Ethereum: $2,500 the Bears’ Next Target?

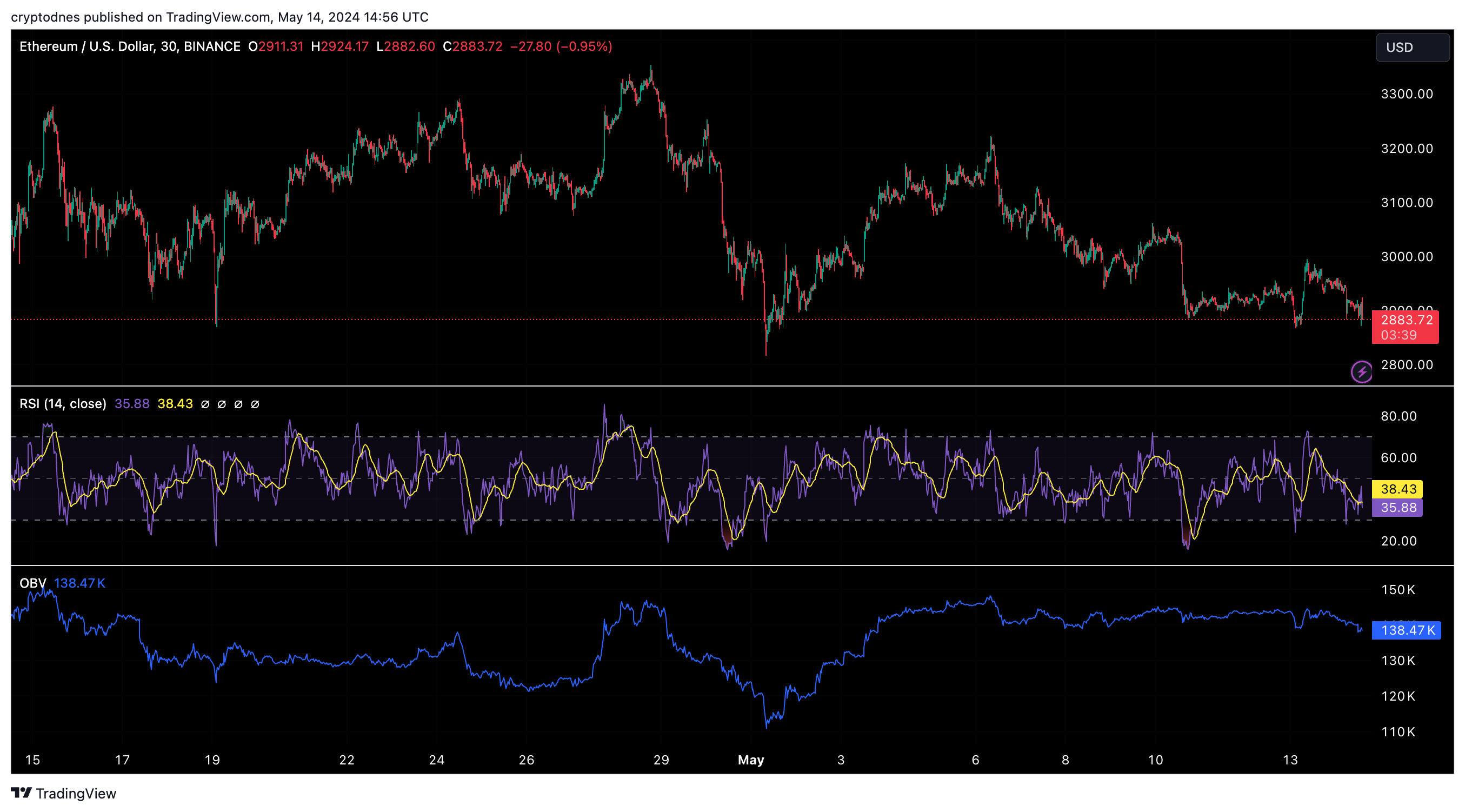

Ethereum (ETH) has been in a downtrend since falling below $3,000 six weeks ago, signaling a potential continuation of the correction.

Reports hinting at a possible rejection of applications for a spot U.S. Ethereum ETF added to market pessimism.

Analysts predict even lower prices for Etherium if these ETF applications are rejected, in line with technical analysis. However, the duration of this decline remains uncertain.

Fibonacci retracement levels were calculated based on ETH’s decline from $4,093 to $3,056.

Although this did not significantly change the overall market structure on higher timeframes, ETH fell below $3,000 in mid-April, tipping the scales towards a bearish structure.

Furthermore, OBV (On-Balance Volume) fell below a key level. Currently, the $3,000 resistance zone is formidable, with momentum favoring the bears, as evidenced by the RSI results of 40.5.

Forecasts suggest a potential drop below $2,800, with a focus on the 50% and 61;.8% extension levels. However, it remains uncertain whether Etherium experiences a V-shaped reversal or consolidates at these levels.

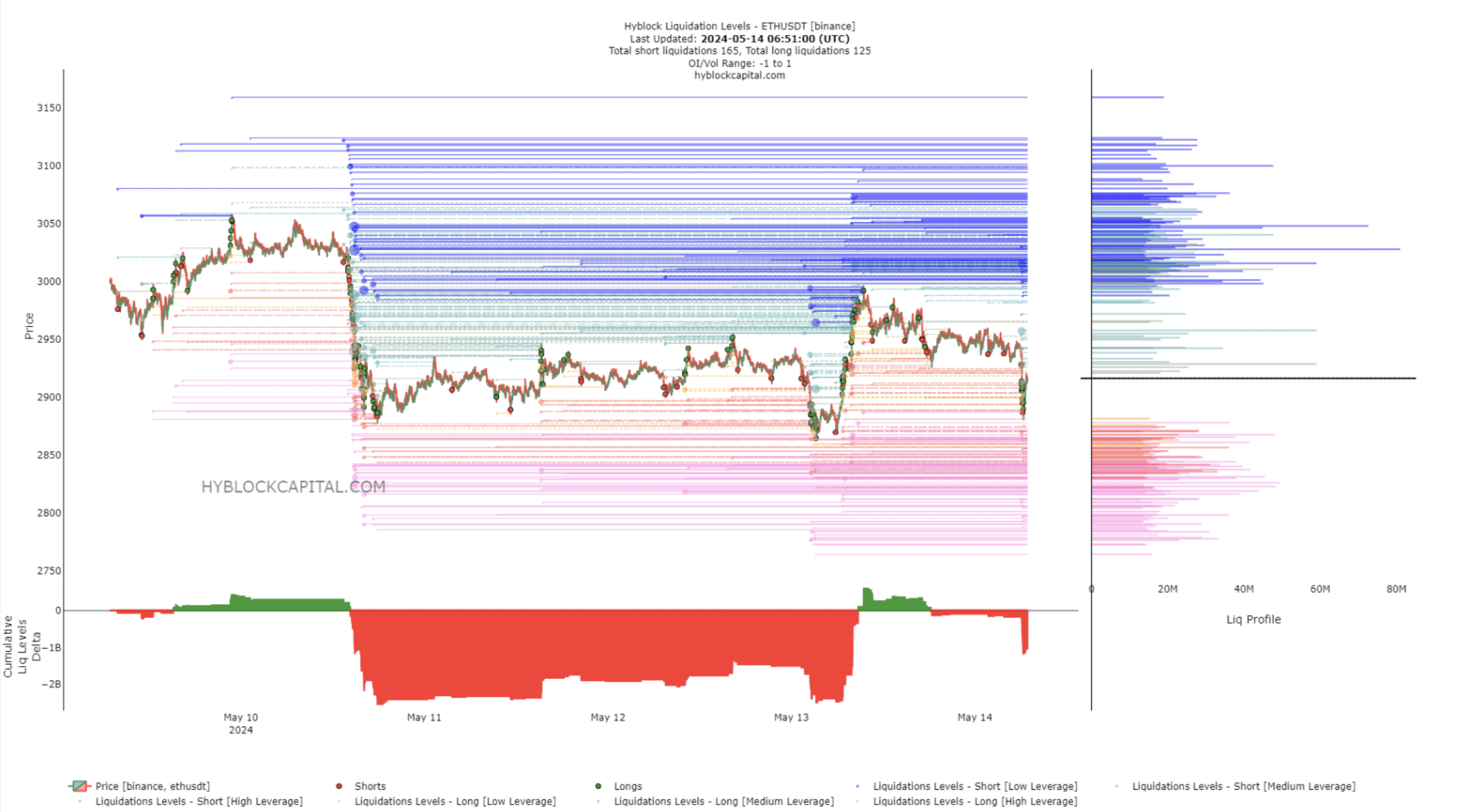

Shortly thereafter, the price bounced from $2,870 to $2,990, wiping out short sellers.

Cumulative liquidation levels currently remain negative but less extreme, suggesting further downside potential. The $2,840 area is emerging as a near-term target for the Ethereum price.

Analysis of the liquidity charts showed the end of the short-term rebound. Just over 24 hours ago, cumulative liquidation levels were significantly negative, indicating more liquidations of shorts than long positions.

Shortly thereafter, the price bounced from $2,870 to $2,990, wiping out late short sellers.

Cumulative liquidation levels currently remain negative but less extreme, suggesting further downside potential. The $2,840 area is emerging as a near-term target for the Ethereum price.

以太坊價格預測: 分析師確認市場修正中的看跌趨勢

以太坊 近期的市場表現引起了分析師的警覺。ETH 從 10 月份的 2,400 美元開始,到 11 月份達到 […]

Ethereum (ETH) Price Struggles With Key Resistance Levels

Recently, Ethereum failed to overcome the $2,450 resist […]

Ethereum Crash Alert: Analyst Predicts Potential Drop Below $1,200

Crypto analyst Benjamin Cowen has shared a cautious out […]

What Technical Indicators Show About the Price of Ethereum

Despite the approval of the Ethereum ETF, the ETH price […]

-

1

Ethereum Crash Alert: Analyst Predicts Potential Drop Below $1,200

05.09.2024 13:30 1 分鐘讀 -

2

Ethereum (ETH) Price Struggles With Key Resistance Levels

17.09.2024 19:00 1 分鐘讀 -

3

以太坊價格預測: 分析師確認市場修正中的看跌趨勢

01.11.2024 21:00 1 分鐘讀 -

4

Ethereum: $2,500 the Bears’ Next Target?

14.05.2024 18:30 2 分鐘讀 -

5

What Technical Indicators Show About the Price of Ethereum

06.06.2024 12:00 2 分鐘讀