Bitcoin Rises as Thousands of Altcoins Disappear

07.07.2025 13:00 2 min. read Kosta Gushterov

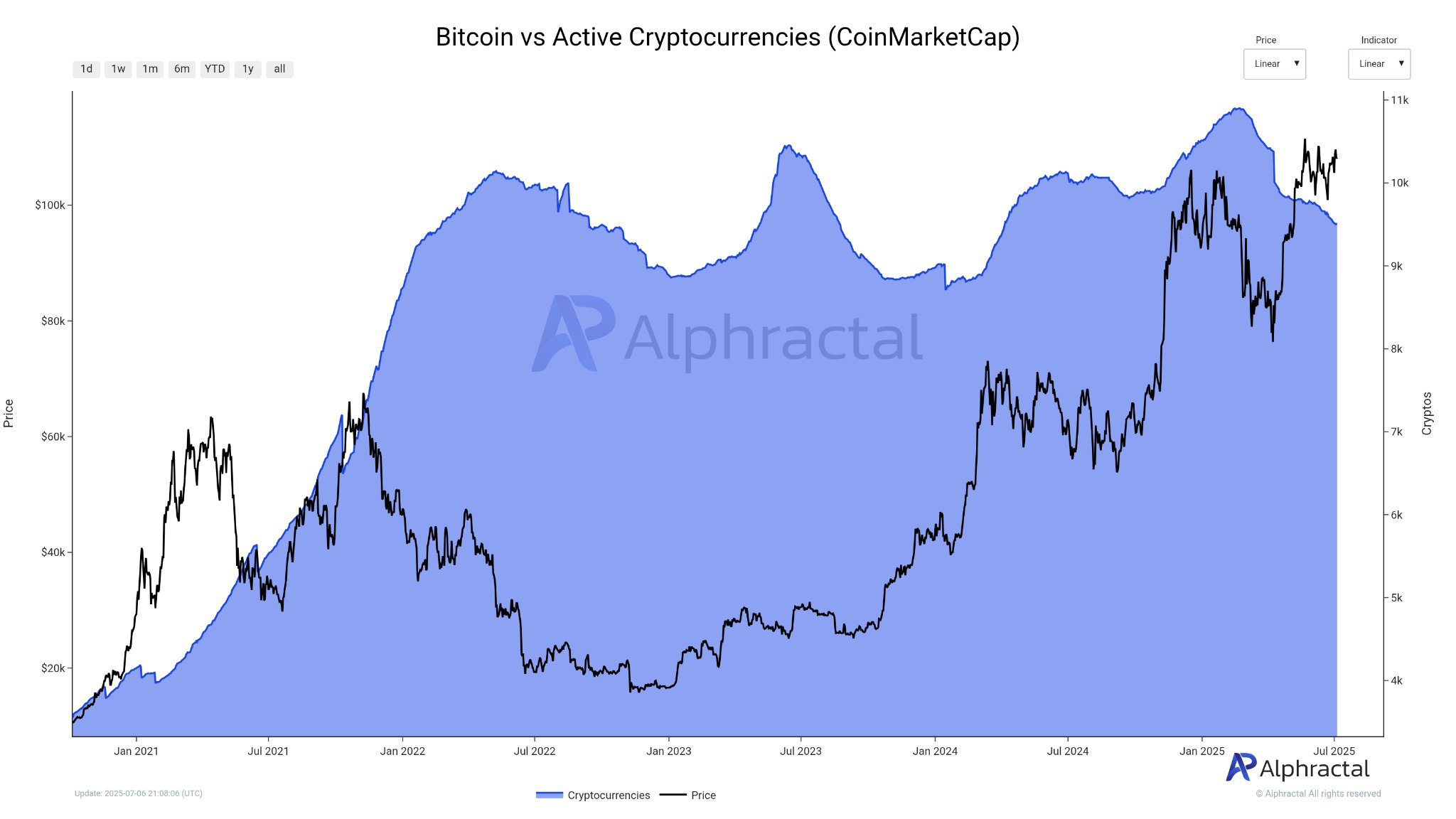

According to a new chart analysis from Alphractal, the number of active cryptocurrencies has declined significantly even as Bitcoin’s price continues to climb.

This market trend, based on CoinMarketCap data, reveals a culling of weaker projects—over 1,400 altcoins are no longer active due to delistings, low trading volume, lack of community interest, or exposure as scam ventures.

The chart shows two overlapping metrics: Bitcoin’s price in black and the number of active cryptocurrencies in blue.

Since early 2024, there has been a sharp drop in the number of listed projects, coinciding with Bitcoin’s steady rise back above $100,000. As of July 2025, the number of tracked active tokens has fallen to around 10,000, down from over 11,400 at the cycle’s peak.

Alphractal’s interpretation of this divergence is broadly positive. The exit of underperforming or fraudulent projects is seen as a form of market cleansing—removing noise and making room for quality. In previous cycles, similar drops in token count have signaled a return to fundamentals and renewed investor focus on core assets like Bitcoin and Ethereum.

Analysts say this shrinking project pool is bullish for crypto. With fewer “zombie” tokens competing for attention and liquidity, capital increasingly flows toward high-conviction plays. Bitcoin’s resilience against the backdrop of widespread project failures supports the narrative that it remains the digital asset market’s anchor.

The delisting of 1,400+ coins may also help restore trust in crypto markets. Many of the defunct tokens were launched during speculative hype phases and failed to deliver real use cases or development activity. Their removal reduces confusion for new investors and highlights the importance of due diligence.

In short, Alphractal’s report presents a healthy sign: fewer tokens, stronger conviction. As Bitcoin rises and the altcoin landscape thins out, the market appears to be entering a more mature, selective growth phase.

-

1

Ripple’s Stablecoin Edges Toward $500M Milestone After Latest Mint

21.06.2025 12:00 1 min. read -

2

Cardano ETF Approval Odds Hit Record High on Polymarket

22.06.2025 12:00 2 min. read -

3

SEC Seen as Nearly Certain to Approve Wave of Crypto ETFs, Say Bloomberg Analysts

21.06.2025 13:00 2 min. read -

4

Ethereum Price Prediction: This Trader Thinks ETH Could Soon Hit $12,000 – Here’s Why

25.06.2025 23:53 3 min. read -

5

Dogecoin’s Slump Could Be the Setup for a Massive Breakout

22.06.2025 14:00 2 min. read

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

Digital asset investment products recorded $1.04 billion in inflows last week, pushing total assets under management (AuM) to a record high of $188 billion, according to the latest report from CoinShares.

SEC Accelerates Spot Solana ETF Timeline as July Deadline Looms

The U.S. Securities and Exchange Commission (SEC) is reportedly expediting the review process for spot Solana (SOL) exchange-traded funds, pushing issuers to submit amended S-1 filings by the end of July.

Saylor’s Strategy Halts Bitcoin Buying After Historic Accumulation

Strategy, the Bitcoin-centric firm formerly known as MicroStrategy, has temporarily paused its regular Bitcoin purchases.

Bonk Price Prediction: Binance.US Mention Triggers 9% Jump – Can BONK Reach $1?

Bonk (BONK) has gone up by 9% in the past 24 hours and currently sits at $0.00002330 after Binance.US shared a cryptic X post that mentioned the token. On Sunday afternoon, the exchange shared a picture of its logo hitting its head with a bat – a clear reference to the viral meme that inspired […]

-

1

Ripple’s Stablecoin Edges Toward $500M Milestone After Latest Mint

21.06.2025 12:00 1 min. read -

2

Cardano ETF Approval Odds Hit Record High on Polymarket

22.06.2025 12:00 2 min. read -

3

SEC Seen as Nearly Certain to Approve Wave of Crypto ETFs, Say Bloomberg Analysts

21.06.2025 13:00 2 min. read -

4

Ethereum Price Prediction: This Trader Thinks ETH Could Soon Hit $12,000 – Here’s Why

25.06.2025 23:53 3 min. read -

5

Dogecoin’s Slump Could Be the Setup for a Massive Breakout

22.06.2025 14:00 2 min. read