Major Altseason May Be Incoming: Bullish Signals Strengthen as Q3 Begins

07.07.2025 15:13 2 min. read Kosta Gushterov

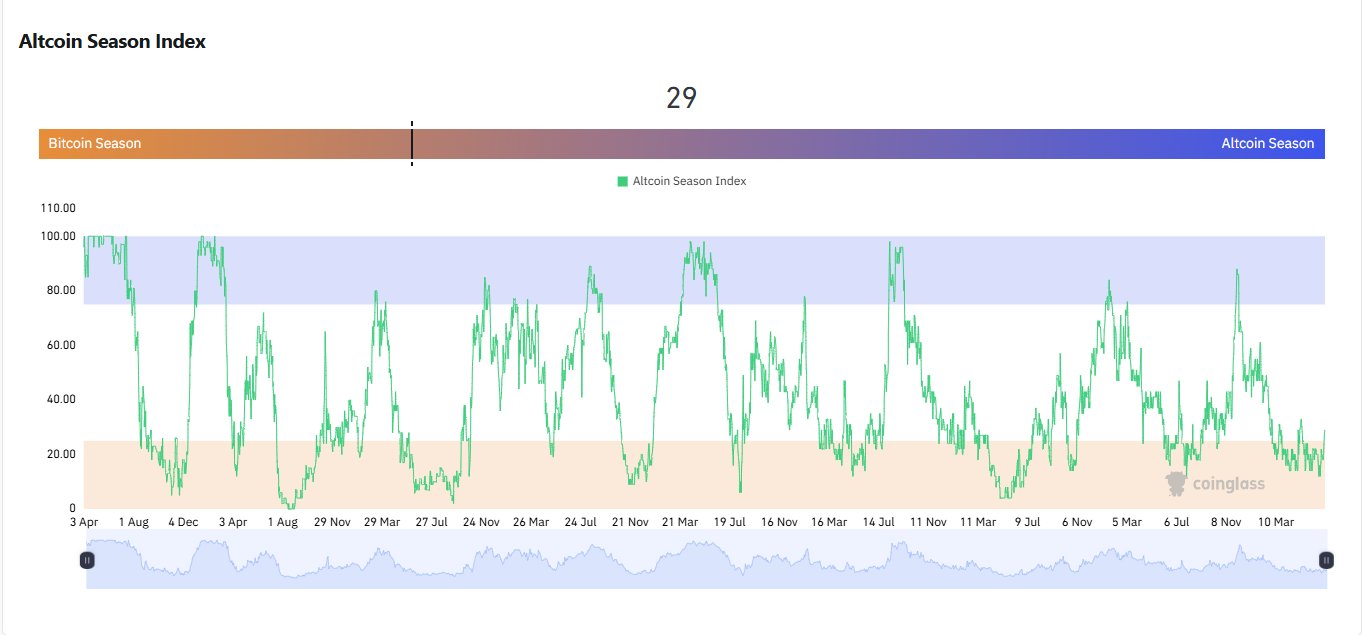

Crypto strategist Michaël van de Poppe recently highlighted a striking pattern in the Altcoin Season Index, signaling a potential surge in altcoin markets.

According to him, the index typically bottoms out in early summer—especially in June—and has consistently led to strong altcoin rallies in the latter half of the year. Now, amid what appears to be a continued bull cycle and the unwinding of quantitative easing, the likelihood of a more pronounced move than that seen in Q4 2023 is growing.

Why This Matters

Analysts from CoinGecko, a respected crypto analytics firm, echoed van de Poppe’s observations. They noted that many blue-chip altcoins saw extended periods of consolidation over the summer months, with significant upward momentum kicking in around July–August. If history repeats, we could be entering a period marked by rapid growth and widespread market rotation away from Bitcoin.

Recent data supports this shift. Over the past two days, Ethereum’s daily on-chain activity has climbed by 8%, while trading volume across DeFi tokens increased by 12%, according to a Messari report—suggesting renewed investor interest in non-BTC assets.

Drivers Behind the Surge

- Macro & Liquidity Dynamics

As central banks worldwide step back from aggressive asset-buying programs, markets seek new injection points. Van de Poppe suggests that this shifting liquidity could fuel altcoin capital flows in the months ahead. - Capital Rotation Pattern

When Bitcoin stabilizes or enters a sideways trend, capital often migrates to top-performing altcoins. With Bitcoin holding firm above $105K, attention increasingly turns to high-beta alt assets. - Emerging Trends & Product Launches

The debut of new altcoin ETFs—including Solana and XRP staking vehicles—has intensified engagement. Santiment’s July data shows these products as among the most-discussed topics in crypto circles, underscoring growing institutional interest.

What Investors Should Monitor

- Altcoin Season Index – Sustained values above 60–70 typically mark the onset of a genuine altseason.

- Trading Volume Spike – Watch for rising activity in top-tier altcoins, which reinforces market momentum.

- Macro Liquidity Updates – Future central bank communications could impact broader asset distribution.

Conclusion

All signs point to the early stages of altseason, potentially stronger than 2023’s. With bullish patterns, increased liquidity, and renewed investor appetite, the final two quarters could bring outsized returns in altcoin markets—provided broader macro conditions remain favorable. Now may be the time for investors to reassess their portfolio stance as the altcoin cycle gains momentum.

-

1

Ripple’s Stablecoin Edges Toward $500M Milestone After Latest Mint

21.06.2025 12:00 1 min. read -

2

Cardano ETF Approval Odds Hit Record High on Polymarket

22.06.2025 12:00 2 min. read -

3

SEC Seen as Nearly Certain to Approve Wave of Crypto ETFs, Say Bloomberg Analysts

21.06.2025 13:00 2 min. read -

4

Ethereum Price Prediction: This Trader Thinks ETH Could Soon Hit $12,000 – Here’s Why

25.06.2025 23:53 3 min. read -

5

Dogecoin’s Slump Could Be the Setup for a Massive Breakout

22.06.2025 14:00 2 min. read

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

Digital asset investment products recorded $1.04 billion in inflows last week, pushing total assets under management (AuM) to a record high of $188 billion, according to the latest report from CoinShares.

SEC Accelerates Spot Solana ETF Timeline as July Deadline Looms

The U.S. Securities and Exchange Commission (SEC) is reportedly expediting the review process for spot Solana (SOL) exchange-traded funds, pushing issuers to submit amended S-1 filings by the end of July.

Bonk Price Prediction: Binance.US Mention Triggers 9% Jump – Can BONK Reach $1?

Bonk (BONK) has gone up by 9% in the past 24 hours and currently sits at $0.00002330 after Binance.US shared a cryptic X post that mentioned the token. On Sunday afternoon, the exchange shared a picture of its logo hitting its head with a bat – a clear reference to the viral meme that inspired […]

Second Largest Bank in Spain Rolls out in-app Bitcoin and Ethereum Trading

Spanish banking giant BBVA has expanded its digital services by introducing in-app Bitcoin and Ethereum trading and custody for retail clients.

-

1

Ripple’s Stablecoin Edges Toward $500M Milestone After Latest Mint

21.06.2025 12:00 1 min. read -

2

Cardano ETF Approval Odds Hit Record High on Polymarket

22.06.2025 12:00 2 min. read -

3

SEC Seen as Nearly Certain to Approve Wave of Crypto ETFs, Say Bloomberg Analysts

21.06.2025 13:00 2 min. read -

4

Ethereum Price Prediction: This Trader Thinks ETH Could Soon Hit $12,000 – Here’s Why

25.06.2025 23:53 3 min. read -

5

Dogecoin’s Slump Could Be the Setup for a Massive Breakout

22.06.2025 14:00 2 min. read