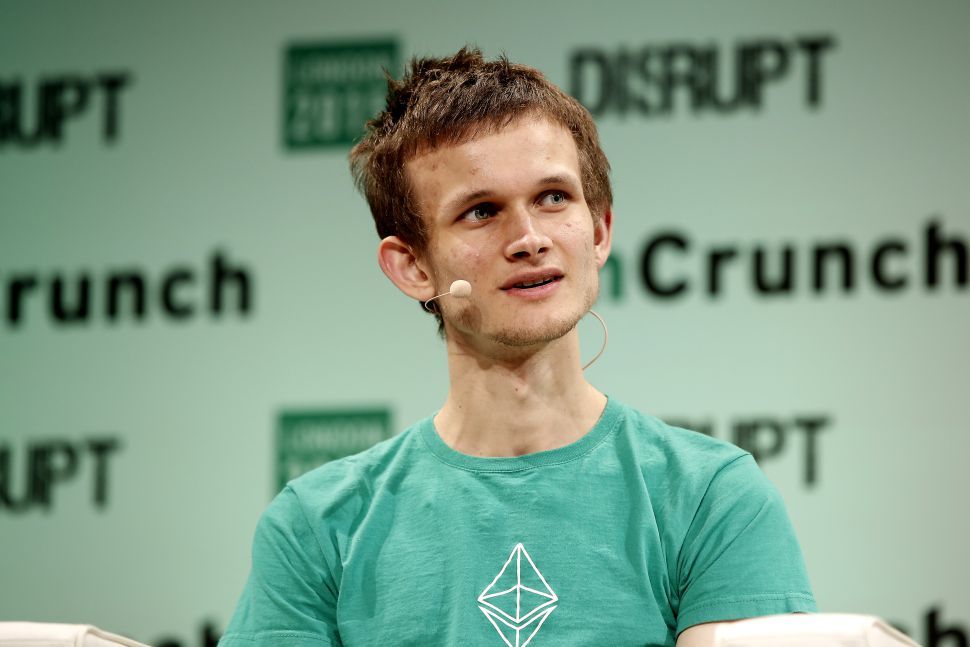

Vitalik Buterin: Ethereum Must Be Ready to Replace Cash

27.05.2025 14:00 1 min. read Alexander Stefanov

Ethereum co-founder Vitalik Buterin has renewed calls for the network to embrace a more cash-like function, pointing to Sweden’s unexpected return to promoting physical currency as a cautionary tale.

Reacting to a Guardian report highlighting Sweden’s reconsideration of its cashless push, Buterin noted on X that even highly digital societies are recognizing the need for physical money in times of uncertainty.

Geopolitical instability and war in Eastern Europe have prompted Swedish officials to advise citizens to keep physical krona on hand, despite years of advancing digital payments and a now-abandoned e-krona pilot.

Buterin argued that centralized systems can prove fragile in crisis scenarios. “Cash turns out necessary as a backup,” he said, emphasizing the need for Ethereum to evolve into a truly robust and private alternative. For the network to serve as a digital fallback, it must meet high standards of resilience and privacy, he added.

His comments reflect a broader vision of Ethereum not just as programmable money, but as a decentralized financial layer capable of serving real-world needs during uncertain times.

With central banks hesitating on digital currencies and public trust in institutions fluctuating, Ethereum’s ability to function as a private, censorship-resistant form of money could become increasingly vital.

-

1

Coinbase Adds ENA to Roadmap, Boosting Token’s Visibility

03.06.2025 12:00 1 min. read -

2

BlackRock Boosts Crypto Holdings with Over $350M in BTC and ETH

05.06.2025 18:00 1 min. read -

3

Crypto Enters a Make-or-Break Era, Says Industry Insider

04.06.2025 8:00 1 min. read -

4

ChatGPT Price Prediction of XRP, Solana, and Cardano by End of 2025

12.06.2025 18:57 3 min. read -

5

Pump.fun Reportedly Planning Massive Token Sale Despite Revenue Drop

04.06.2025 20:00 2 min. read

Pi Price Prediction: Top Community Member Believes PI Will Drop to $0.40

Pi Coin (PI) has gone down by 33% in the past month and has dropped below a key support at $0.60 as the community has been disappointed by a lack of updates from the Pi Core Team and delays in the migration of Pi tokens to the public mainnet. One notable supporter of Pi whose […]

Pepe Coin Slides but Signals Hint at a Potential Rebound

Pepe Coin is facing tough market conditions, with its price falling to $0.00001042 — over 36% down from its May peak and more than 60% below its all-time high.

Ethereum Loses Retail Momentum as Bitcoin Pulls Ahead

Ethereum is struggling to hold attention from retail investors, even as larger players ramp up their exposure to the second-largest cryptocurrency.

Fetch.AI Commits $50M to Token Buyback Amid Platform Growth

Blockchain project Fetch.AI has launched a $50 million buyback initiative for its FET token, citing rising platform usage and what it considers an undervalued market price.

-

1

Coinbase Adds ENA to Roadmap, Boosting Token’s Visibility

03.06.2025 12:00 1 min. read -

2

BlackRock Boosts Crypto Holdings with Over $350M in BTC and ETH

05.06.2025 18:00 1 min. read -

3

Crypto Enters a Make-or-Break Era, Says Industry Insider

04.06.2025 8:00 1 min. read -

4

ChatGPT Price Prediction of XRP, Solana, and Cardano by End of 2025

12.06.2025 18:57 3 min. read -

5

Pump.fun Reportedly Planning Massive Token Sale Despite Revenue Drop

04.06.2025 20:00 2 min. read