Will Litecoin be Able to Make a Breakthrough Before Bitcoin’s Halving?

Litecoin (LTC) appears to be at a pivotal moment, suggesting a potential trend reversal.

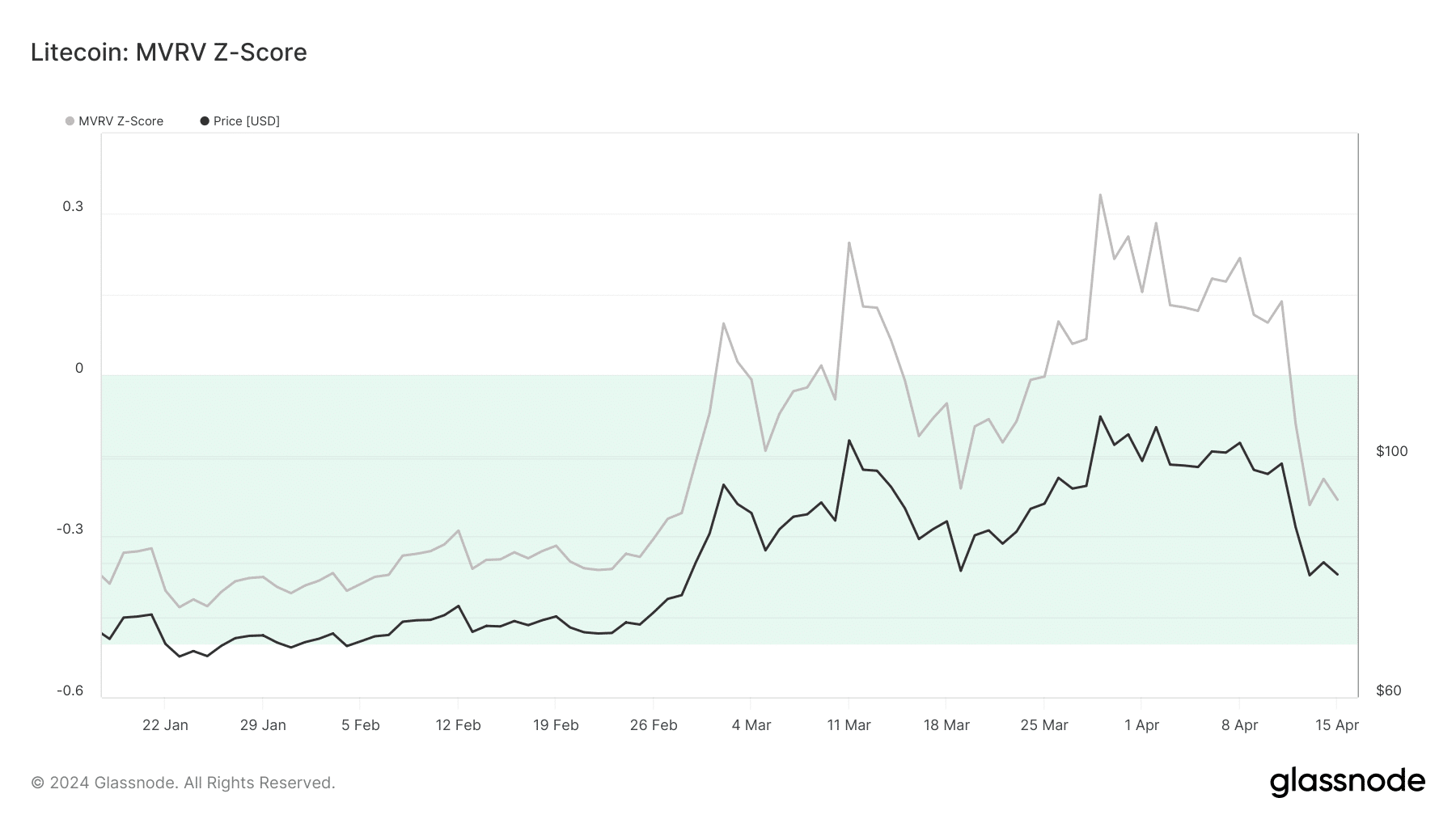

Currently, the Z-score of the market-to-value ratio (MVRV) derived from Glassnode’s data stands at -0.23.

This metric measures the valuation of a cryptocurrency. A similar reading was seen around February 29, which coincided with LTC trading at $74.62. Within the short span of two days, the coin’s value rose to $94.47.

This trend is not unprecedented for Litecoin. In March, despite the negative metric, LTC suffered a price drop to recover to $109.29 just 10 days later.

LTC is currently trading at $78.62, with Bitcoin’s imminent halving within 4 days. Historically, LTC has shown a tendency to rise sharply before significant Bitcoin-related events.

However, caution is needed before assuming an imminent price increase, which necessitates a review of LTC’s performance during previous halving events.

In 2016, LTC traded at $3.19 shortly before the post-halving increase, reaching $4.12 on the day of the event. Conversely, during the 2020 halving depreciation, LTC remained in a range between $43 and $46.

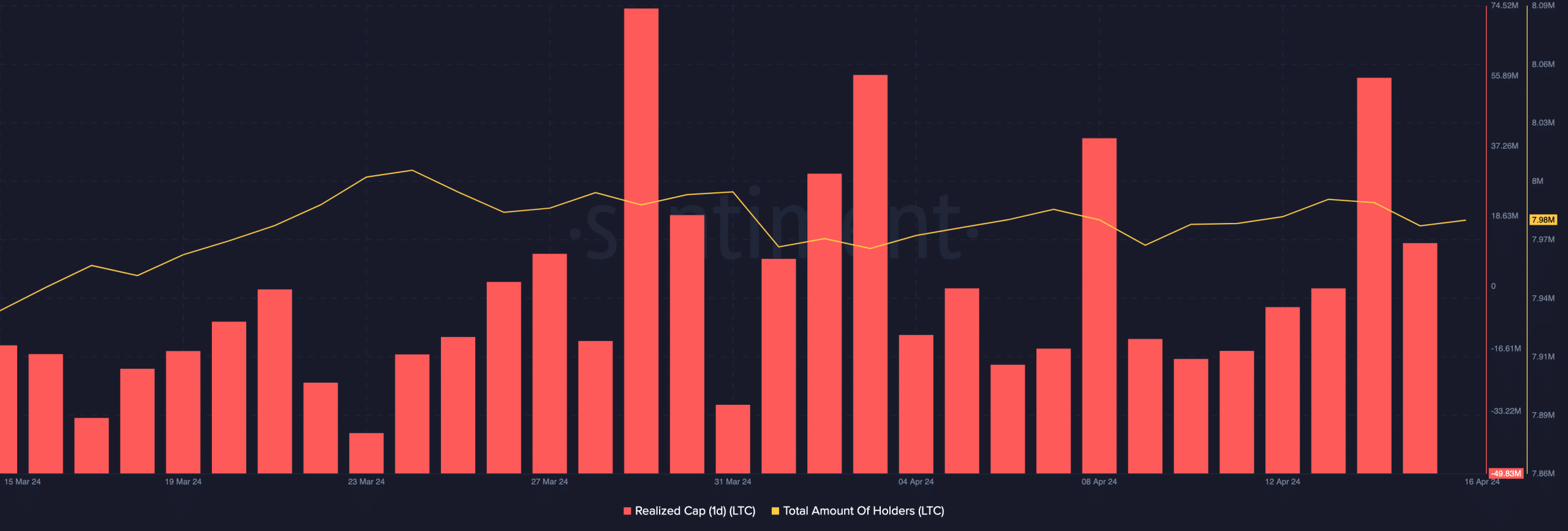

Realized capitalization offers insight into market sentiment. The spike in this metric suggests that coins acquired at lower prices are selling off, potentially leading to a further correction.

Conversely, a decline in realized capitalization signals perceived undervaluation. Currently, the one-day realized capitalization of Litecoin stands at -49.83 million, suggesting a potential recovery.

If this metric continues its downward trend, the likelihood of LTC’s upside ahead of Bitcoin’s halving could increase. Conversely, a reversal in the direction of the metric could invalidate this forecast.

Despite the upbeat outlook, skepticism persists among some market participants, as evidenced by the decline in the total number of Litecoin holders according to Santiment data.