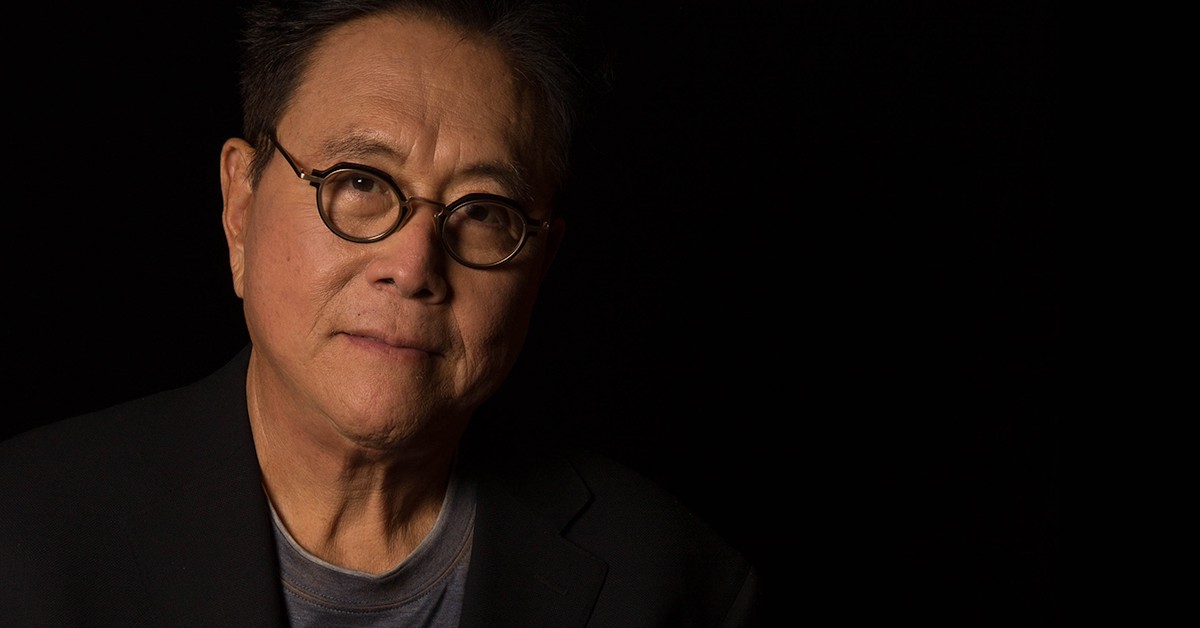

Robert Kiyosaki Warns of Economic Breakdown, Calls Bitcoin a Lifeline

28.05.2025 16:00 1 min. read Alexander Stefanov

Robert Kiyosaki, author of Rich Dad Poor Dad, is sounding a dire alarm over what he describes as the beginning of financial chaos in the U.S.—a scenario he believes will wipe out millions financially.

Referencing a recent U.S. bond auction that reportedly saw little demand, Kiyosaki claims the Federal Reserve was forced to buy $50 billion worth of bonds using newly printed dollars, a move he says marks the arrival of hyperinflation. “The system is imploding,” he said, calling the event a clear sign the economy is entering crisis territory.

In response to this, Kiyosaki is once again championing hard assets. He predicts that gold could soar to $25,000, silver to $70, and Bitcoin to between $500,000 and $1 million. He argues that the dollar is rapidly losing value, and that the best defense is owning scarce, non-inflationary assets.

With only a small portion of Bitcoin left to be mined, Kiyosaki emphasized that time is running out for everyday investors to accumulate BTC at current prices. Even owning a fraction, he says, could become life-changing. As the macro environment deteriorates, he believes Bitcoin is heading into what analyst Raoul Pal refers to as the “Banana Zone”—a period of parabolic price action driven by supply constraints and rising demand.

For Kiyosaki, the message is simple: ignore the volatility, hold Bitcoin, and prepare for a turbulent financial future.

-

1

UniCredit to Launch Structured Product Tied to BlackRock’s Spot Bitcoin ETF

01.07.2025 17:53 1 min. read -

2

Trump’s Two big Bitcoin Moves: Key Catalysts or Just Noise for BTC Price?

08.07.2025 7:30 2 min. read -

3

Bitcoin Market Stalls as Profit-Taking, Whale Dispersal, and Sideways Action Define the Cycle

01.07.2025 20:00 3 min. read -

4

Speculation Surges as Binance BTC Futures Volume Tops $650 Trillion

04.07.2025 17:37 2 min. read -

5

Which Is the Next Bitcoin Price Target?

06.07.2025 20:00 2 min. read

Public Companies Now hold Over $100 Billion in Bitcoin — 4% of Total Supply

According to new data shared by Bitcoin Magazine Pro, publicly traded companies now collectively hold over 844,822 BTC, valued at more than $100.5 billion, marking a historic milestone for institutional Bitcoin adoption.

Trump Media Holds $2B in Bitcoin as Crypto Plan Expands

Trump Media and Technology Group, the parent company of Truth Social, Truth+, and Truth.Fi, has officially disclosed that it now holds approximately $2 billion in Bitcoin and Bitcoin-related securities.

Strategy Adds 6,220 BTC, Pushing Total Holdings Past 607,000

Michael Saylor’s Strategy has confirmed another major Bitcoin purchase, acquiring 6,220 BTC last week for approximately $739.8 million.

Bitcoin Open Interest Hits $42B as Funding Rates Signal Bullish Overextension

Bitcoin’s derivatives market is heating up, with open interest climbing back to $42 billion while funding rates continue to surge.

-

1

UniCredit to Launch Structured Product Tied to BlackRock’s Spot Bitcoin ETF

01.07.2025 17:53 1 min. read -

2

Trump’s Two big Bitcoin Moves: Key Catalysts or Just Noise for BTC Price?

08.07.2025 7:30 2 min. read -

3

Bitcoin Market Stalls as Profit-Taking, Whale Dispersal, and Sideways Action Define the Cycle

01.07.2025 20:00 3 min. read -

4

Speculation Surges as Binance BTC Futures Volume Tops $650 Trillion

04.07.2025 17:37 2 min. read -

5

Which Is the Next Bitcoin Price Target?

06.07.2025 20:00 2 min. read