Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read Kosta Gushterov

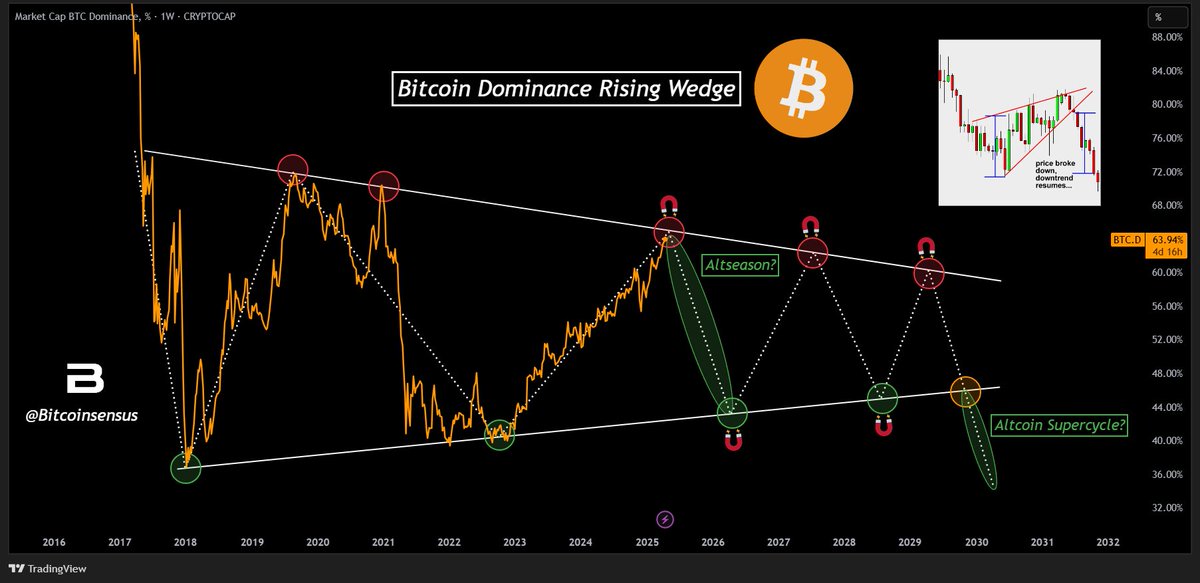

A major shift in the crypto cycle may be approaching as Bitcoin dominance (BTC.D) once again reaches critical long-term resistance.

According to analysis shared by Bitcoinsensus, the BTC.D index — which measures Bitcoin’s market share relative to the total crypto market — is testing the upper boundary of a multi-year rising wedge pattern.

Historical pattern suggests a reversal

The chart highlights a recurring pattern dating back to 2017. Each time BTC.D touched the upper resistance of this wedge, it triggered a sharp reversal — often followed by the start of an altseason. This cycle repeated in 2018, 2021, and 2023, and now appears to be setting up for another move lower in the second half of 2025.

If history rhymes, a breakdown from this wedge could set the stage for a broad altcoin rally — especially as Bitcoin’s dominance has surged to 63.94%, near previous local tops.

Why this resistance level matters

The rising wedge pattern indicates that BTC.D is making higher lows but facing rejection at a consistent diagonal resistance. These trendlines act like pressure zones. When dominance fails to break above resistance, capital often flows into altcoins, sparking increased volatility and rapid price appreciation across the sector.

A confirmed reversal could mark the beginning of the next altcoin supercycle, with assets like Ethereum, Solana, and other Layer 1s benefiting the most.

Key levels and timing

- BTC.D Resistance zone: ~64%–65%

- Wedge support zone: ~40%–45%

- Historical altseason pivots: Post-rejection phases from 2018, 2021, 2023

Bitcoinsensus notes that this setup “makes sense” for a full-blown altseason in the next few months, especially if dominance begins to roll over.

-

1

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

2

Altcoin Market May Be on the Verge of Major Rally, Analyst Suggests

27.06.2025 14:00 2 min. read -

3

Trump-Linked Crypto Project WLFI Prepares for Token Listing and Stablecoin Audit

27.06.2025 11:00 2 min. read -

4

TRON (TRX) Eyes Breakout as Bollinger Bands Signal Squeeze

30.06.2025 13:00 2 min. read -

5

New Meme Coin to Watch: TOKEN6900 Presale Tipped as Next SPX6900

01.07.2025 20:59 4 min. read

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

Bitcoin has officially broken through the $121,000 level, rising 2.84% in the past 24 hours to hit $121,400, according to CoinMarketCap data.

ProShares XRP ETF Set to Launch on July 18, Boosting Institutional Access

ProShares is set to launch its long-awaited XRP ETF on July 18, 2025, marking a major milestone for Ripple’s token amid rising institutional demand for regulated crypto products.

Ethereum nears key resistance as analysts predict $3,500 surge

Ethereum (ETH) has climbed 1.8% in the past 24 hours, reaching $2,987 on July 13, as strong technical momentum, ETF inflows, and forced short liquidations contribute to the upward move.

Altcoin Supercycle? Analysts Signal ‘Banana Zone 2.0’ as Market Erupts

The altcoin market is heating up fast — and some crypto analysts say we may be entering a full-blown “Banana Zone” similar to the explosive rally of 2020–2021.

-

1

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

2

Altcoin Market May Be on the Verge of Major Rally, Analyst Suggests

27.06.2025 14:00 2 min. read -

3

Trump-Linked Crypto Project WLFI Prepares for Token Listing and Stablecoin Audit

27.06.2025 11:00 2 min. read -

4

TRON (TRX) Eyes Breakout as Bollinger Bands Signal Squeeze

30.06.2025 13:00 2 min. read -

5

New Meme Coin to Watch: TOKEN6900 Presale Tipped as Next SPX6900

01.07.2025 20:59 4 min. read