Bitcoin: Is the Cycle Top In and How to Spot It?

09.07.2025 16:00 2 min. read Kosta Gushterov

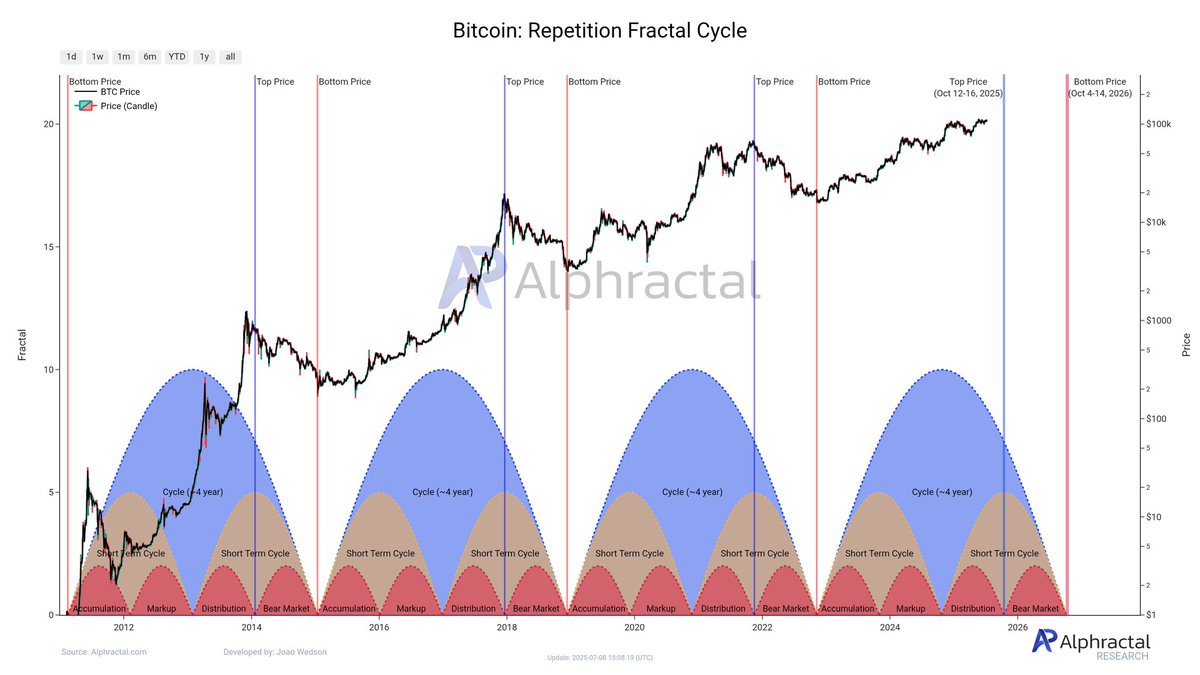

Bitcoin may not have reached its peak in the current market cycle, according to a recent analysis by crypto analytics firm Alphractal.

The firm points to its Repetition Fractal Cycle model—a metric it says has consistently timed Bitcoin’s tops and bottoms since 2015—with remarkable precision.

Analysts at Alphractal argue that, based on this fractal pattern, the current market still shows room for upward movement. “Will it repeat this time? No one knows for sure,” the firm stated, “but there’s a strong possibility.” The next few months are expected to be critical in testing the reliability of this repeating fractal structure, which has become one of the firm’s most referenced tools for long-term trend assessment.

Miners and momentum: a leading signal?

Another insight shared by Alphractal focuses on the mining sector—often seen as a key driver of Bitcoin’s price behavior. The firm points out that mining stocks, particularly Iris Energy (IREN), are now appreciating at a faster pace than Bitcoin itself. IREN’s market capitalization has surged from $1.2 billion to over $4 billion, signaling renewed investor interest in Bitcoin’s infrastructure layer.

However, Alphractal also notes a weakening correlation between mining stocks and BTC, suggesting increased volatility ahead. Since mining firms typically hold substantial reserves of Bitcoin both on-chain and through institutional vehicles, any strategic movement by these entities could influence BTC’s market direction significantly. The firm advises close monitoring of miner activity as a proxy for broader market sentiment.

How to spot a Bitcoin cycle top: insights from experts

Identifying the top of a Bitcoin cycle remains a complex task, but several indicators have proven useful historically. According to Glassnode and other leading on-chain data providers, one of the most reliable signals is the MVRV Z-Score (Market Value to Realized Value). This metric highlights when Bitcoin is significantly overvalued relative to its realized price. Historically, MVRV values above 7 have aligned with major market tops.

Another key metric is the Pi Cycle Top Indicator, developed by Philip Swift. This model compares the 111-day moving average with a 2x multiple of the 350-day moving average. Crossovers have historically coincided with BTC peaks within a few days.

Lastly, exchange inflows from long-term holders are often a red flag. When dormant coins begin to move onto exchanges, it may suggest profit-taking behavior, typically observed near cycle tops.

Combining these data-driven tools with macro trends and miner behavior can offer a more complete picture of Bitcoin’s cyclical turning points.

-

1

‘Nobody Saw This Coming’: Saylor Points to Political Winds Fueling Bitcoin Boom

22.06.2025 10:00 2 min. read -

2

Strategy Adds to Its Bitcoin Pile Again, Shrugging Off Market Slump

23.06.2025 17:00 1 min. read -

3

Arthur Hayes Sees Bitcoin Surge Ahead as Fed Prepares to Print More Money

24.06.2025 10:00 2 min. read -

4

ETF Era and Corporate Buying Set Stage for Bitcoin’s Next Big Move

22.06.2025 8:00 1 min. read -

5

Strategy Teases More Bitcoin Buys as Market Eyes Saylor’s Next Move

23.06.2025 8:00 2 min. read

Bitcoin Hits New All-Time High Above $112,000 as Short Squeeze and Tariffs Fuel Rally

Bitcoin surged past $112,000 on Wednesday, briefly setting a new all-time high before retracing slightly to $111,000.

Dollar Weakness Signals Major Bitcoin Move Ahead, Data Suggests

A new report from CryptoQuant highlights a historically strong inverse correlation between the U.S. dollar and Bitcoin—one that may be signaling the next leg of the crypto bull market.

Bitcoin Liquidity Hits Multi-Year Low: CryptoQuant Flags Bullish Setup

According to new data from CryptoQuant, Bitcoin’s sell-side liquidity is hitting critical lows—potentially laying the groundwork for the next major price rally.

BlackRock’s IBIT Bitcoin ETF Surpasses 700,000 BTC in Record Time

BlackRock’s iShares Bitcoin Trust (IBIT) has officially crossed the 700,000 BTC mark, reinforcing its position as one of the fastest-growing exchange-traded funds in financial history.

-

1

‘Nobody Saw This Coming’: Saylor Points to Political Winds Fueling Bitcoin Boom

22.06.2025 10:00 2 min. read -

2

Strategy Adds to Its Bitcoin Pile Again, Shrugging Off Market Slump

23.06.2025 17:00 1 min. read -

3

Arthur Hayes Sees Bitcoin Surge Ahead as Fed Prepares to Print More Money

24.06.2025 10:00 2 min. read -

4

ETF Era and Corporate Buying Set Stage for Bitcoin’s Next Big Move

22.06.2025 8:00 1 min. read -

5

Strategy Teases More Bitcoin Buys as Market Eyes Saylor’s Next Move

23.06.2025 8:00 2 min. read