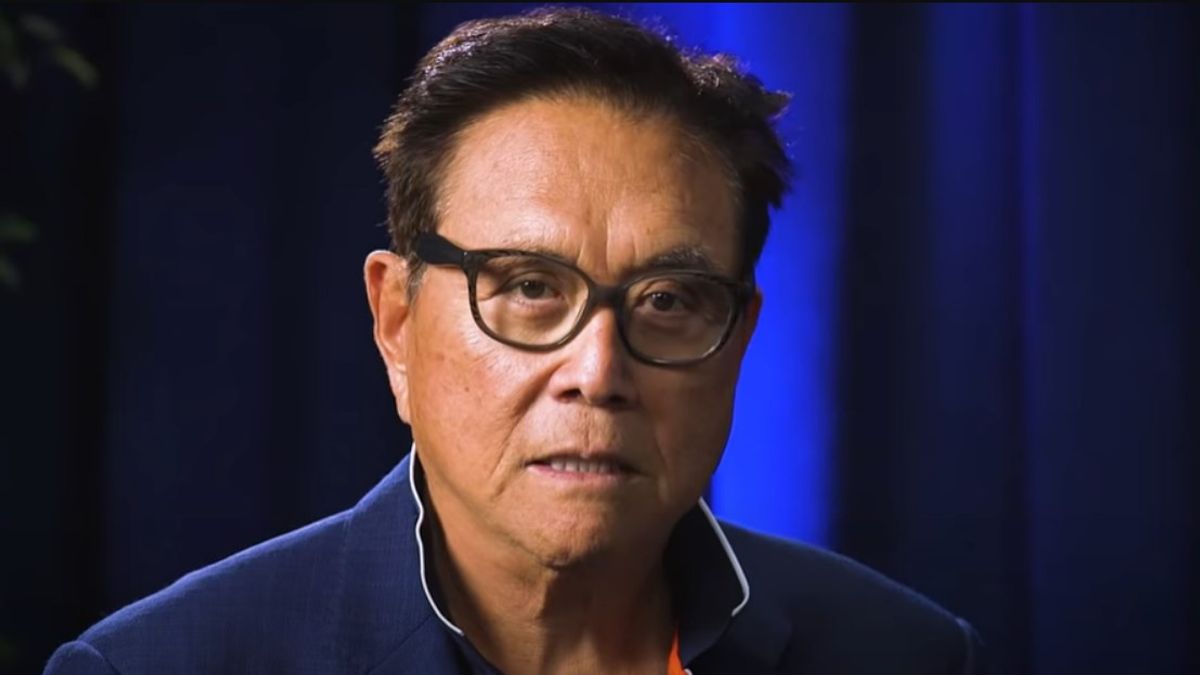

Robert Kiyosaki Predicts 2025 “Super-Crash,” Urges Hoarding Gold, Silver, and Bitcoin

23.06.2025 13:31 2 min. read Alexander Stefanov

Personal-finance author Robert Kiyosaki is sounding the alarm that next year could bring an economic breakdown unlike anything modern markets have seen.

In a recent X thread, the Rich Dad Poor Dad writer blames surging prices and rapid job disruption from artificial intelligence for what he calls an inevitable “biggest crash in history.”

Why 2025?

- Runaway inflation: Kiyosaki argues soaring living costs are eroding retirees’ savings faster than they can respond.

- AI-driven layoffs: He forecasts “millions” will lose work as automation spreads across white- and blue-collar roles.

- False security: Traditional advice—earn a degree, land a steady job—no longer protects households, he says.

The “hard-money” playbook

Kiyosaki’s solution remains unchanged: accumulate scarce, non-government assets.

- Gold & silver: Ignore daily spot moves and focus on how many ounces you hold.

- Bitcoin: He started buying around $6 k and still adds on dips, predicting BTC could top $1 million by 2030.

“Poor people obsess over price; the wealthy count units,” he wrote, stressing that ownership volume, not headline quotes, will decide who weathers the storm.

Dismiss “false prophets”

The author warns against YouTube influencers and conventional educators promising job security. Instead, he urges followers to vet information sources carefully and build positions in what he terms “real money.”

With 2025 framed as a potential financial reset, Kiyosaki’s message is blunt: stockpile gold, silver, and Bitcoin now—or risk being caught on the wrong side of history’s next major market wipeout.

-

1

UK Political Party Becomes First to Accept Bitcoin Donations

31.05.2025 10:00 2 min. read -

2

Bitcoin Treasury Frenzy Faces First Major Test as Market Cools

02.06.2025 18:00 2 min. read -

3

JPMorgan Quietly Opens the Door to Bitcoin-Backed Lending

05.06.2025 15:00 1 min. read -

4

Anthony Pompliano’s Latest Venture Targets $750M to Fuel Bitcoin Strategy

15.06.2025 13:00 1 min. read -

5

Bitcoin Faces Key Test as Fed Uncertainty and Market Exhaustion Collide

05.06.2025 21:00 1 min. read

Norwegian Mining Firm Adopts Bitcoin as Treasury Reserve

Oslo-based seabed-mining firm Green Minerals is shifting its treasury reserves from kroner and dollars into bitcoin, calling the move a hedge against inflation and geopolitical risk.

Crypto Funds Pull in $1.2B Despite Market Drop and Global Tensions

Global crypto funds just logged a tenth straight week of fresh capital, pulling in another $1.24 billion even as prices slid and geopolitics turned tense.

Anthony Pompliano Unveils Bitcoin Treasury Giant After Landmark Merger

Investor and entrepreneur Anthony Pompliano is rolling his private outfit, ProCap BTC LLC, into blank-check firm Columbus Circle Capital to form ProCap Financial, a new Nasdaq-listed business built around Bitcoin.

Strategy Adds to Its Bitcoin Pile Again, Shrugging Off Market Slump

The tech-turned-Bitcoin play Strategy (formerly MicroStrategy) has quietly scooped up another batch of BTC, its eleventh consecutive weekly buy, undeterred by the market’s slide below $100,000.

-

1

UK Political Party Becomes First to Accept Bitcoin Donations

31.05.2025 10:00 2 min. read -

2

Bitcoin Treasury Frenzy Faces First Major Test as Market Cools

02.06.2025 18:00 2 min. read -

3

JPMorgan Quietly Opens the Door to Bitcoin-Backed Lending

05.06.2025 15:00 1 min. read -

4

Anthony Pompliano’s Latest Venture Targets $750M to Fuel Bitcoin Strategy

15.06.2025 13:00 1 min. read -

5

Bitcoin Faces Key Test as Fed Uncertainty and Market Exhaustion Collide

05.06.2025 21:00 1 min. read