Bitcoin Price Prediction: Can the Genius Act Push Bitcoin to $200K?

20.06.2025 22:52 3 min. read Alejandro Ar

Bitcoin (BTC) has gone down by 1.2% in the past month but an important piece of legislation in the United States could change the top crypt’s trajectory in the next few months.

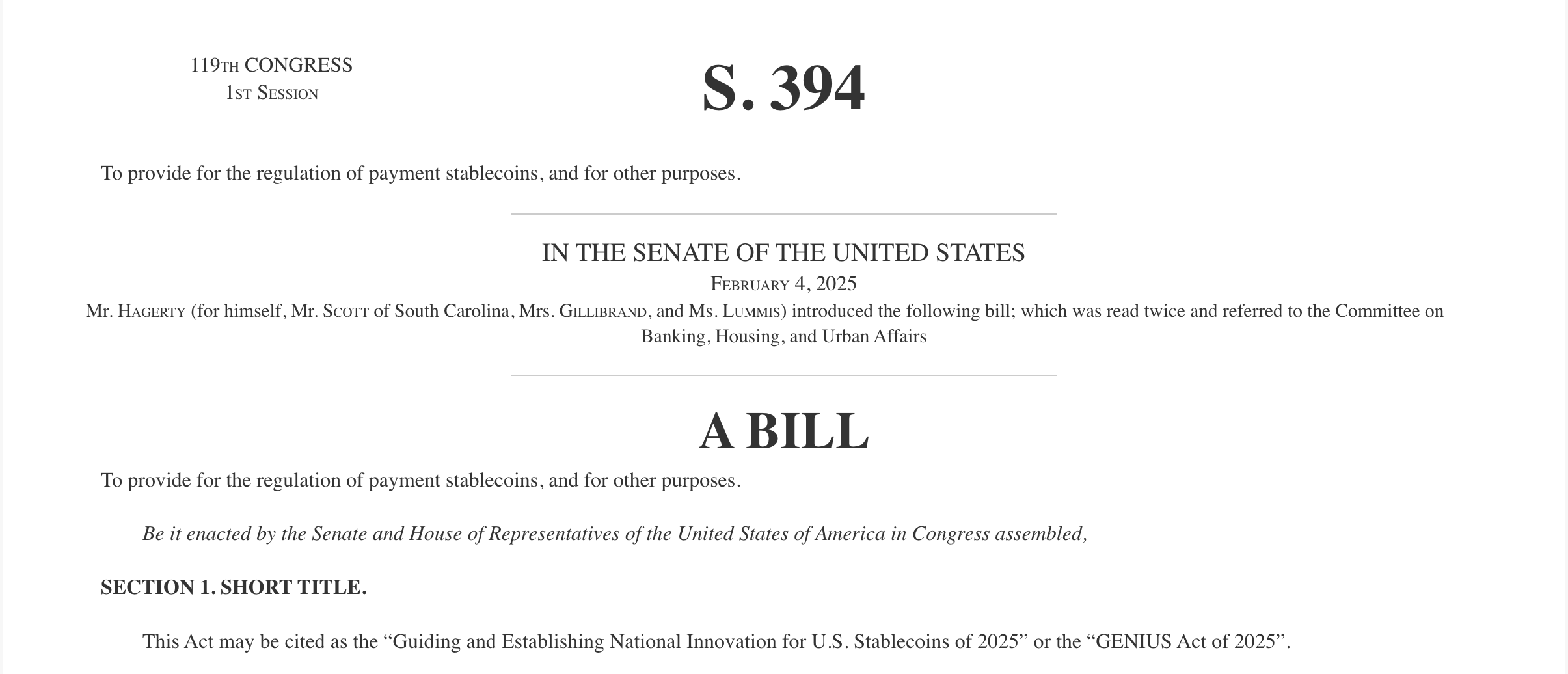

The so-called ‘GENIUS Act’, an acronym that stands for “Guiding and Establishing National Innovation for U.S. Stablecoins Act”, has been passed in the Senate in an overwhelming 68-30 vote and now needs to be approved by the House of Representatives before it can land on President Donald Trump’s desk.

This piece of legislation establishes a much-needed legal framework that would allow stablecoins to be used freely in U.S. territory as a means of payment.

President Trump has urged the House not to delay their vote. “Get it to my desk, ASAP—no delays and no add ons,” he commented in a Truth Social post today.

Trump anticipates that the bill’s approval could drive trillions of dollars toward Bitcoin (BTC) and other top cryptocurrencies. This obviously favors and supports a bullish Bitcoin price prediction.

Recently, the Trump-linked crypto company, World Liberty Financial (WLFI), issued a stablecoin called USD1 that was used by an Abu Dahbi-based investment firm to make a $2 billion investment in Binance.

Legalizing the use of stablecoins in the United States would be huge for the market as it would allow firms to develop products and services that rely on these digital assets such as loans, stablecoin-back payment cards, and savings accounts.

Bitcoin Price Prediction: BTC Nears Key Support at $101,000

Bitcoin (BTC) experienced a significant drop today as the 4-hour chart shows and seems headed to retest the $101,000 level.

The $107,000 was retested and swiftly rejected by market participants earlier today and the price acted somehow counter-intuitively to the passing of this pro-crypto legislation.

In this lower time frame, the price has dropped below the 200-period exponential moving average (EMA), which favors a bearish outlook, and the short-term moving averages have made a move below this indicator as well, triggering a sell signal known as a ‘death cross’.

Momentum indicators favor a bearish push as well. The Relative Strength Index (RSI) has dropped below the 14-period moving average.

Everything points to an imminent retest of the $101,000 level. If the price bounces off this mark, it could result in a big push that finally capitalizes on this positive news.

Bitcoin’s growth prospects are as promising as ever and one hot crypto presale called Bitcoin Hyper (HYPER) could capitalize on this positive momentum to raise the necessary capital to launch its powerful Bitcoin L2.

Bitcoin Hyper (HYPER) Surpasses $1M Mark Less Than Month After Its Presale Kicked Off

Bitcoin Hyper (HYPER) is a layer-2 scaling solution for Bitcoin that opens up the floodgates for a new era for BTCFi.

With this protocol, developers will be able to create scalable and efficient Bitcoin-native DeFi apps, payment platforms, and more.

The project is powered by a Solana-based bridge that automatically mints new Bitcoin tokens right after these are received in a canonical Bitcoin wallet address monitored 24/7 by smart contracts.

Once BTC tokens are moved to the Bitcoin Hyper L2, they can be transferred cheaply to support DeFi applications and more.

As the project is embraced by top wallets and exchanges, the demand for $HYPER will skyrocket. To buy this token at its discounted presale price, head to the Bitcoin Hyper website and connect your wallet (e.g. Best Wallet).

You can either swap USDT or ETH or use a bank card to make your investment.

-

1

Bitcoin Faces Cooling Phase Unless Bulls Step In, Says On-Chain Expert

02.06.2025 9:00 1 min. read -

2

BlackRock Boosts Crypto Holdings with Over $350M in BTC and ETH

05.06.2025 18:00 1 min. read -

3

Bitcoin ETFs Just Had Their Worst Day in Months — But One Fund Stood Apart

30.05.2025 17:00 1 min. read -

4

Crypto Enters a Make-or-Break Era, Says Industry Insider

04.06.2025 8:00 1 min. read -

5

Bitcoin ETFs See $268M in Outflows Over Three Straight Days Amid Institutional Cooldown

03.06.2025 13:05 1 min. read

Ethereum Loses Retail Momentum as Bitcoin Pulls Ahead

Ethereum is struggling to hold attention from retail investors, even as larger players ramp up their exposure to the second-largest cryptocurrency.

Here is What Robert Kiyosaki Expects From Bitcoin Until 2030

Robert Kiyosaki, the author behind Rich Dad Poor Dad, has once again made waves with a bold projection for Bitcoin.

South Korea Moves Toward Spot Crypto ETFs and Stablecoin Oversight

South Korea’s Financial Services Commission (FSC) is drafting a proposal to support the launch of spot crypto ETFs, aiming for release in the second half of 2025.

Bitcoin Fortifies Its $100K Floor as Institutions Keep Buying

Even with fresh conflict in the Middle East and a less-than-dovish Federal Reserve outlook, Bitcoin has spent more than five weeks trading comfortably above $100,000.

-

1

Bitcoin Faces Cooling Phase Unless Bulls Step In, Says On-Chain Expert

02.06.2025 9:00 1 min. read -

2

BlackRock Boosts Crypto Holdings with Over $350M in BTC and ETH

05.06.2025 18:00 1 min. read -

3

Bitcoin ETFs Just Had Their Worst Day in Months — But One Fund Stood Apart

30.05.2025 17:00 1 min. read -

4

Crypto Enters a Make-or-Break Era, Says Industry Insider

04.06.2025 8:00 1 min. read -

5

Bitcoin ETFs See $268M in Outflows Over Three Straight Days Amid Institutional Cooldown

03.06.2025 13:05 1 min. read