Top 30 Altcoin Plummets, Leaving Investors in Limbo

14.04.2025 9:00 1 min. read Alexander Stefanov

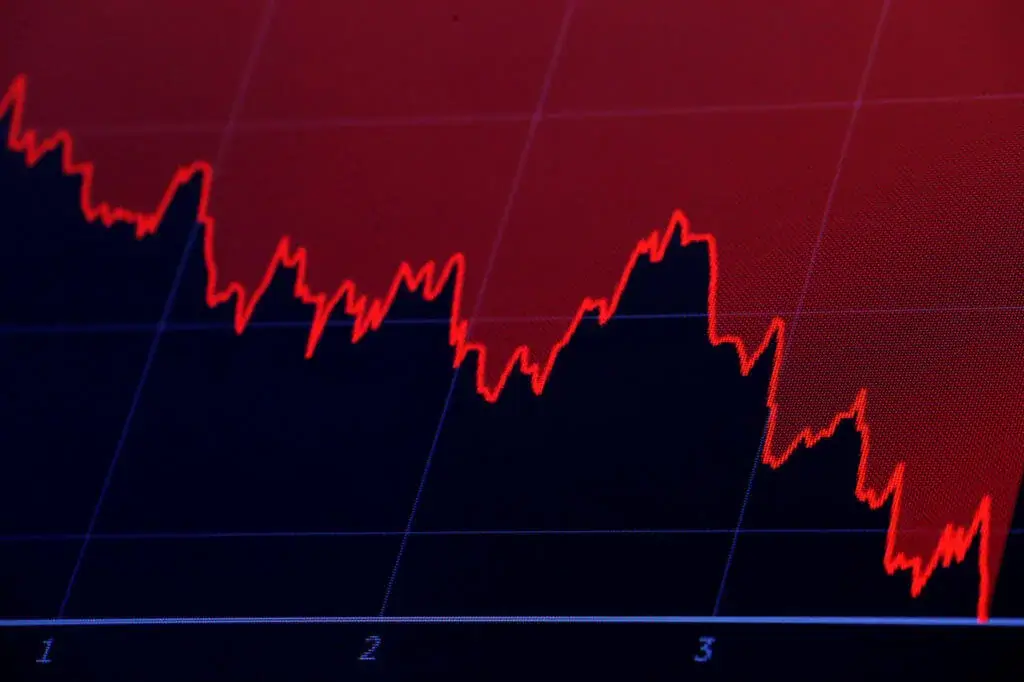

The cryptocurrency market was rocked today after Mantra (OM), once ranked among the top 30 altcoins, saw its value evaporate in a flash crash that erased over 90% of its price within hours.

Speculation quickly spread that members of the project’s own development team may have triggered the collapse through large-scale sell-offs. However, the Mantra team has firmly denied any involvement, attributing the dramatic plunge to what they described as “reckless purges” unrelated to any internal actions.

“We want to make it absolutely clear—this wasn’t us,” the team stated in an official message to the community. “Mantra remains a fundamentally strong project. What happened today was unexpected and not connected to any decisions or actions from within our organization. We’re currently investigating the situation and will provide updates once we have more clarity.”

The statement was issued in response to mounting community frustration, especially after a comment from one of Mantra’s community leaders stirred backlash. The representative claimed that developers had no immediate awareness of the crash because it occurred during nighttime hours in Hong Kong—a remark that didn’t sit well with investors searching for accountability.

As uncertainty lingers around OM, crypto traders and holders are being urged to approach the token with extreme caution. With no clear explanation yet and volatility still high, the situation remains fluid and potentially risky for those looking to engage with the asset.

-

1

BlackRock Boosts Crypto Holdings with Over $350M in BTC and ETH

05.06.2025 18:00 1 min. read -

2

Pump.fun Reportedly Planning Massive Token Sale Despite Revenue Drop

04.06.2025 20:00 2 min. read -

3

ChatGPT Price Prediction of XRP, Solana, and Cardano by End of 2025

12.06.2025 18:57 3 min. read -

4

Crypto Enters a Make-or-Break Era, Says Industry Insider

04.06.2025 8:00 1 min. read -

5

Corporate Interest in XRP Surges as Firms Eye It for Treasury Reserves

06.06.2025 15:00 1 min. read

Shiba Inu Hangs by a Thread as Chart Signals 50% Breakdown

Shiba Inu has surrendered roughly a quarter of its market value over the past month, hovering this morning near $0.0000113.

SEC Seen as Nearly Certain to Approve Wave of Crypto ETFs, Say Bloomberg Analysts

Confidence is surging among analysts that U.S. regulators are preparing to greenlight a wide array of cryptocurrency ETFs, marking a pivotal change in the SEC’s approach to digital assets.

Ripple’s Stablecoin Edges Toward $500M Milestone After Latest Mint

Ripple has minted another 13 million RLUSD tokens, pushing its dollar-pegged stablecoin closer to the half-billion-dollar mark in circulating supply.

Pi Price Prediction: Top Community Member Believes PI Will Drop to $0.40

Pi Coin (PI) has gone down by 33% in the past month and has dropped below a key support at $0.60 as the community has been disappointed by a lack of updates from the Pi Core Team and delays in the migration of Pi tokens to the public mainnet. One notable supporter of Pi whose […]

-

1

BlackRock Boosts Crypto Holdings with Over $350M in BTC and ETH

05.06.2025 18:00 1 min. read -

2

Pump.fun Reportedly Planning Massive Token Sale Despite Revenue Drop

04.06.2025 20:00 2 min. read -

3

ChatGPT Price Prediction of XRP, Solana, and Cardano by End of 2025

12.06.2025 18:57 3 min. read -

4

Crypto Enters a Make-or-Break Era, Says Industry Insider

04.06.2025 8:00 1 min. read -

5

Corporate Interest in XRP Surges as Firms Eye It for Treasury Reserves

06.06.2025 15:00 1 min. read