Bitcoin Price Prediction: Traders Are Betting Heavily on a New All-Time High for BTC – $140K Next?

27.05.2025 22:23 3 min. read Alejandro Ar

Bitcoin (BTC) has delivered gains of 17% in the past month and currently stands at $109,736 as the top crypto has retreated a bit from its fresh all-time high.

Trading volumes have gone up by 20.3% in the past 24 hours after the token neared the $111,000 threshold once again as selling pressure at these key levels is typically higher than the average.

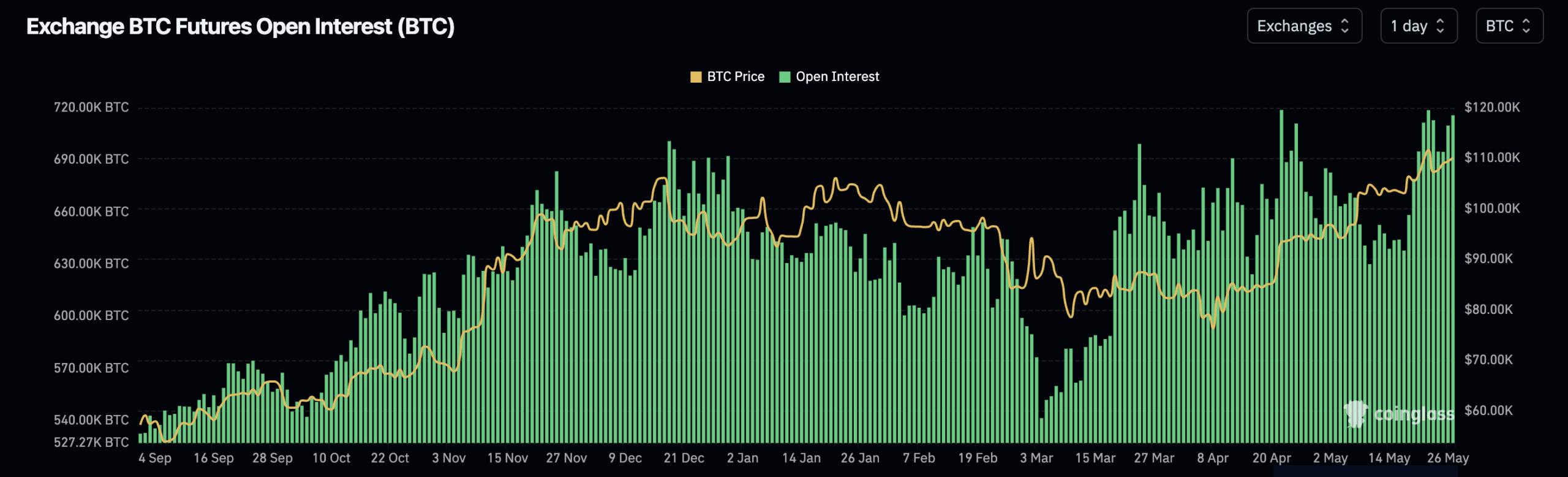

The futures market has been heating up ever since BTC climbed above $90,000 again in late April as reflected by a surge in open interest.

When this metric is expressed in BTC rather than USD, as the latter is distorted by the token’s price fluctuations, we can see that OI has exploded back to record levels and has already surpassed the historical records reached in November when President Donald Trump won the U.S. Presidential election.

This is an indication that traders have a strong bullish bias and believe that the token will continue to rise from its current levels.

Data from CoinGlass shows that OI has surged to almost 716,000 BTC while, on the day that the token rose to its latest all-time high, this figure closed the day slightly above that mark at 718,000 BTC.

Bitcoin Price Prediction: BTC Could Rise to $140K But Will Need a Breather Before Getting There

Looking at the daily price action, BTC has formed a bearish rising wedge as the price has recovered almost vertically in just a month.

Market sentiment has moved from one extreme to the other during this same period as reflected by the Fear and Greed Index, which bounced from Extreme Fear to Greed in record time.

At this point, traders should be careful not to be the last to enter the rally as a strong correction seems to be in order as every technical signal is flashing overbought.

This is not necessarily bad as the rally needs additional liquidity that it can only find after a steep drop as this gives late buyers the chance to enter the rally at a much lower price.

Momentum is still quite positive and this supports a bullish Bitcoin price prediction with a short-term target set at $140,000 based on how the top crypto have performed in similar rallies lately.

Hence, waiting for a better entry would be a good idea at this point. In the meantime, a new crypto presale called BTC Bull Token (BTCBULL) offers a milestone-based reward system tied to the performance of Bitcoin that will generate passive income for token holders.

BTC Bull Token (BTCBULL) Will Distribute Its First Reward as Soon as Bitcoin Reaches $125K

BTC Bull Token (BTCBULL) is a fun alternative to earn passive income as Bitcoin reaches new heights.

The rewards system is quite simple. Starting at a baseline price of $100,000, token holders are rewarded via token burns and direct Bitcoin airdrops for every $25K that BTC adds on top of that mark.

The first milestone is set at $125,000, at which point a portion of BTCBULL’s circulating supply will be burned to raise its price.

Next up, once the price gets to $150K, BTCBULL investors will receive a direct Bitcoin airdrop proportional to the number of tokens they have bought.

To buy $BTCBULL before the first reward is unlocked, head to the BTC Bull Token website and connect your wallet (e.g. Best Wallet). You can either swap USDT or ETH for this token or use a bank card to invest.

-

1

Bitcoin Price Prediction for the End of 2025 From Standard Chartered

02.07.2025 18:24 1 min. read -

2

Robert Kiyosaki Says Crypto Is Key to Building Wealth in a Failing System

27.06.2025 10:00 1 min. read -

3

Franklin Templeton Warns of Serious Risks in Institutional Bitcoin Treasury Strategies

03.07.2025 18:12 2 min. read -

4

Top Public Companies by Bitcoin Holdings

02.07.2025 10:00 2 min. read -

5

American State Bans Crypto Investments and Payments in Sweeping New Law

01.07.2025 14:33 2 min. read

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

Standard Chartered has taken a major step into the cryptocurrency space, becoming the first globally systemically important bank to offer spot trading for Bitcoin (BTC) and Ethereum (ETH) to institutional clients.

Canadian Bank Sees Bitcoin Hitting $155,000 by 2025

TD Cowen has boosted its price target for Strategy (formerly MicroStrategy) to $680, up from $590.

Bitcoin Price Prediction: As BTC Hits New All-Time High Is $200K In Sight?

Bitcoin (BTC) has hit a new all-time high today at $123,090 as per data from CoinMarketCap and trading volumes have exploded as a result. Nearly $180 billion worth of Bitcoin has exchanged hands in the past 24 hours. This represents a 284% increase during this period. This volume accounts for 7.5% of BTC’s circulating supply. […]

Bitcoin Price Prediction From Bernstein After the Recent All-Time High

As Bitcoin surged to another record high above $123,000 on Monday, analysts at Bernstein offered a bullish long-term outlook for the digital asset, forecasting a transformative period ahead for the entire crypto sector.

-

1

Bitcoin Price Prediction for the End of 2025 From Standard Chartered

02.07.2025 18:24 1 min. read -

2

Robert Kiyosaki Says Crypto Is Key to Building Wealth in a Failing System

27.06.2025 10:00 1 min. read -

3

Franklin Templeton Warns of Serious Risks in Institutional Bitcoin Treasury Strategies

03.07.2025 18:12 2 min. read -

4

Top Public Companies by Bitcoin Holdings

02.07.2025 10:00 2 min. read -

5

American State Bans Crypto Investments and Payments in Sweeping New Law

01.07.2025 14:33 2 min. read