Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Best Crypto to Buy Now as BlackRock Bitcoin ETF Outvalues S&P 500 Fund

04.07.2025 12:44 8 min. read Nikolay KolevWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

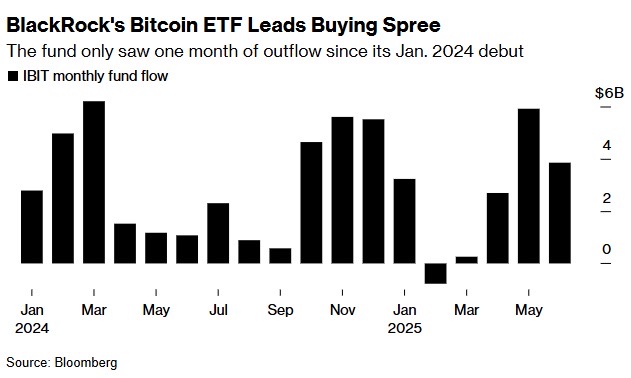

BlackRock’s iShares Bitcoin Trust (IBIT) has quietly surged past the asset manager’s flagship S&P 500 ETF (IVV) in annual fee revenue, upending long‑standing expectations in the traditional fund world.

#BlackRock’s Bitcoin ETF now generates more revenue than its S&P 500 ETF. pic.twitter.com/UhvEIbC1jM

— Christiaan (@ChristiaanDefi) July 2, 2025

This shift matters because it signals institutional money is now placing bigger bets on digital assets than on established equity benchmarks, reshaping portfolio strategies across Wall Street. For anyone weighing the best crypto to buy now, this watershed moment underscores why regulated Bitcoin exposure is rapidly moving from niche to mainstream.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products, or other materials on this page.

How BlackRock’s Tiny Bitcoin ETF Topped Its Giant S&P Fund in Fees

BlackRock’s Bitcoin ETF is now earning more money for the company than its flagship S&P 500 fund, a strikingly symbolic shift as institutional investors pour money into crypto during this demand surge.

How is that possible when the Bitcoin fund’s assets are much smaller? It comes down to fees. BlackRock’s iShares Bitcoin Trust (IBIT) charges a 0.25% fee, significantly higher than the tiny 0.03% fee on its massive iShares Core S&P 500 ETF (IVV).

Bloomberg reported that IBIT pulls in roughly $187.2 million annually, just edging out IVV’s $187.1 million. That’s a big deal. Since launching in January 2024, IBIT has rapidly gathered about $75 billion and dominates the Bitcoin ETF space, holding over half the total market share.

U.S. regulatory approval for spot Bitcoin ETFs was crucial, opening the floodgates for hedge funds, pension funds, and banks to participate. This institutional rush explains why IBIT is now among the top 20 ETFs by trading volume.

As Nate Geraci of Novadius Wealth Management noted, IBIT surpassing IVV in fees highlights both the intense demand for Bitcoin and how fiercely competitive fees have become for traditional core equity funds.

Paul Hickey, Bespoke Investment Group co-founder, added that Bitcoin’s reputation as a reliable store of value has cemented its lead in the crypto market, meeting pent-up investor demand for easy portfolio access without needing separate accounts.

Meanwhile, BlackRock CEO Larry Fink has done a remarkable reversal, becoming a strong Bitcoin supporter after earlier skepticism. He now calls it “digital gold” – a practical hedge against inflation and currency devaluation, especially given rising national debt and global uncertainty.

Fink even suggests that if major sovereign wealth funds allocated just a small portion (2%-5%) to Bitcoin, its price could potentially soar to between $500,000 and $700,000. He believes the transparency and liquidity provided by ETFs will speed up Bitcoin’s acceptance as a mainstream asset.

Best Crypto to Buy Now

The fact that IBIT now outpaces IVV in fee revenue highlights a broader conviction: regulated Bitcoin vehicles can rival legacy equity plays in institutional appeal. As treasury managers and pension funds pivot toward digital assets, informed selection is more critical than ever, making the search for the best crypto to buy now more relevant than ever.

Bitcoin Hyper

With BlackRock’s ETF success highlighting Bitcoin’s growing financial significance, Bitcoin Hyper emerges as a solution to Bitcoin’s scalability and transaction speed challenges. $HYPER’s Layer-2 technology directly addresses the demand for faster, cheaper Bitcoin transactions, making it increasingly relevant as institutional and retail activity intensifies.

Bitcoin Hyper is quickly emerging as a breakout Layer-2 project, drawing attention as Bitcoin adoption surges and early investors look for the next big opportunity. Built on the Solana Virtual Machine, it offers fast, low-cost transactions while tapping into Bitcoin’s security and long-term credibility.

Transactions settle in under a second, with near-zero fees, making Bitcoin Hyper a practical fit for high-volume DeFi and dApp activity. Unlike past workarounds, this setup aims to make Bitcoin a true execution layer, not just a store of value.

The $HYPER token drives the network, powering everything from governance and staking to transactions and app access. It also unlocks full cross-chain support from day one, including Ethereum and Solana, key for developers navigating today’s crowded blockchain space.

Early buyers can stake $HYPER during the presale, with rewards offering up to 429% APY, giving backers a clear incentive to get in early. This staking option could add staying power to what’s shaping up to be one of 2025’s most talked-about crypto launches.

Best Wallet is the go-to for purchasing, with a clean interface and $HYPER already featured in its ‘Upcoming Tokens’ list. It also gives users a smoother buying experience, early access to presales, and easy token management from one dashboard.

SUBBD

As BlackRock’s Bitcoin ETF signals surging institutional interest and mainstream adoption of digital assets, tokens like SUBBD are capitalizing on this momentum by transforming content monetization and creator economies. SUBBD leverages blockchain’s transparency and efficiency, offering creators and fans new ways to interact and transact in the current crypto space.

SUBBD ($SUBBD) is a crypto token powering a new platform for creators and fans, with every transaction built around it. It aims to become the financial backbone for online entertainment, offering utility across the entire ecosystem.

The platform lets fans pay for various digital subscriptions, like Netflix or productivity apps, using just one token. If widely adopted, SUBBD could reshape how people pay for internet services across multiple platforms.

Creators can issue their own subscription tokens, unlocking exclusive content, live streams, and perks for fans who stake. It’s a direct challenge to platforms like Patreon and OnlyFans, pushing for a decentralized model in creator monetization.

With backing from influencers and niche communities, SUBBD is making crypto feel more mainstream and creator-friendly. Tipping, subscribing, and even partial content ownership are all enabled through the $SUBBD token.

Token holders get 20% fixed staking rewards, plus access to premium platform features and creator engagement tools. This creates stronger connections between fans and influencers, adding real value to the token beyond speculation.

Introducing Yua Sakura 🔥

She’s ready to captivate every feed. Powered by SUBBD 🚀 pic.twitter.com/Y9DaCdlg5n

— SUBBD (@SUBBDofficial) June 30, 2025

The project has also introduced AI tools, including monetizable digital influencers and human-like video or voice replies. These features give creators new ways to scale, engage audiences, and offer personalized experiences at a low cost.

Over 250 million followers are already onboarded, showing strong early traction for SUBBD’s decentralized creator economy. With presales underway, the project is positioning itself as a bold contender in the crypto and content landscape.

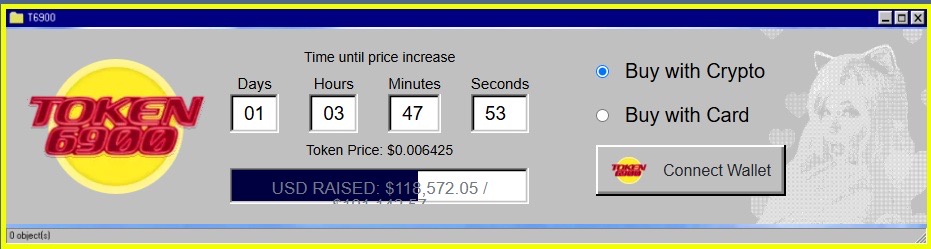

TOKEN6900

The record-breaking performance of BlackRock’s Bitcoin ETF underscores how crypto has entered the mainstream, sparking interest not only in utility tokens but also in meme coins like TOKEN6900. T6900 rides this wave of mass adoption, reflecting the playful and speculative side of the market that thrives alongside institutional innovations.

TOKEN6900 is turning heads in 2025 with its zero-utility philosophy. Launched as $T6900, the project leans into chaos, satire, and community-driven momentum over traditional features.

The project’s whitepaper reads more like performance art than a roadmap, calling the coin “a lobotomy, not a token.” It promises nothing, offering a rare kind of honesty in a space crowded with inflated claims and empty hype.

Described as a Non-Corrupt Token (NCT), the project rejects AI tools, metaverse plans, and private investor rounds. Instead, 80% of its supply was released to the public, with no insider deals or early access lists.

The rest of the token allocation is as strange as its branding, with 40% for meme marketing and 10% for liquidity. One mystery remains: a 24.9993% “Dolphin Allocation” that the team refuses to explain.

TOKEN6900 is fully capped, no new coins will ever be minted, setting it apart in a market flooded with inflationary supply. This fixed model stands as a clear swipe at government money printing and token overproduction across crypto.

While others promise utility and partnerships, TOKEN6900 strips it all back. No pitch decks. No promises. Just memes and code. It’s a deliberate counter to overengineered projects that often fail to deliver.

As noted by one of the well-known crypto YouTubers, 99Bitcoins, Token 6900 has the potential to deliver a 100x return.

The project’s launch phase included staking, audits, and a nostalgic 90s-themed site, all completed on time. With the presale now live, the token has built early credibility by actually following through.

In an industry often built on smoke and mirrors, TOKEN6900’s raw transparency is striking a chord. It’s part joke, part protest, and possibly one of the most honest launches in this year’s meme coin wave.

Conclusion

BlackRock’s landmark feat, with its Bitcoin ETF eclipsing a $624 billion S&P 500 staple in fees, underscores a turning point in asset management. What began as a niche experiment has become a mainstream option, proving that institutional demand can drive digital‑asset products to outperform legacy funds.

As regulatory clarity and corporate allocations continue to firm up, investors seeking the best crypto to buy now must balance proven tokens with emerging plays that capture this institutional momentum.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Best Crypto Presale to Buy in July: Why BTC Bull Token is Set for Massive Gains

03.07.2025 11:46 4 min. read -

2

Best Crypto to Buy for Q3? BTC Bull Token Enters Final Week of Presale

24.06.2025 17:53 5 min. read -

3

Best Crypto to Buy Now as USA Strikes Iran, Ethereum Price Dips

23.06.2025 14:35 7 min. read -

4

Is BTC Bull Token the Best Crypto Presale? Bitcoin Airdrops, Token Burns, and BTCBULL Rewards

25.06.2025 10:40 4 min. read -

5

Best Altcoins to Buy Now: 5 Low-Cap Cryptos That Could Explode in Q3

25.06.2025 23:39 5 min. read

Best Crypto to Buy Now as Trump’s Vietnam Deal Ignites Bitcoin and Stocks

When U.S. President Donald Trump made a historic trade deal with Vietnam, cutting tariffs on Vietnamese goods from 46% to 20%, world markets stirred into action. Bitcoin surged more than 3% as institutional investors welcomed lowered friction in international trade, and the Nasdaq and S&P 500 rose in tandem. BREAKING: Trump announced a trade deal with […]

Best Crypto Presale to Buy in July: Why BTC Bull Token is Set for Massive Gains

The BTC Bull Token presale is almost over. With less than five days left, this is the last chance for buyers to secure a lower price before the token goes live. The project’s raised amount will breach the $8 million mark any minute now, showing a notable uptick in investor support in the final presale […]

Best Crypto to Buy Now After Trump’s $220 Million Bitcoin Power Play

When Eric Trump’s American Bitcoin secured a $220 million injection from private backers to snap up Bitcoin and state‑of‑the‑art mining rigs, it marked more than just a hefty capital raise. This move highlights the widening gap between traditional finance and crypto’s institutional frontier, where major investors are racing to legitimize digital gold. 🔺 Eric Trump-Backed Mining […]

Best Crypto to Buy Now as Big‑Money Bitcoin Wallets Hit New Highs

Coinbase Institutional’s latest report reveals a striking uptick in high‑value Bitcoin holdings, with wallets surpassing the $1 million mark jumping sharply since early 2024. This milestone underscores growing corporate conviction in BTC’s resilience and long‑term upside. This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products, or other […]

-

1

Best Crypto Presale to Buy in July: Why BTC Bull Token is Set for Massive Gains

03.07.2025 11:46 4 min. read -

2

Best Crypto to Buy for Q3? BTC Bull Token Enters Final Week of Presale

24.06.2025 17:53 5 min. read -

3

Best Crypto to Buy Now as USA Strikes Iran, Ethereum Price Dips

23.06.2025 14:35 7 min. read -

4

Is BTC Bull Token the Best Crypto Presale? Bitcoin Airdrops, Token Burns, and BTCBULL Rewards

25.06.2025 10:40 4 min. read -

5

Best Altcoins to Buy Now: 5 Low-Cap Cryptos That Could Explode in Q3

25.06.2025 23:39 5 min. read