XRP Price Prediction: Can CME Futures Propel XRP to $4?

26.05.2025 23:49 3 min. read Alejandro Ar

XRP is one of the best-performing tokens of the top 5 apart from Bitcoin (BTC) with year-to-date gains of 11.1%.

Trading volumes have subsided a bit as the token has entered a long period of consolidation after a strong rally between November and January.

Multiple victories on the legal front, a positive change in the SEC’s leadership including the appointment of a new pro-crypto Chairman, and the launch of XRP futures in the CME are some of the tailwinds that have lifted the price of this crypto asset lately.

It’s happening. Institutional access to crypto is accelerating.

From the launch of XRP Futures and ETFs on CME and Nasdaq just this week, it’s clear the market is maturing and exposure to crypto is expanding.@bgarlinghouse locks in for 60 seconds and unpacks the excitement… pic.twitter.com/O3ugSDkn8i

— Ripple (@Ripple) May 23, 2025

Last week, XRP futures recorded trading volumes of $19 million on their first day. Two XRP-linked contracts are now available to be traded, one micro-contract of 2,500 XRP tokens and another large-sized contract made up of 50,000 XRP for institutional traders primarily.

“The addition of XRP and Micro XRP futures to our leading, regulated cryptocurrency suite will provide investors with the deeply liquid, capital-efficient tools they need to support their growing cryptocurrency investment and hedging strategies,” commented the global head of cryptocurrency products for the CME Group, Giovanni Vicioso.

Meanwhile, the odds that an XRP-linked exchange-traded fund (ETF) could soon be approved by the U.S. Securities and Exchange Commission (SEC) this year are quite high as the agency’s leadership change supports a positive outlook for this kind of product.

These tailwinds support a bullish XRP price prediction and could push the token to retest its all-time high of $3.4 as soon as the token steps out of consolidation.

XRP Price Prediction: XRP Could Rise to $3.2 as Bullish Structure Holds Up

XRP’s daily chart shows that the token has been struggling not to break its bullish structure as the selling pressure was quite strong as it hit $2.6.

The token’s short-term exponential moving averages (EMAs) indicate that XRP has entered a period of consolidation but it is still on an uptrend as the price is above the 200-day EMA.

Based on the size of the descending triangle that XRP broke out of, the price could rise to a first target of $3.2.

However, momentum indicators have been trending lower and the 9-day EMA is threatening to move below the 21-day EMA, which would confirm a bearish short-term outlook.

In case this ‘death cross’ occurs, the price could drop to the $2 level as there seems to be little liquidity at current levels to propel XRP higher.

A move toward the $2 area could draw buyers and draw the necessary fuel to push XRP to $3 and beyond.

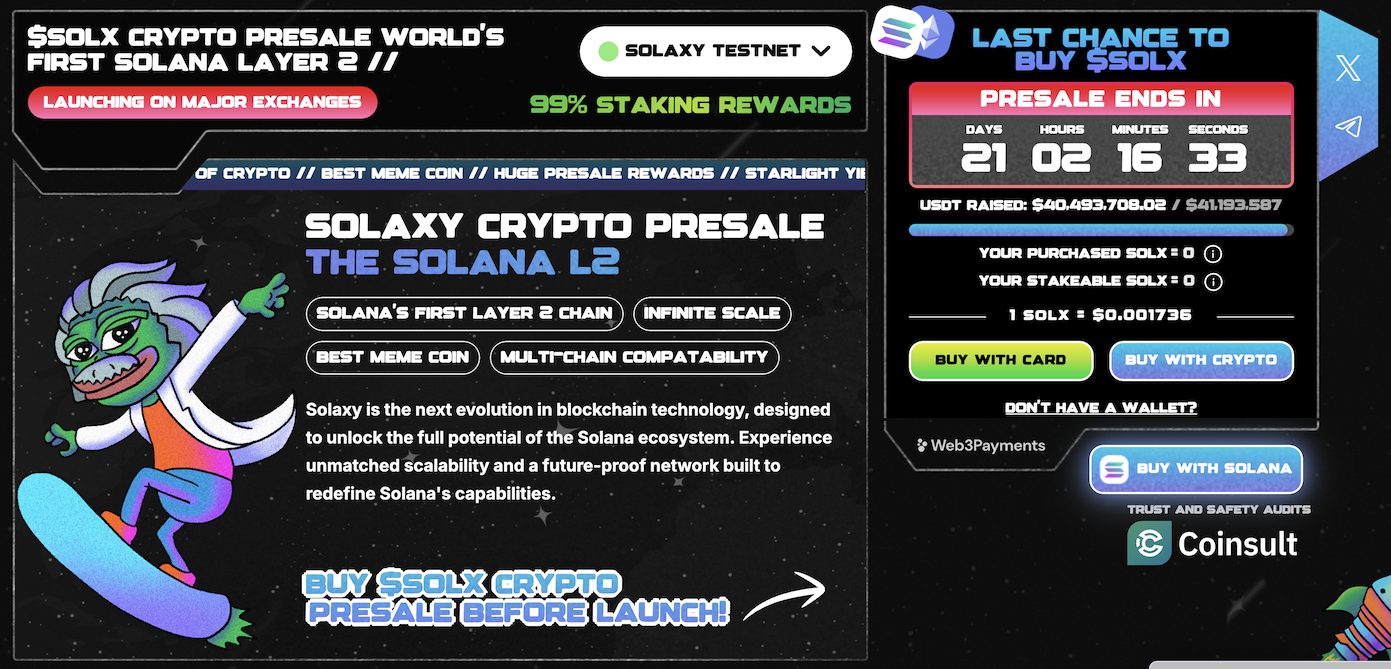

Although the upside potential that XRP offers at the moment seems limited, the best crypto presales of the year like Solaxy (SOLX) offer significant gains to early buyers who scoop up this token at its heavily discounted price.

Solaxy (SOLX) Solves Solana Congestion Issues By Launching a Powerful L2

Solaxy (SOLX) was conceived to solve the congestion issues that have plagued Solana’s operational efficiency in the past, especially during peak usage periods.

The Solaxy L2 functions as a side chain where transactions are bundled offline before they are sent to the mainnet. This alleviates the latter’s burden and increases its efficiency and scalability.

The project’s L2 and a token bridge testnets have already been launched along with a block explorer so investors can check how Solaxy is performing.

$SOLX is the L2’s utility token. Its demand will skyrocket once the solution is embraced by top wallets and exchanges. Hence, at its discounted price of $0.001736, this token could deliver significant gains to early buyers.

To buy $SOLX, simply head to the Solaxy website and connect your wallet (e.g. Best Wallet). You can either swap USDT or ETH for this token or use a bank card to invest.

-

1

Nasdaq-Lister Firm Bets Bigger on Solana with Largest Purchase Yet

15.05.2025 10:00 1 min. read -

2

New Altcoin Goes Live on Binance with Futures, Airdrop, and 50x Leverage

14.05.2025 18:00 1 min. read -

3

Cardano Eyes Comeback With Bullish Momentum Building

11.05.2025 21:00 1 min. read -

4

Visa Backs Stablecoin Startup BVNK in Latest Crypto Payments Bet

07.05.2025 17:32 3 min. read -

5

21Shares Launches Cronos ETP in Europe

08.05.2025 11:00 2 min. read

Pi Price Prediction: Can PI Climb Back Above $1? Key Levels to Watch

Pi (PI) has gone down by 4.3% in the past 24 hours and trading volumes seem to have evaporated as the crypto market appears to be ready to cool down from its recent peaks. Selling pressure was strong for PI at the $0.85 – $0.80 levels and this ended up pushing the price to its […]

Cardano Activity Surges as ADA ETF Decision Nears

Cardano is enjoying renewed momentum as daily transactions on the blockchain push toward 50,000, bolstered by growing excitement over a possible spot ADA exchange-traded fund (ETF).

Analysts Predict XRP Surge After Bullish Chart Patterns

XRP appears to be gaining bullish traction, with analysts pointing to a potential breakout that could send the token toward new highs.

Vitalik Buterin: Ethereum Must Be Ready to Replace Cash

Ethereum co-founder Vitalik Buterin has renewed calls for the network to embrace a more cash-like function, pointing to Sweden’s unexpected return to promoting physical currency as a cautionary tale.

-

1

Nasdaq-Lister Firm Bets Bigger on Solana with Largest Purchase Yet

15.05.2025 10:00 1 min. read -

2

New Altcoin Goes Live on Binance with Futures, Airdrop, and 50x Leverage

14.05.2025 18:00 1 min. read -

3

Cardano Eyes Comeback With Bullish Momentum Building

11.05.2025 21:00 1 min. read -

4

Visa Backs Stablecoin Startup BVNK in Latest Crypto Payments Bet

07.05.2025 17:32 3 min. read -

5

21Shares Launches Cronos ETP in Europe

08.05.2025 11:00 2 min. read