Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Ethereum Price Prediction: ETH ETFs See $726M Inflow, Is $10K in Sight?

18.07.2025 13:39 5 min. read Nikolay KolevWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

Ethereum (ETH) has just seen a record-breaking $726.74 million daily inflow into its spot ETFs. This helped send its price above $3,600 for the first time since January, with ETH currently up over 20% from this time last week.

ETH has been steadily outperforming Bitcoin (BTC) over the past 30 days, hinting at an altcoin season. XRP just hit an all-time high of $3.6, but will Ethereum pump even higher?

Our Ethereum price prediction analyzes the second largest cryptocurrency’s prospects and considers whether we could see it reach $10,000 this year.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

ETH Sees a New ETF Daily Net Inflow Record as Whales Step In

Ethereum ETFs experienced their largest daily net inflow ever, peaking at $726.74 million on July 16th, a massive step up from the $192.33 million recorded on the previous day. The surge was led by BlackRock’s ETHA, which accounted for $499.25 million of the inflow, according to SoSoValue data.

Following the impressive inflows on July 16th, Ethereum ETFs saw their total net assets rise to $16.41 billion, which means they now hold around 4% of Ethereum’s total circulating supply.

Beyond growing ETF activity, Ethereum is also experiencing a surge in demand from companies that have adopted it as their primary treasury reserve asset.

According to Lookonchain, SharpLinkGaming has accumulated $343.38 million worth of ETH over the past 8 days alone. Over the past 24 hours, Trump’s World Liberty swapped $5 million USDC for ETH, raising its total holdings to $61.7 million worth of ETH.

The massive institutional interest in ETH has also encouraged whales to step in. Lookonchain reported that one whale withdrew 88,292 ETH from Kraken over the past week, valued at $298.26 million.

As fresh capital flows into ETH, on-chain analysts from Coinvo pointed out that Ethereum’s total value of tokenized assets crossed $7.5 billion recently.

This is proof that $ETH will hit $10,000 sooner than you think. pic.twitter.com/hQhWUHt79S

— Coinvo (@ByCoinvo) July 17, 2025

Since the surging tokenization converges with unprecedented ETF inflows and rapid corporate and whale accumulation, it’s no surprise the analysts are confident ETH will reach $10,000 soon.

Although it could be months before ETH climbs to a five-figure mark, the token’s technical indicators reveal it has a strong short-term growth potential. Despite its 35.44% surge over the past 30 days, it still enjoys a 1.85 long/short ratio, which underscores that the majority of traders expect it to keep pushing upward.

Plus, its current price of $3,471 is well above its 50-day Simple Moving Average (SMA) of $2,619, which suggests ETH is positioned for sustained growth.

While a move to the $10,000 mark for ETH would see it grow by 188% from its current price, many investors are already looking beyond Ethereum in anticipation of a broader altcoin season.

One low-cap token that’s gaining momentum is Snorter, with some anlaysts predicting huge gains as its presale sees rapidly growing inflows.

Snorter Presale Nears $2 Million Ahead of Potential Altcoin Season

Expecting the massive capital flowing into leading cryptocurrencies like Ethereum to soon shift to meme coins, investors are showing significant interest in Snorter (SNORT), a meme coin currently in its presale.

That’s because holding SNORT, which currently costs $0.0985 each, ensures its backers get the most out of the project’s upcoming Telegram trading bot for Solana, Snorter Bot. Holding SNORT lets Snorter Bot’s users snipe newly released Solana meme coins with no limits, allowing them to be among the first to secure a position.

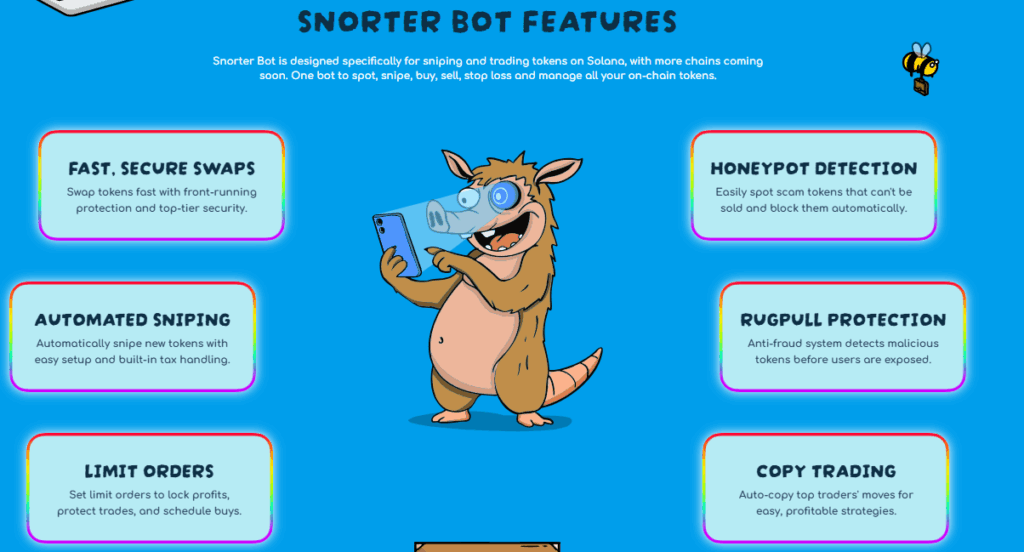

Snorter Bot features numerous automation tools, ranging from copy trading to scheduled buying and a dynamic stop-loss. It’s also designed to protect its users from various threats traders often face, which include harmful smart contract functions such as minting or blacklisting.

SNORT’s holders will face fees of just 0.85% while using Snorter Bot, which is well below the standard 1-2% its competitors charge. The token can also be staked throughout the presale phase, with estimated rewards currently of 197% pa.

Pointing out that SNORT will launch on both Solana and Ethereum, presale expert Borch Crypto believes it can explode by 100x if it maintains its momentum, which helped it raise nearly $2 million since late May, post-launch.

With Snorter Bot built to help traders capture the best opportunities in the next wave of meme coin breakouts sparked by the ETH rally, SNORT may prove to be the best meme coin play this year.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

How to Buy $PUMP Token (Pump.fun) – MEXC Bonuses, ICO Date & Price Prediction

11.07.2025 10:15 3 min. read -

2

Best Crypto Presale to Buy: Bitcoin Hyper Smashes $2.5 Million Amid BTC’s Record Highs

13.07.2025 12:51 4 min. read -

3

BTC Bull Token Presale Enters Final 24 Hours Ahead of Exchange Listing Tomorrow: Next Crypto to Explode?

06.07.2025 11:30 4 min. read -

4

Best Crypto Presales: BTC Bull Token Raises $8 Million, Just 48 Hours to Go Until Exchange Launch

05.07.2025 11:18 4 min. read -

5

Google’s AI Gemini Predicts Bitcoin to Reach $215,000 by 2026, Bitcoin Hyper Could 20x

09.07.2025 11:42 4 min. read

Best Crypto to Buy Now as Trump Injects Crypto Into $9 Trillion Retirement Plans

President Donald Trump is gearing up to sign an executive order that would give American workers unprecedented access to a $9 trillion retirement market by allowing 401(k) plans to hold alternative assets such as cryptocurrencies, gold, and private equity. This landmark move could usher in a new era of institutional capital for digital assets, shifting retirement […]

Best Crypto to Buy Now as Trump Shakes Up Crypto Week with Bold Moves

The much‑anticipated “Crypto Week” kicked off on July 14 with high hopes for landmark legislation to formalize digital assets in the U.S. Instead, a procedural vote derailed the GENIUS Act, forcing House Speaker Mike Johnson to pull the remaining measures. Stepping into the fray, President Donald Trump convened key Republicans in a last‑ditch effort to […]

Is Meme Coin Season Here? Bonk and Pepe Soar, TOKEN6900 Could Be the Next Crypto to Explode

Meme coins are exploding this week, and traders are profiting. Bonk and Pepe have posted strong moves – and now there’s talk that a full-blown “meme coin season” could be incoming. Low cap meme coins – like TOKEN6900 – are also rocketing and taking advantage of the same retail trader demand. Currently in presale, T6900 […]

Best Crypto to Buy Now as Peter Schiff Warns Of Corporate Bitcoin Hoarding

When gold proponent Peter Schiff sounded the alarm on July 14, he wasn’t cheering for Bitcoin adoption. He was warning of a brewing crisis. Schiff argues that today’s rally isn’t driven by grassroots interest but by corporations piling up Bitcoin on their balance sheets, turning digital gold into a speculative asset class. Bitcoin demand has […]

-

1

How to Buy $PUMP Token (Pump.fun) – MEXC Bonuses, ICO Date & Price Prediction

11.07.2025 10:15 3 min. read -

2

Best Crypto Presale to Buy: Bitcoin Hyper Smashes $2.5 Million Amid BTC’s Record Highs

13.07.2025 12:51 4 min. read -

3

BTC Bull Token Presale Enters Final 24 Hours Ahead of Exchange Listing Tomorrow: Next Crypto to Explode?

06.07.2025 11:30 4 min. read -

4

Best Crypto Presales: BTC Bull Token Raises $8 Million, Just 48 Hours to Go Until Exchange Launch

05.07.2025 11:18 4 min. read -

5

Google’s AI Gemini Predicts Bitcoin to Reach $215,000 by 2026, Bitcoin Hyper Could 20x

09.07.2025 11:42 4 min. read