Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Best Crypto to Buy Now as Whales Sell But ETFs Scoop Up Billions

27.06.2025 15:46 7 min. read Nikolay KolevWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

On June 26, CNBC highlighted a notable shift in Bitcoin’s on-chain dynamics: investors holding Bitcoin for at least 155 days are easing up on their HODL strategies and starting to sell. This change from the typically patient group comes as spot Bitcoin ETFs continue to attract capital at an unprecedented pace.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products, or other materials on this page.

Why does this matter? When whales decide to realize gains, they can significantly influence market sentiment and even counteract the impact of institutional inflows. With this tug-of-war between profit-taking and fresh demand, traders are asking: what’s the smartest play? Welcome to your guide to the best crypto to buy now.

Bitcoin Ownership Shifts as Whales Sell, Forcing Trader Adaptation

Bitcoin ETFs continue to draw strong interest, marking 12 straight days of fresh inflows. Investors added $548 million across five major funds yesterday, with BlackRock’s IBIT leading the way, pulling in $340 million. Fidelity’s FBTC and Ark’s ARKB followed closely, with $115 million and $70 million, respectively.

#Bitcoin Spot ETF saw a total net inflow of 547.72M USD yesterday, marking a 12 days of consistent inflow pic.twitter.com/kwHgSfrUjB

— MetaPath (@MetaPath_me) June 26, 2025

Despite steady institutional demand, Bitcoin’s price remains surprisingly sluggish, sparking debate and raising concerns about custody practices. The influx of funds is not pushing the price higher as expected, triggering speculation across the market.

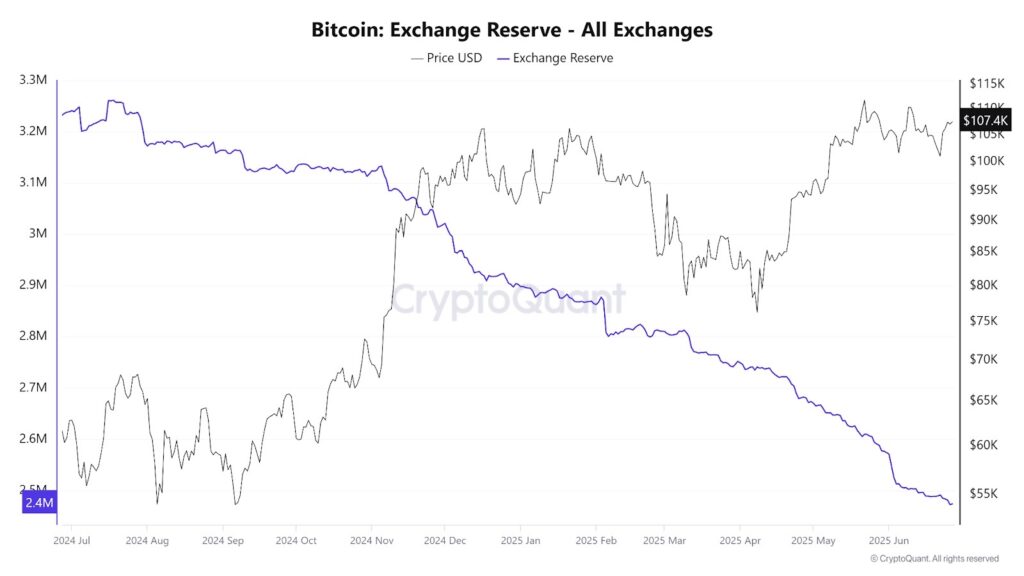

Massive ETF buying, totaling $4 billion this month, contrasts sharply with Bitcoin’s modest 3% gain. The key factor appears to be the presence of major sellers, with data from CryptoQuant indicating that ‘whales,’ likely Chinese miners, are offloading their holdings, offsetting the ETF purchases.

This shift in market dynamics reveals a significant trend: large holders (with 1,000+ BTC) are selling, while institutional ETFs and corporations are buying. Retail investors with under 1 BTC are also selling, though their actions now have less impact. Traders may begin turning to more complex options or Bitcoin stock proxies in response to this changing market landscape.

Bitcoin Price Analysis

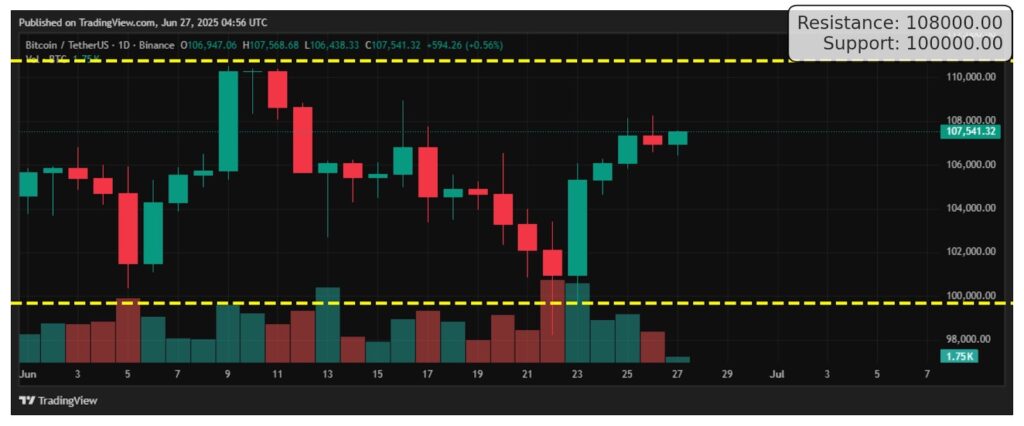

The Bitcoin daily chart reveals two key levels: resistance at $108,000 and support at $100,000. The price is currently stalling near the $108K resistance, which aligns with highs from earlier in June, suggesting that sellers are stepping in around this level. On the other hand, the $100K support zone has previously acted as a safety net, with buyers stepping in to defend the price, as seen during the sharp bounce on June 23.

After bouncing strongly off the $100K support, BTC has gradually climbed back up. The series of green candles and rising volume suggest bullish momentum. However, the repeated rejection near the $108K resistance raises caution. If Bitcoin can break through this level with strong volume, it could signal a bullish breakout. Otherwise, we may see consolidation or a pullback toward the support level.

This pattern resembles a rounded base or cup-like formation, where the price drops, recovers, and tests previous highs, often indicating accumulation before a potential breakout.

Block Diversity, a crypto analyst on X, reports that Bitcoin is currently range-bound between $106K and $108K, with heavy liquidations taking place.

$BTC complete analysis

– still in range and $108k is level to flip

– Dominance is high, needs to break down below 64% for alts for any gain

– Heatmap, fully loaded with longs from $106.4k and shorts from $108.6kSummary: range bound 106k-108k, a lot of liquidations. $BTC ATH… pic.twitter.com/nYIAJvsDwH

— Block_Diversity v.8 ™️ (@i_bot404) June 26, 2025

Best Crypto to Buy Now

As long-term holders trim positions and ETFs keep their foot on the gas, the market is splitting into two camps: strategic accumulation versus profit-taking. This divide sets the stage for targeted opportunities in tokens that thrive on both institutional momentum and on-chain fundamentals. Let’s cut through the noise and zero in on the best crypto to buy now.

Bitcoin Hyper

Riding the ETF wave, Bitcoin Hyper uses yield-generating strategies on Bitcoin positions. As institutions enter and whales exit, the token’s compounding mechanism could take advantage of both inflows and spot-funding arbitrage.

Bitcoin Hyper has quickly gained attention as a groundbreaking crypto project, introducing major innovations to the space. As the first Layer-2 solution for Bitcoin, it aims to overhaul the network and address its key limitations.

By speeding up transactions and reducing fees, Bitcoin Hyper offers a more efficient alternative for everyday purchases. Its solution connects to Bitcoin’s main chain via a decentralized bridge, combining Bitcoin’s security with Solana’s fast transaction speeds.

Using the SVM, Bitcoin Hyper ensures a seamless experience, allowing users to lock BTC, mint wrapped tokens, and enjoy faster, low-cost transactions. Zero-knowledge proofs maintain security and integrity while enabling high throughput.

After users are finished, they can burn wrapped tokens and recover native BTC via the trustless bridge. HYPER token is at the center of this system, facilitating transactions, staking, governance, and network incentives.

Bitcoin Hyper seeks to unlock innovative use cases for Bitcoin, such as lending, trading, and smart contracts, without compromising the decentralization and security that are the founding principles of the Bitcoin network.

BTC Bull

When whales cash out, volatility increases, and BTC Bull is designed to capitalize on that movement. Its momentum-driven structure makes it an ideal choice for traders looking to gain amplified exposure to Bitcoin’s fluctuations.

BTC Bull has raised $7.3 million in its presale, positioning itself as a prime token for Bitcoin maximalists who believe Bitcoin can replace fiat. Holders are also rewarded as Bitcoin hits key milestones.

When Bitcoin hits $125k, $175k, and $225k, BTCBULL tokens will be burned. At $150k and $200k, Bitcoin airdrops will trigger, and at $250k, a BTCBULL airdrop will distribute 10% of the tokens to the community.

The token’s mascot, a soldier-clad bull, symbolizes the resilience required in investing. Beyond milestone rewards, users can also stake their BTCBULL tokens for additional benefits.

Over $7M raised. This is not a drill. 🐂🔥 pic.twitter.com/S7Mq8LPWq7

— BTCBULL_TOKEN (@BTCBULL_TOKEN) June 24, 2025

To participate and earn rewards, users need a decentralized (DeFi) wallet, with the team recommending Best Wallet, a non-KYC option available on iOS and Android.

Best Wallet Token

As custody questions swirl, Best Wallet Token offers on-chain governance and enhanced security features. This crypto bridges institutional trust and retail usability, positioning it to benefit when large holders and newcomers alike demand safer storage solutions.

Best Wallet Token launched in 2024 and has already raised over $13.5 million in its presale. With a growing feature set and attractive early incentives, it’s quickly becoming a popular choice among traders.

Aimed at both crypto professionals and newcomers, Best Wallet is a non-custodial mobile wallet built for ease of use. It supports over 60 blockchains, allowing users to manage a wide range of assets in one place.

At the core of Best Wallet is Multi-Party Computation (MPC) technology, which ensures top-tier security without the need for a long seed phrase. It’s like a vault that requires multiple keys to open, offering strong protection.

Being a non-custodial wallet, Best Wallet provides users with complete control of their private keys and cryptocurrencies, with the result that it is a good option for privacy-focused users. The application has been engineered to make the users masters of their funds.

One of the highlights is the “Upcoming Tokens” tab, in which users can find promising initial projects before they launch. Best Wallet’s BEST token serves as the pivot of the ecosystem, fueling fees, governance, and special perks.

BEST token holders get reduced transaction charges, increased staking benefits, and priority access to verified token sales. Also part of the plan is a staking aggregator for improved yields and upcoming Best Card for spending cryptocurrencies with cashback rewards.

ClayBro, a prominent figure in the crypto YouTube community, forecasts that 2026 could be a major year for Best Wallet.

Conclusion

The tug-of-war between profit-taking long-term holders and steady ETF inflows highlights a turning point in Bitcoin’s maturation. While whales are cashing in, institutional demand remains strong, and this dual force could keep markets volatile yet full of selective opportunities.

Investors who focus on tokens that offer both yield strategies and secure custody stand to benefit as the landscape evolves. Stay attentive to how these dynamics reshape on-chain flows and fund allocations, as timing is crucial in volatile markets. And remember: the best crypto to buy now.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Best Crypto to Buy Now as Canada Spot XRP ETF Unlocks New Capital Inflows

18.06.2025 19:04 8 min. read -

2

Next 1000x Crypto: 4 Presales That Could Give Massive Returns

21.06.2025 19:34 6 min. read -

3

Best Crypto to Buy Now as Amazon and Walmart Plan New Stablecoins

14.06.2025 19:17 7 min. read -

4

Bitcoin Hyper Is the Fastest Way to Use BTC – and It’s Just Getting Started

16.06.2025 10:43 5 min. read -

5

Best Crypto to Buy Now as Metaplanet Overtakes Coinbase’s Bitcoin Stash

17.06.2025 18:51 8 min. read

Best Crypto Presales That Whales Are Adding to Their Portfolios for July

Bitcoin continues to test support at $107K, with traders and investors positioning for the next push higher. Many think it’s just a matter of time before Bitcoin makes another big move, especially with new money flowing into the market and more people bringing up crypto in mainstream media. As a result, some of the biggest […]

BTC Bull Token Enters Final 3 Days of Viral Presale: Next 100x Crypto?

Bitcoin’s (BTC) latest recovery from the sub-$100,000 level has reignited optimism about a potential bull run in Q3. The benchmark cryptocurrency now remains firmly above $105,000, and crucially, it does so against a backdrop of mounting institutional conviction. US spot Bitcoin ETFs have now posted a 12-day streak of net inflows, while corporate treasuries continue […]

Best Crypto to Buy Now as Laffont’s $5T Bitcoin Prediction Sparks Institutional Surge

Hedge fund titan Philippe Laffont has flipped his stance on Bitcoin, forecasting its market cap could more than double to $5 trillion within five years. This projection underscores shifting institutional sentiment and waning volatility in the largest crypto asset. Philippe Laffont on #bitcoin: “Every day I do think, ‘Why do I not own it?’” pic.twitter.com/YopeiJD2wn […]

Best Altcoin to Buy in July? Best Wallet Token Presale Hits $13.5 Million

The Best Wallet Token (BEST) presale has surpassed $13.5 million, just as Mastercard’s recent partnership with Chainlink opens a highway for over 3 billion cardholders to buy crypto directly on-chain. With more fiat money flowing directly into on-chain wallets, demand for safe, non-custodial wallet solutions is set to increase dramatically. This trend aligns with Best […]

-

1

Best Crypto to Buy Now as Canada Spot XRP ETF Unlocks New Capital Inflows

18.06.2025 19:04 8 min. read -

2

Next 1000x Crypto: 4 Presales That Could Give Massive Returns

21.06.2025 19:34 6 min. read -

3

Best Crypto to Buy Now as Amazon and Walmart Plan New Stablecoins

14.06.2025 19:17 7 min. read -

4

Bitcoin Hyper Is the Fastest Way to Use BTC – and It’s Just Getting Started

16.06.2025 10:43 5 min. read -

5

Best Crypto to Buy Now as Metaplanet Overtakes Coinbase’s Bitcoin Stash

17.06.2025 18:51 8 min. read