Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Best Altcoins to Buy as Corporate Bitcoin Holdings Surge to $91 Billion

12.07.2025 11:10 6 min. read Nikolay KolevWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

Bitcoin isn’t just for retail buyers anymore – corporations are piling in, and fast. With corporate holdings now topping $91 billion, public companies are quietly turning Bitcoin into a mainstream treasury asset.

That shift is a huge win for BTC, but it’s also an endorsement of the entire crypto market. So, if you’re hunting for the best altcoins to buy right now, let’s take a look at five projects that could be about to rally.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

Why Corporate Bitcoin Holdings Surging Past $91B is Important

Corporate Bitcoin holdings leapt higher last quarter. Bitwise’s latest data shows public companies now hold 847,000 BTC – over 4% of the entire supply – which is up 23% from Q1 and marks the biggest quarterly haul on record.

A cool 159,107 BTC landed on corporate balance sheets in only three months, vacuuming liquidity out of the market. And it’s not just new faces like GameStop and Twenty One that are accumulating. Michael Saylor’s Strategy scooped up another 69,000 BTC, taking its holdings to nearly 700,000 coins.

Companies are buying bitcoin, Q2 2025 edition pic.twitter.com/0UxrlIZQvb

— Bitwise (@BitwiseInvest) July 9, 2025

Meanwhile, Trump Media is planning a $2.5 billion raise aimed squarely at Bitcoin. All told, the number of listed companies holding Bitcoin jumped from 79 to 125 – a 58% increase that shows how fast boardrooms are warming to crypto.

But why does that matter? Because this demand affects price in two ways: it shrinks the circulating supply and broadcasts a stamp of approval that retail and institutions can’t ignore. When CFOs sign off on multimillion-dollar buys, they’re telling the market that Bitcoin has matured enough for their balance sheet.

Add in fair-value accounting rules and spot-ETF tailwinds, and you get a positive feedback loop where corporate buying drives price up, higher prices lead to more investment, and scarcity ramps up each quarter.

What Are the Best Altcoins to Buy as Corporate BTC Holdings Rise?

Bitcoin may get all the attention, but it’s not the only crypto set to benefit from corporate buying. Below are five projects that might also be about to rally:

1. Bitcoin Hyper (HYPER)

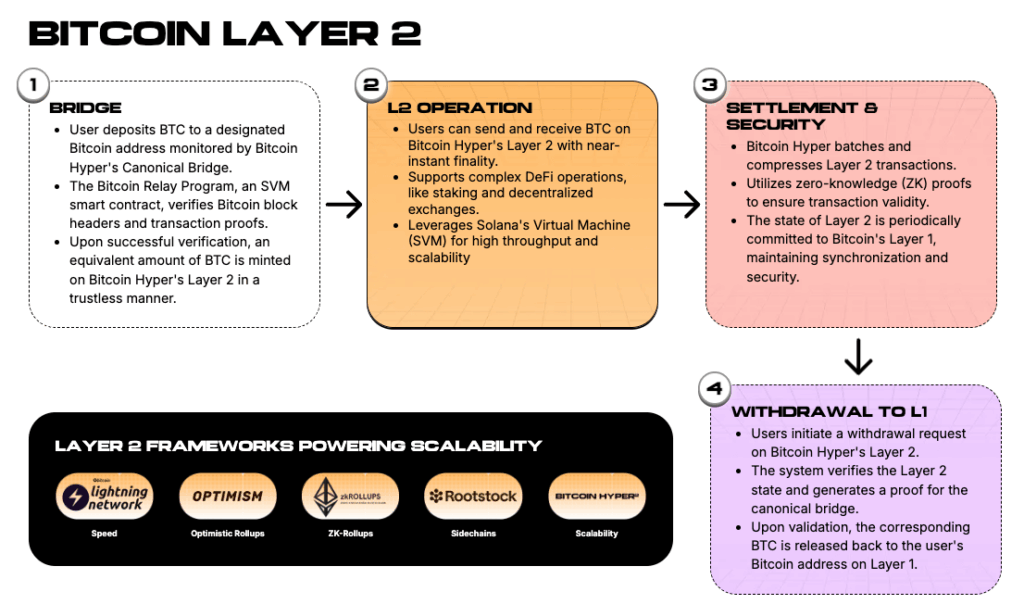

Bitcoin Hyper (HYPER) is a Layer-2 network that combines Bitcoin’s security with Solana’s speed, aiming to enhance BTC’s original “digital cash” vision. Built on the Solana Virtual Machine, it uses a non-custodial, zero-knowledge bridge to wrap BTC for low-fee staking, yield farming, and payments.

Burn the wrapped BTC, and your base-chain coins unlock right away – it’s a completely frictionless setup. Macro conditions are also going in its favor, as Elon Musk’s new America Party just called fiat “hopeless” and suggested embracing Bitcoin.

That stance goes perfectly with Bitcoin Hyper’s effort to make Bitcoin more practical. Meanwhile, the project’s presale momentum backs up the theory: over 147 million HYPER staked already and $2.2 million in early funding raised.

You can buy HYPER tokens priced at $0.0122 using ETH, USDT, BNB, card, or via Best Wallet’s “Upcoming Tokens” tab. So, given it’s a scalable Bitcoin Layer-2 with a clear roadmap, Bitcoin Hyper could be one of the best altcoins to buy now. Visit Bitcoin Hyper Presale.

2. MemeCore (M)

MemeCore (M) is a Layer-1 chain built for what the team calls “Meme 2.0,” where meme culture meets real utility. Founded by Ledger veteran Jun Ahn and backed by Waterdrip and IBC Group, MemeCore lets memes become programmable money, governance tokens, and game incentives.

Its native M token handles gas fees, staking, and a new “Proof-of-Meme” consensus that rewards community creativity. Recent listings on Binance Alpha, Kraken, and others pumped liquidity fast, and the chain already hosts NFT tools, meme-themed games, and social dApps.

All of that has helped M rally 79% in the past 24 hours. In a market that trades on narrative as much as utility, MemeCore is in the perfect position to keep rising.

3. Best Wallet Token (BEST)

If altcoin season is incoming – as several analysts suggest – traders will need wallets that can handle a lot of activity. Best Wallet (BEST) is made for that: a multi-chain, non-custodial mobile app supporting over 60 chains and more than 330 liquidity pools for instant swaps.

Fiat on-ramps via PayPal or debit card skip KYC requirements, and MPC cryptography balances speed with security. Plus, Best Wallet has a built-in launchpad called “Upcoming Tokens” that helped launch viral projects like Solaxy and Pepe Unchained.

The presale for the native BEST token has already pulled in $13.7 million by offering tokens for just $0.025305 each. Holding BEST provides discounted fees, launch-access perks, and staking rewards. That’s why YouTuber Borch Crypto predicted BEST could “100x” after listing.

Desktop support, gas-free transfers, and more DeFi tie-ins are expected later this year. So, if you’re seeking the best altcoins to buy today, Best Wallet Token could be a great option. Visit Best Wallet Token Presale.

4. Haedal Protocol (HAEDAL)

Liquid staking on Sui gets supercharged with Haedal Protocol (HAEDAL). Stake SUI or WAL, receive liquid haSUI or haWAL, and deploy these tokens across DeFi while rewards keep rolling in – no lock-ups and no hassle.

A smart validator picker maximizes your returns, and Wormhole integration lets your assets bridge to other chains. Plus, weekly “HaeVault” raffles (temporarily suspended) and hooks into Scallop and Turbos Finance add to the value proposition.

Backed by the likes of Animoca Ventures and OKX Ventures, Haedal holds the highest TVL among Sui liquid-staking protocols and even landed a Binance listing. Although it’s not directly tied to corporate Bitcoin ownership, its staking model could soak up liquidity as institutional money flows into DeFi.

5. Snorter (SNORT)

Crypto can still be complicated for newcomers, which is why Snorter (SNORT) is getting lots of attention. Accessible via the Telegram app, this AI-powered trading bot automates swaps, portfolio rebalancing, and staking with a couple of taps – no charts or manual input needed.

Behind the scenes, machine-learning models time buys and sells or follow rules that you set, letting even beginners trade like seasoned pros. These features are why Cryptonews’ analysts called it the “best bot on Solana.”

Snorter’s presale just passed $1.5 million, and the SNORT price is currently set at $0.0977, which is expected to be lower than the DEX listing price. And if you buy SNORT early, you can even stake your tokens while the presale is ongoing to earn passive income.

The SNORT token has already been listed on popular tracking sites like CoinSniper. Ultimately, if you want a bot that makes trading as easy as texting, Snorter could be a smart play. Visit Snorter Presale.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Pepe and Mog Coin Witness Strong Gains But Snorter Could Be the Best Meme Coin to Buy Now

01.07.2025 12:41 5 min. read -

2

4 Meme Coins Under $1 That Could Explode in Q3

30.06.2025 1:41 5 min. read -

3

Why BTC Bull Token Could be the Best Crypto to Buy Before Bitcoin Hits ATH in Q3

30.06.2025 13:48 5 min. read -

4

Best Crypto to Buy Now as Laffont’s $5T Bitcoin Prediction Sparks Institutional Surge

26.06.2025 19:24 6 min. read -

5

Solana Tokens Explode as Market Recovers: DogWifHat, Snorter Among Biggest Winners

25.06.2025 23:39 4 min. read

Best Crypto To Buy Now as Schiff’s Silver Storm Meets Bitcoin’s Meteoric Rise

Precious metals enthusiast Peter Schiff has sounded the alarm on silver’s rally, dismissing Bitcoin’s latest highs as nothing more than a distraction. His comments come as silver reclaims levels not seen in over a decade, reigniting debates about where true value lies. This publication is sponsored. CryptoDnes does not endorse and is not responsible for […]

Bitcoin Surges to New ATH Above $118,000: These Three Memecoins Show Insane Potential

Crypto markets are roaring back to life. Bitcoin has broken past $118,000, marking a new all-time high as optimism returns across the financial landscape.

These Are the 3 Best Cryptocurrencies to Buy in 2025, According to DeepSeek AI

Bitcoin has just posted a new all-time high, Ethereum has broken above $3,000 again, and the entire crypto market cap has passed $3.6 trillion. This week’s rally is showing no signs of easing up – driven by massive ETF inflows, short squeezes, and big institutions ramping up their exposure. But picking the best cryptocurrencies to […]

Bitcoin Price Prediction: BTC to Hit $148,000 in Current Rally? BTC Layer 2 Presale Raises $2.3M

Growing by 8.27% over the past seven days, Bitcoin (BTC) peaked above $118,856 on July 11th, setting a new all-time high (ATH). As the leading cryptocurrency appears ready to grow even further, a project currently in its presale, Bitcoin Hyper (HYPER), aims to permanently transform Bitcoin from primarily a store of value into a versatile blockchain. […]

-

1

Pepe and Mog Coin Witness Strong Gains But Snorter Could Be the Best Meme Coin to Buy Now

01.07.2025 12:41 5 min. read -

2

4 Meme Coins Under $1 That Could Explode in Q3

30.06.2025 1:41 5 min. read -

3

Why BTC Bull Token Could be the Best Crypto to Buy Before Bitcoin Hits ATH in Q3

30.06.2025 13:48 5 min. read -

4

Best Crypto to Buy Now as Laffont’s $5T Bitcoin Prediction Sparks Institutional Surge

26.06.2025 19:24 6 min. read -

5

Solana Tokens Explode as Market Recovers: DogWifHat, Snorter Among Biggest Winners

25.06.2025 23:39 4 min. read