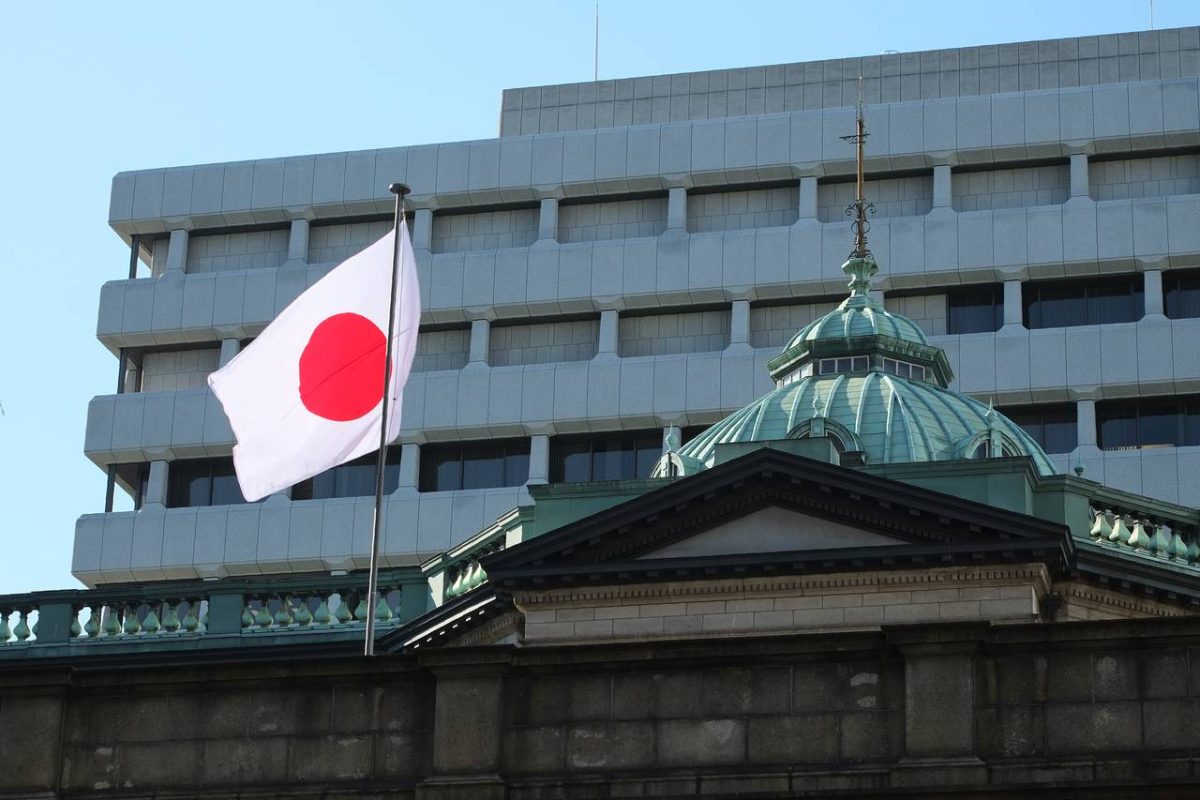

Japan Faces Mounting Financial Stress as Bond Market Cracks

20.05.2025 9:00 1 min. read Alexander Stefanov

A wave of economic red flags is shaking confidence in Japan’s fiscal health.

With its long-term bond yields hitting two-decade highs and GDP contracting for the first time in a year, investors are growing wary of the country’s financial trajectory.

The spike in 40-year bond yields signals rising skepticism about the government’s ability to manage debt over the long haul. Once viewed as a bastion of stability, Japan’s bond market is now flashing warning signs reminiscent of past debt crises abroad.

Prime Minister Shigeru Ishiba has called the situation more severe than Greece’s financial collapse — a stark assessment reflecting both domestic and international unease.

His comments come as Moody’s downgrade of U.S. credit adds further stress to global markets, intensifying capital outflows and triggering a sharp 3.2% drop in the Nikkei 225.

Analysts point to structural weaknesses — an aging population, sluggish growth, and an overreliance on ultra-low interest rates — as reasons why Japan’s economy may struggle to regain footing. And with bond yields rising, the cost of servicing that debt is beginning to bite.

In a global economy increasingly sensitive to debt sustainability, Japan’s troubles serve as a stark reminder: even developed markets aren’t immune to fiscal reckoning.

-

1

U.S. PCE Inflation Rises for First Time Since February, Fed Rate Cut Likely Delayed

27.06.2025 18:00 1 min. read -

2

Key U.S. Economic Events to Watch Next Week

06.07.2025 19:00 2 min. read -

3

Gold Beats U.S. Stock Market Over 25 Years, Even With Dividends Included

13.07.2025 15:00 1 min. read -

4

U.S. Announces Sweeping New Tariffs on 30+ Countries

12.07.2025 16:30 2 min. read -

5

US Inflation Heats Up in June, Fueling Uncertainty Around Fed Cuts

15.07.2025 16:15 2 min. read

US Inflation Heats Up in June, Fueling Uncertainty Around Fed Cuts

U.S. inflation accelerated in June, dealing a potential setback to expectations of imminent Federal Reserve rate cuts.

Gold Beats U.S. Stock Market Over 25 Years, Even With Dividends Included

In a surprising long-term performance shift, gold has officially outpaced the U.S. stock market over the past 25 years—dividends included.

U.S. Announces Sweeping New Tariffs on 30+ Countries

The United States has rolled out a broad set of new import tariffs this week, targeting over 30 countries and economic blocs in a sharp escalation of its trade protection measures, according to list from WatcherGuru.

Key U.S. Economic Events to Watch Next Week

After a week of record-setting gains in U.S. markets, investors are shifting focus to a quieter yet crucial stretch of macroeconomic developments.

-

1

U.S. PCE Inflation Rises for First Time Since February, Fed Rate Cut Likely Delayed

27.06.2025 18:00 1 min. read -

2

Key U.S. Economic Events to Watch Next Week

06.07.2025 19:00 2 min. read -

3

Gold Beats U.S. Stock Market Over 25 Years, Even With Dividends Included

13.07.2025 15:00 1 min. read -

4

U.S. Announces Sweeping New Tariffs on 30+ Countries

12.07.2025 16:30 2 min. read -

5

US Inflation Heats Up in June, Fueling Uncertainty Around Fed Cuts

15.07.2025 16:15 2 min. read