Bitcoin’s Realized Cap Hits Record as Market Eyes Six-Figure Return

08.05.2025 16:00 1 min. read Alexander Zdravkov

Bitcoin is on the verge of regaining its psychological threshold of $100,000, and analysts at CryptoQuant explain some of the reasons behind the rise.

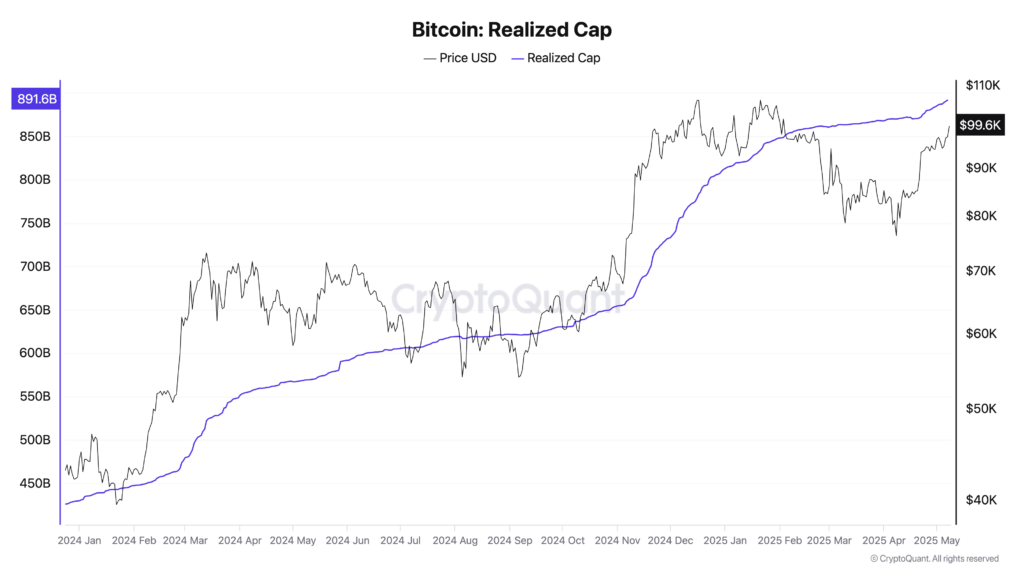

Bitcoin is seeing new highs — not just in price but in on-chain valuation metrics. According to CryptoQuant, the network’s realized cap, which tracks the value of BTC based on its last on-chain movement, reached an all-time high of $891 billion as of May 7. This metric reflects increasing investor conviction and steady capital inflows.

CryptoQuant’s Carmelo Alemán notes that both long- and short-term holders are accumulating, signaling confidence in Bitcoin’s long-term potential. The current momentum may be laying the groundwork for a broader bull cycle.

Glassnode’s latest report echoes this optimism, noting that daily profit-taking now exceeds $1 billion. Despite fears of a pullback, the report suggests that rising demand is absorbing sell pressure, maintaining market balance near the $100,000 mark.

Since late 2023, the market has remained in a profit-focused regime, with capital inflows consistently outpacing outflows — a trend analysts see as a healthy sign of growing demand.

-

1

BlackRock and Fidelity Pour Over $500M Into Bitcoin in One Day

25.06.2025 21:00 1 min. read -

2

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

3

Bitcoin to Track Global Economy, Not Dollars, Says Crypto Expert

09.06.2025 18:00 2 min. read -

4

BlackRock’s Bitcoin ETF Breaks Into Top 15 Most Traded ETFs of 2025

12.06.2025 18:00 2 min. read -

5

Bank of America Compares Bitcoin to History’s Most Disruptive Inventions

17.06.2025 14:00 1 min. read

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

Bitcoin’s network hashrate has fallen 3.5% since mid-June, marking the sharpest decline in computing power since July 2024.

Bitcoin Surpasses Alphabet (Google) to Become 6th Most Valuable Asset Globally

Bitcoin has officially overtaken Alphabet (Google’s parent company) in global asset rankings, becoming the sixth most valuable asset in the world, according to the latest real-time market data.

Is Bitcoin a Missed Opportunity? This Billionaire Begins to Wonder

Philippe Laffont, the billionaire behind Coatue Management, is beginning to question his stance on Bitcoin.

Robert Kiyosaki Says Crypto Is Key to Building Wealth in a Failing System

Personal finance author Robert Kiyosaki is urging investors to rethink their approach to money as digital assets reshape the economic landscape.

-

1

BlackRock and Fidelity Pour Over $500M Into Bitcoin in One Day

25.06.2025 21:00 1 min. read -

2

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

3

Bitcoin to Track Global Economy, Not Dollars, Says Crypto Expert

09.06.2025 18:00 2 min. read -

4

BlackRock’s Bitcoin ETF Breaks Into Top 15 Most Traded ETFs of 2025

12.06.2025 18:00 2 min. read -

5

Bank of America Compares Bitcoin to History’s Most Disruptive Inventions

17.06.2025 14:00 1 min. read