Sui Price Prediction: SUI Surpasses BNB and HYPE Trading Volumes in June – $10 by July?

02.07.2025 18:40 3 min. read Alejandro Ar

Sui (SUI) has gone up by nearly 4% in the past 24 hours and its performance is diverging from that of other altcoins after some interesting technical news.

Popular trading accounts on X pointed out that Sui’s trading volumes in June surpassed those of well-established tokens like BNB Coin (BNB) and Hyperliquid (HYPER) by $7 billion and $17 billion, respectively.

This emphasizes how strong investors and traders’ interest in the token is at a point when institutional adoption and awareness are rising.

Last month, the Nasdaq exchange filed the required paperwork to list a Sui spot exchange-traded fund (ETF) managed by 21 Shares.

This is an important proceeding that sets off a ticking clock for the U.S. Securities and Exchange Commission (SEC) to respond.

A spike in trading volumes in June following this important filing could indicate that market participants are accumulating the token in preparation for an upcoming price surge.

Moreover, this week, the first Solana ETF was approved and hit the trading floor today. This marks a pivotal moment for the crypto market as another altcoin apart from ETH has received the regulator’s blessing to be offered to both retail and institutional investors via a regulated vehicle.

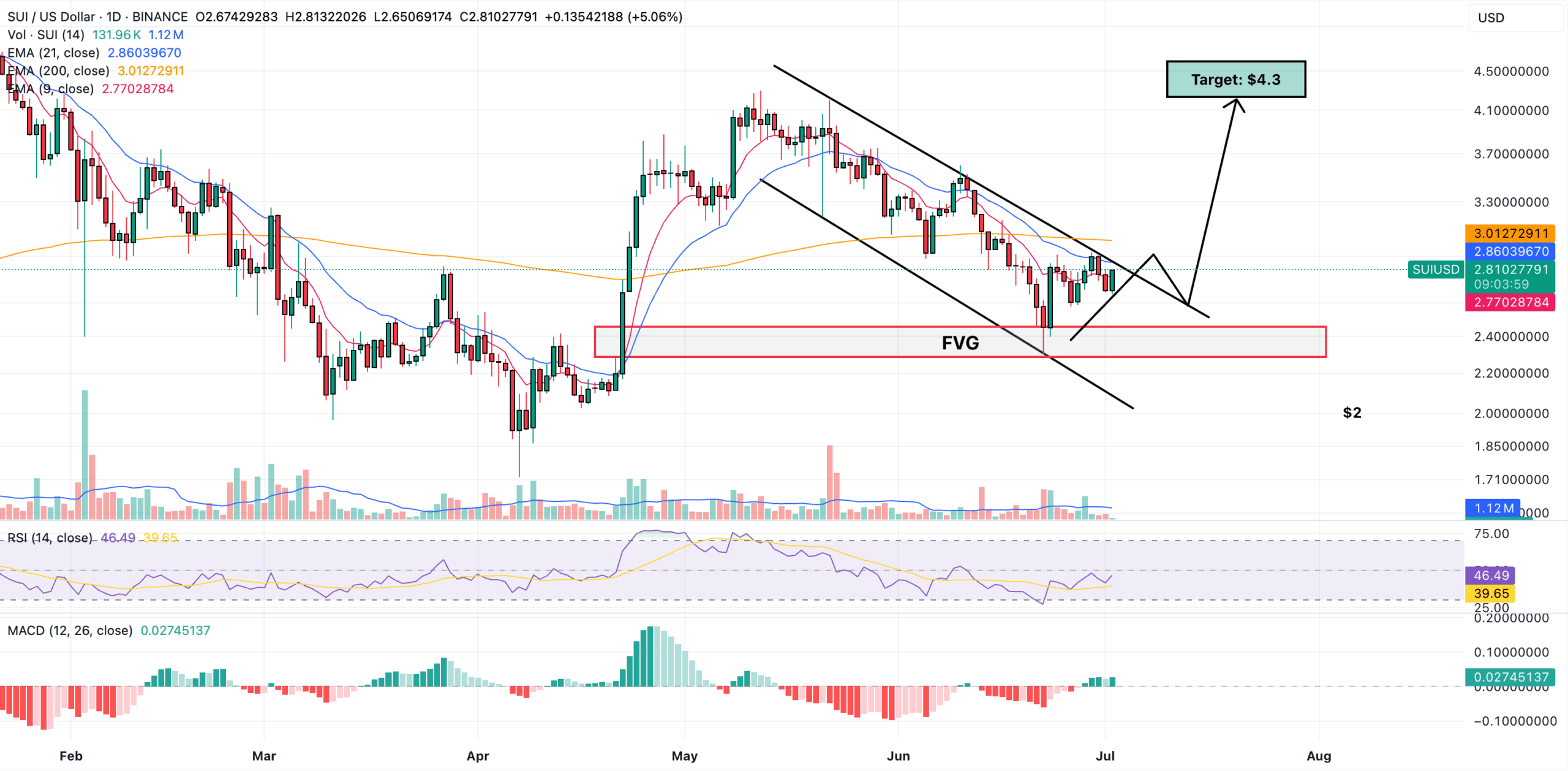

Sui Price Prediction: SUI Bounces Off Fair Value Gap (FVG)

Sui has been on a downtrend since late May when the token hit a strong resistance at $4 for a second time and rejected a move above that threshold.

Since then, the price has dived and the 9-day and 21-day exponential moving averages (EMAs) have made a death cross with the 200-day EMA, favoring a bearish Sui price prediction.

A descending price channel has formed as a result. In the past few days, the price has bounced upon touching a candle that is typically referred to as a “fair value gap”.

These are temporary market inefficiencies that market makers aim to correct. Once the price get to these unique candles, it tends to bounce strongly as a big volume of buy orders sits at those levels.

If buyers’ interest for SUI stands strong as June’s trading volumes seem to indicate, the price could recover from this point on and break above its descending price channel. This breakout would confirm a bullish outlook and could push SUI to retest its May highs.

As altcoins continue to recover and institutional adoption grows, the best crypto presales like Bitcoin Hyper (HYPER) will draw further attention from investors and offer the highest upside potential to early buyers.

Bitcoin Hyper (HYPER) Raises $1.8M to Launch Its Solana-Powered BTCFi Solution

Bitcoin Hyper (HYPER) is a layer-2 chain that aims to unlock the untapped potential of the BTCFi ecosystem.

With the help of a Solana-based protocol, Bitcoin Hyper leverages the efficiency of this smart contracts network to create a scalable environment to launch DeFi apps, meme coins, and payment platforms that support Bitcoin as their native asset.

BTC holders don’t need to leave the Bitcoin blockchain to transfer their assets to these applications as the Bitcoin Hyper bridge receives their BTC in a designated Bitcoin wallet address and mints the corresponding amount of tokens in its L2 immediately.

Once this protocol becomes widely adopted by Bitcoin maximalists, the demand for HYPER will skyrocket.

To take advantage of HYPER’s discounted presale price and reap the highest returns, head to the Bitcoin Hyper website and connect your wallet (e.g. Best Wallet). You can either swap USDT or ETH for this token or use a bank card to invest.

-

1

Binance Could Introduce Golden Visa Option for BNB Investors Inspired by TON

07.07.2025 8:00 1 min. read -

2

Ethereum and Solana 2025 Update: Upgrades, Growth, and What’s next

12.07.2025 14:30 2 min. read -

3

Pepe Price Prediction: PEPE Could Rise Another 10% If It Breaks This Key Level

16.07.2025 17:26 3 min. read -

4

Top 10 Trending Altcoins Right Now, According to CoinGecko Data

13.07.2025 17:30 3 min. read -

5

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read

Sui Price Prediction: As DeFi TVL Jumps by 42% – Will SUI Hit $5 Soon?

Sui (SUI) has gone up by 34% in the past 30 days as the project’s DeFi ecosystem has been growing rapidly this year. This favors a bullish SUI price prediction as it indicates increased adoption by developers. Data from DeFi Llama shows that the total value locked (TVL) within the Sui blockchain has expanded by […]

Eric Trump Says Ethereum is Undervalued, Backs Analyst’s $8,000 Target

U.S. President Donald Trump continues to draw attention for his pro-cryptocurrency stance—and now his son, Eric Trump, is turning the spotlight to Ethereum.

10 Crypto Unlocks to Watch in the Next 14 hours

A wave of token unlocks is set to hit the crypto market within the next 14 hours, potentially shaking up price dynamics for several low- and mid-cap projects.

What the Crypto Community is Thinking as Bitcoin Slips

Traders are growing cautious, and the crypto mood is beginning to shift. Bitcoin has stalled near $115,500, and momentum is no longer as confident as it was earlier this month.

-

1

Binance Could Introduce Golden Visa Option for BNB Investors Inspired by TON

07.07.2025 8:00 1 min. read -

2

Ethereum and Solana 2025 Update: Upgrades, Growth, and What’s next

12.07.2025 14:30 2 min. read -

3

Pepe Price Prediction: PEPE Could Rise Another 10% If It Breaks This Key Level

16.07.2025 17:26 3 min. read -

4

Top 10 Trending Altcoins Right Now, According to CoinGecko Data

13.07.2025 17:30 3 min. read -

5

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read