2 Altcoins Gaining Strength as Bitcoin Enters New Phase

08.07.2025 13:00 2 min. read Kosta Gushterov

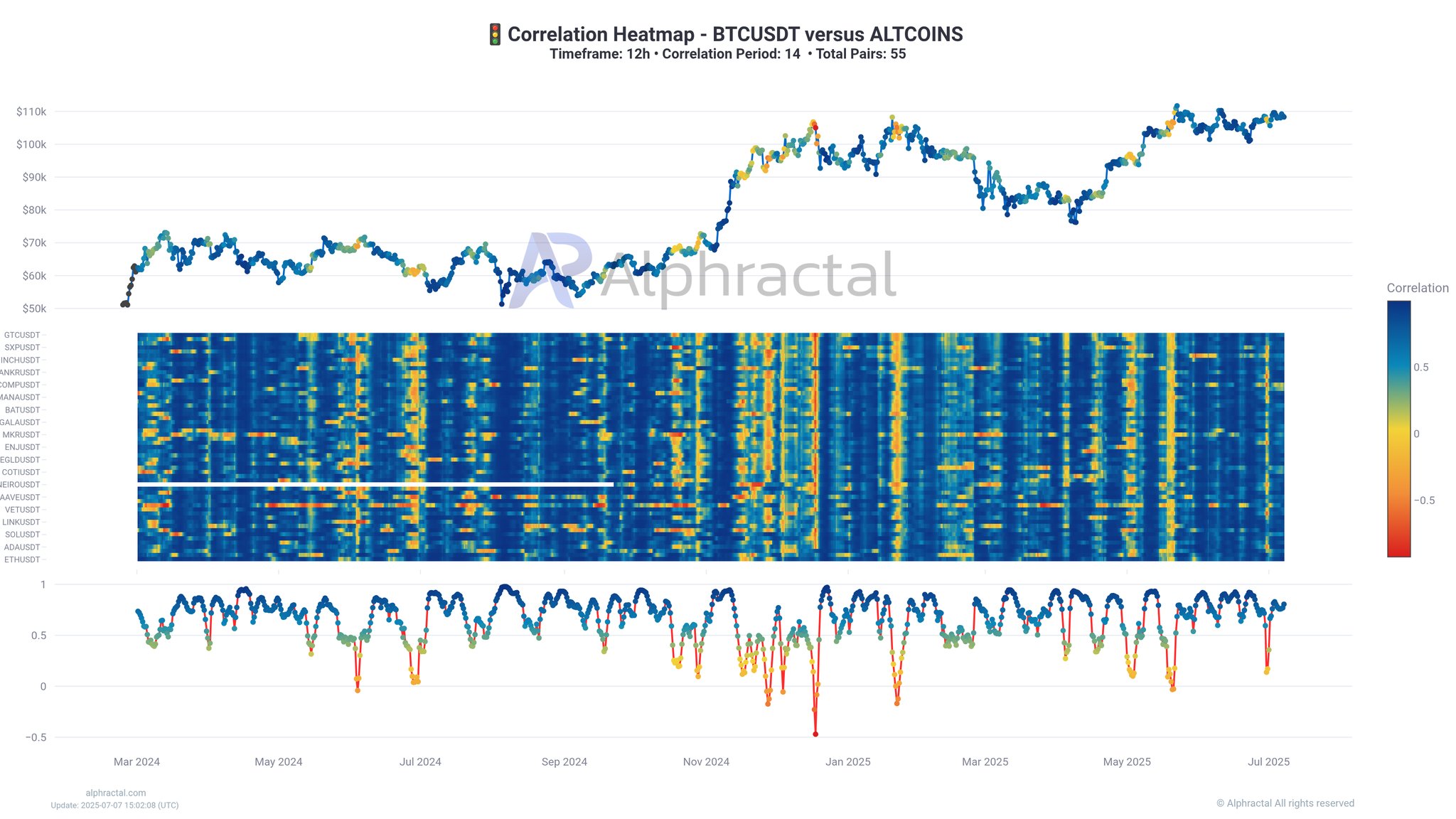

As Bitcoin enters a new on-chain trend phase, two altcoins are standing out for their growing correlation with the leading cryptocurrency and their resilience amid market shakeouts, according to new analysis by Joao Wedson, CEO of analytics firm Alphractal.

In a recent market update, Wedson pointed to Solana (SOL) and Ethereum (ETH) as two altcoins closely aligning with Bitcoin’s price action. SOL’s correlation with BTC rose from 0.53 to 0.75, while Ethereum maintained its position as one of the most tightly correlated altcoins. “ETH and THETA currently exhibit the highest correlation with Bitcoin,” Wedson noted. “This makes them prime candidates to benefit from any sustained BTC rally.”

As correlation increases, these tokens may become strategic options for investors seeking altcoin exposure without diverging too far from Bitcoin’s momentum. According to Wedson, higher correlation often signals stronger market integration and higher investor confidence.

Altcoin Purge Strengthens the Ecosystem

Wedson also highlighted the disappearance of over 1,400 altcoins from active listings—a trend he views as bullish for the sector. Many of these projects were either scams, lacked real use cases, or failed to generate sufficient volume. “Only the most durable and valuable projects remain,” Wedson said. “This makes the market more secure and innovation-driven.”

The mass delisting effectively clears the way for stronger fundamentals, as capital and attention shift to projects with real-world applications, robust security, and active development.

On-Chain Metrics Show New Bitcoin Cycle

Alphractal further noted that the SOPR Trend Signal—an indicator that measures whether investors are selling at a profit—has risen for a third time in the current cycle. This suggests a unique phase of bullish discovery. “The current behavior doesn’t resemble bearish patterns,” the firm added, advising investors to remain observant but calm.

With Solana and Ethereum gaining traction and the broader market purging weaker assets, the foundation may be forming for a more sustainable altcoin season.

-

1

Will Ethereum and Solana Benefit from Wall Street’s Shift?

09.07.2025 19:00 2 min. read -

2

BNB Chain Upgrades and Token Delistings Reshape Binance Ecosystem

16.07.2025 22:00 2 min. read -

3

Solana Price Prediction: SOL Could be Ready to Move to $225 After Breakout

21.07.2025 17:14 3 min. read -

4

Altcoin Supercycle? Analysts Signal ‘Banana Zone 2.0’ as Market Erupts

13.07.2025 19:00 2 min. read -

5

Most Trending Cryptocurrencies on CoinGecko After Bitcoin’s New ATH

11.07.2025 19:00 2 min. read

Interactive Brokers Weighs Stablecoin Launch

Interactive Brokers, one of the world’s largest online brokerage platforms, is exploring the possibility of issuing its own stablecoin, signaling a potential expansion into blockchain-driven financial infrastructure as U.S. crypto regulation begins to ease.

BNB Coin Price Prediction: As BNB Chain Daily Transaction Volumes Explode Can It Hit $900?

Trading volumes for BNB Coin (BNB) have doubled in the past 24 hours to $3.8 billion as the price rises by 7%. This favors a bullish BNB Coin price prediction at a point when the token just made a new all-time high. BNB is the second crypto in the top 5 to make a new […]

PENGU Price Soars While Whale Transfers Raise Alarms

The Pudgy Penguins’ PENGU token is under intense scrutiny after large transfers from its team wallet raised potential red flags.

BNB Hits New All-Time High Amid Token Launch Frenzy

BNB surged to a new all-time high on July 28 around $860, breaking above the critical $846 level following a sharp 7% intraday move.

-

1

Will Ethereum and Solana Benefit from Wall Street’s Shift?

09.07.2025 19:00 2 min. read -

2

BNB Chain Upgrades and Token Delistings Reshape Binance Ecosystem

16.07.2025 22:00 2 min. read -

3

Solana Price Prediction: SOL Could be Ready to Move to $225 After Breakout

21.07.2025 17:14 3 min. read -

4

Altcoin Supercycle? Analysts Signal ‘Banana Zone 2.0’ as Market Erupts

13.07.2025 19:00 2 min. read -

5

Most Trending Cryptocurrencies on CoinGecko After Bitcoin’s New ATH

11.07.2025 19:00 2 min. read