoin's market dominance has dropped to 61.6%, marking a 2.36% decrease.

Meanwhile, Ethereum and other altcoins are gaining traction, with Ethereum dominance climbing to 10.9% (+1.51%) and “Others” rising to 27.6% (+0.85%), according to CoinMarketCap data.

Declining BTC dominance signals changing investor sentiment

Bitcoin dominance, which reflects Bitcoin’s share of the total cryptocurrency market cap, is often used as a barometer of market sentiment. A decrease typically signals growing confidence in altcoins or heightened appetite for risk.

Over the past month, BTC dominance has slipped from 64% to its current 61.6% level. Compared to its recent high of 65.1% on June 27, 2025, this trend indicates investors are rotating capital into Ethereum and emerging projects.

Ethereum’s dominance rose from 9.3% last month to 10.9% today, a significant move that aligns with rising institutional interest and the broader narrative of a potential “altseason.” Likewise, the category of “Others”—which includes mid- and small-cap altcoins—gained 1% over the month, suggesting broader diversification among traders.

Market implications and outlook

This redistribution of market share may reflect increased bullishness around Ethereum’s upcoming upgrades, the growth of real-world asset (RWA) tokenization, and speculation around ETF approvals. Ethereum’s 60%+ 7-day price gain, as seen in other data, also reinforces the current altcoin momentum.

If Bitcoin’s dominance continues to decline, it may signal the start of a stronger altcoin rally. However, traders should remain cautious, as sudden shifts in sentiment could lead to volatility, especially if BTC reasserts dominance during broader market corrections.

-

1

Ethereum Core Developer Launches Foundation to Push ETH to $10,000

03.07.2025 20:00 2 min. read -

2

First-Ever Staked Crypto ETF Set to Launch in the U.S. This Week

01.07.2025 9:00 2 min. read -

3

XRP Price Prediction: Price Compression and Higher ETF Approval Odds Could Propel XRP to $4

01.07.2025 20:03 3 min. read -

4

LINK Stuck Below $15 as Whales Accumulate and Retail Stalls, CryptoQuant Reports

03.07.2025 19:00 2 min. read -

5

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read

Ethereum Sparks Altcoin Season as FOMO Shifts Away From Bitcoin

Traders are rapidly shifting their focus to Ethereum and altcoins after Bitcoin’s recent all-time high triggered widespread retail FOMO.

BSTR to Launch With 30,021 BTC, Becomes 4th Largest Public Bitcoin Holder

BSTR Holdings Inc. is set to become the fourth-largest public holder of Bitcoin, announcing it will launch with 30,021 BTC on its balance sheet as part of its public debut.

Ethereum ETF Inflows Hit Record High as Price Jumps Past $3,400

Ethereum saw an explosive surge in institutional demand this week, with spot exchange-traded funds (ETFs) posting their highest single-day inflow on record. O

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

Fartcoin (FARTCOIN) is once again leaving a trail of strong gains as the crypto market rallies. In the past 24 hours alone, the token has produced an 18.2% return as trading volumes have exploded. Data from CoinMarketCap shows that Fartcoin’s volumes have more than doubled during this period. More than $500 million worth of this […]

-

1

Ethereum Core Developer Launches Foundation to Push ETH to $10,000

03.07.2025 20:00 2 min. read -

2

First-Ever Staked Crypto ETF Set to Launch in the U.S. This Week

01.07.2025 9:00 2 min. read -

3

XRP Price Prediction: Price Compression and Higher ETF Approval Odds Could Propel XRP to $4

01.07.2025 20:03 3 min. read -

4

LINK Stuck Below $15 as Whales Accumulate and Retail Stalls, CryptoQuant Reports

03.07.2025 19:00 2 min. read -

5

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read