EU Grants MiCA Licenses to 53 Crypto Firms: Here Is the Full List

07.07.2025 19:00 2 min. read Kosta Gushterov

The European Union has granted a total of 53 licenses under its MiCA (Markets in Crypto-Assets) regulatory framework, marking a major step toward harmonized crypto oversight across the region.

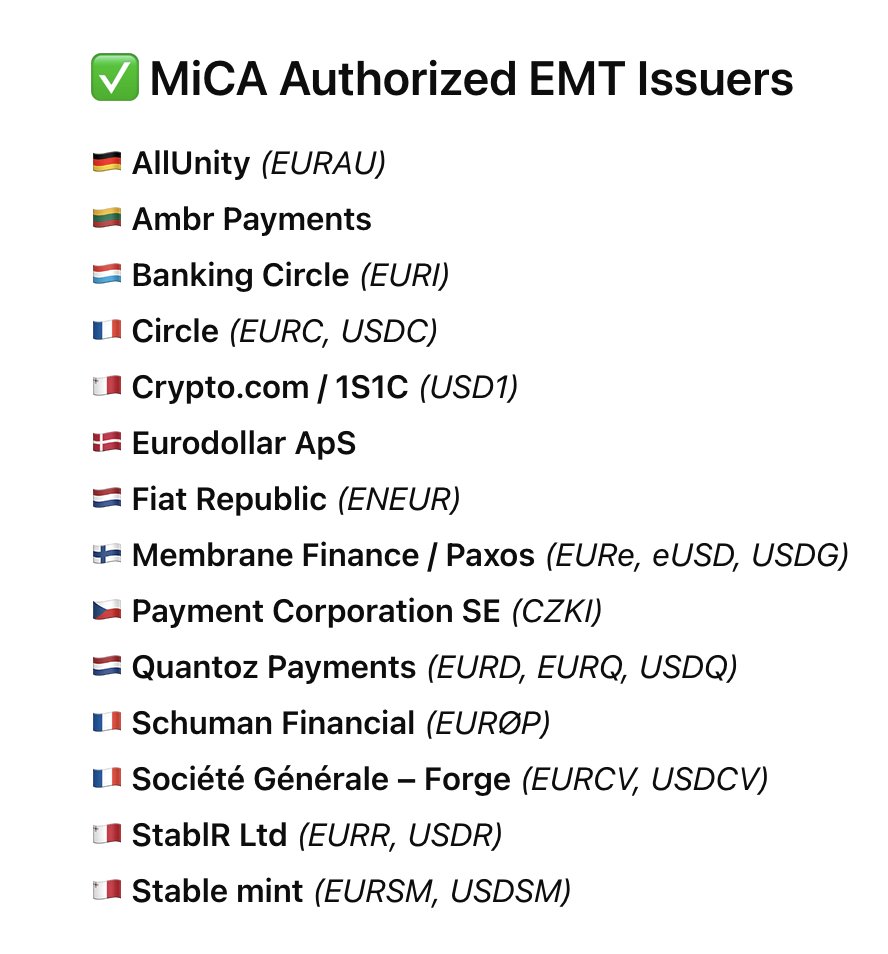

This includes 14 authorized e-money token (EMT) issuers and 39 MiCA-licensed crypto-asset service providers (CASPs).

The 14 EMT issuers originate from seven EU member states and are collectively issuing 20 fiat-backed stablecoins: 12 pegged to the euro, 7 to the U.S. dollar, and 1 to the Czech koruna. Leading names include Circle, Société Générale – Forge, Membrane Finance, and Crypto.com. These approvals aim to standardize stablecoin compliance under MiCA and expand consumer trust in digital euro and dollar equivalents.

Meanwhile, 39 CASPs have secured full MiCA licenses, allowing them to operate across the entire European Economic Area (EEA). Countries like Germany (12 firms), the Netherlands (11), and Malta (5) dominate the approvals. The list includes a blend of traditional financial institutions (e.g., BBVA, Clearstream), fintech platforms (eToro, N26), and major crypto exchanges (Coinbase, Kraken, Bitstamp, OKX).

MiCA Momentum Builds Amid Oversight Gaps and Compliance Push

Despite the progress, the MiCA rollout has revealed regulatory blind spots. No asset-referenced token (ART) issuers have been approved, indicating tepid market interest in non-fiat-backed assets. About 30 whitepapers have been filed under MiCA Title II for major assets like BTC and ETH, reflecting increasing institutional alignment with crypto regulation.

At the same time, over 35 firms are flagged as non-compliant—many by Italy’s CONSOB. Transition periods have ended in multiple jurisdictions, including Finland, Poland, and the Netherlands, where the Dutch AFM is leading license issuance. With MiCA enforcement underway, firms are racing to gain approval and passport their services across 30 EEA states.

-

1

Turkey Targets Crypto Crime With New Withdrawal Delays and Transfer Limits

25.06.2025 11:00 1 min. read -

2

Europe Takes the Lead in Crypto as U.S. Stalls on Regulation

22.06.2025 22:00 2 min. read -

3

Japan Plans Major Crypto Reform with New Tax Rules and ETF Access

24.06.2025 20:00 2 min. read -

4

Gemini Launches Tokenized MicroStrategy Stock for EU Users

28.06.2025 9:30 2 min. read -

5

U.S. Crypto Investors Hit by IRS Letter Surge as Tax Crackdown Looms

29.06.2025 11:00 3 min. read

Here is When the U.S. House Will Vote on Key Crypto Bills

Following the passage of President Donald Trump’s sweeping tax and spending bill, House Republicans are now setting the stage for a major push on cryptocurrency legislation.

SEC Chairman With Important Comments on Regulation, Crypto, and Trading

U.S. Securities and Exchange Commission (SEC) Chairman Paul Atkins has emphasized the agency’s continued focus on investor protection, addressing insider trading, market manipulation, and the evolving landscape of cryptocurrency regulation.

Arizona Governor Vetoes Bill, Related to State Crypto Reserve Fund: Here Is Why

Arizona Governor Katie Hobbs has officially vetoed House Bill 2324, a legislative proposal that aimed to create a state-managed reserve fund for holding seized cryptocurrency assets.

SEC Explores New Fast-Track Process for Token-Based ETFs

The U.S. Securities and Exchange Commission (SEC) is in the early stages of developing a standardized listing framework for token-based exchange-traded funds (ETFs), according to a July 1 report by journalist Eleanor Terrett.

-

1

Turkey Targets Crypto Crime With New Withdrawal Delays and Transfer Limits

25.06.2025 11:00 1 min. read -

2

Europe Takes the Lead in Crypto as U.S. Stalls on Regulation

22.06.2025 22:00 2 min. read -

3

Japan Plans Major Crypto Reform with New Tax Rules and ETF Access

24.06.2025 20:00 2 min. read -

4

Gemini Launches Tokenized MicroStrategy Stock for EU Users

28.06.2025 9:30 2 min. read -

5

U.S. Crypto Investors Hit by IRS Letter Surge as Tax Crackdown Looms

29.06.2025 11:00 3 min. read