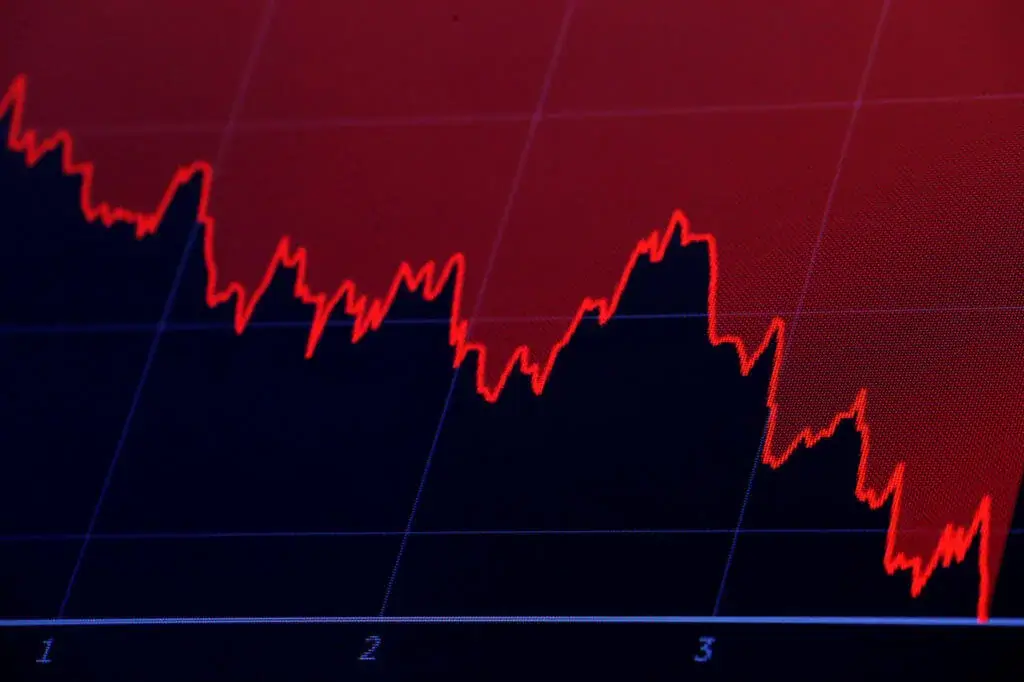

Failed Cryptos Flood the Market as Speculation and Fear Take Over

02.05.2025 21:00 1 min. read Alexander Stefanov

The crypto graveyard is growing fast. According to CoinGecko, more than half of all digital tokens launched since 2021 have already vanished—roughly 3.7 million failed projects, or 52.7% of listings on GeckoTerminal.

And 2025 isn’t slowing down: the first quarter alone has seen over 1.8 million new casualties, nearly topping all of 2024.

The flood of worthless tokens is being fueled by a mix of economic anxiety, impulsive retail speculation, and the meme coin gold rush.

New platforms like pump.fun have made token creation nearly effortless, resulting in an avalanche of one-and-done projects with no roadmap or real intent to last. Binance estimates that nearly all meme coins—about 97%—end up dead shortly after launch.

Geopolitical instability and fears surrounding Trump’s return to office have also spooked the market. With inflation back in the spotlight, investors are shedding high-risk assets in favor of safer havens like gold—leaving even Bitcoin’s role as digital gold up for debate.

Despite the surge in failures, the sheer number of new projects keeps rising. The space has ballooned from 428,000 listings in 2021 to nearly 7 million in 2025. But as nearly half of all coin deaths this decade have occurred just this year, the question now is: how much of this is innovation—and how much is noise?

-

1

Educational Company Enters Crypto Market with $500M Solana Reserve Plan

04.06.2025 16:00 1 min. read -

2

Cardano Shows Signs of Recovery as Market Sentiment Turns Positive

17.06.2025 16:00 1 min. read -

3

Canada Green-Lights First XRP ETF, Beating the U.S. to Market

17.06.2025 9:00 1 min. read -

4

Coinbase Brings Wrapped XRP and DOGE to Base for DeFi Integration

06.06.2025 13:00 1 min. read -

5

Uphold Wants to Pay Yield on XRP – Here’s the Work-Around

15.06.2025 19:00 2 min. read

Pennsylvania Man Sentenced to 8 Years for $40M Crypto Ponzi Scheme

The U.S. Department of Justice has sentenced Dwayne Golden, 57, of Pennsylvania to 97 months in prison for orchestrating a fraudulent crypto investment scheme that stole over $40 million from investors.

Snorter Token ($SNORT) Price Prediction, ChatGPT Forecasts 10x by end of 2025

Snorter Token ($SNORT) is a new meme coin and utility token designed to enhance crypto trading with its Telegram-native trading bot, Snorter Bot. This bot is equipped with sniping capabilities, copy trading, and swap functionalities, offering traders the ability to profit from the volatile crypto markets. As the presale has garnered significant attention, raising over […]

Binance Netflow Data Shows Diverging Altcoin Trends

According to a new report from CryptoQuant, recent Binance netflow data reveals a clear divergence in altcoin behavior — offering insights into which tokens may be poised for upside and which could face near-term sell pressure.

What Are the Most Talked-About Words in Crypto Today?

Cryptocurrency analysis firm Santiment has revealed the words that have attracted the most attention in the cryptocurrency community in the last 24 hours.

-

1

Educational Company Enters Crypto Market with $500M Solana Reserve Plan

04.06.2025 16:00 1 min. read -

2

Cardano Shows Signs of Recovery as Market Sentiment Turns Positive

17.06.2025 16:00 1 min. read -

3

Canada Green-Lights First XRP ETF, Beating the U.S. to Market

17.06.2025 9:00 1 min. read -

4

Coinbase Brings Wrapped XRP and DOGE to Base for DeFi Integration

06.06.2025 13:00 1 min. read -

5

Uphold Wants to Pay Yield on XRP – Here’s the Work-Around

15.06.2025 19:00 2 min. read