How Much Bitcoin You’ll Need to Retire in 2035

19.07.2025 19:09 2 min. read Kosta Gushterov

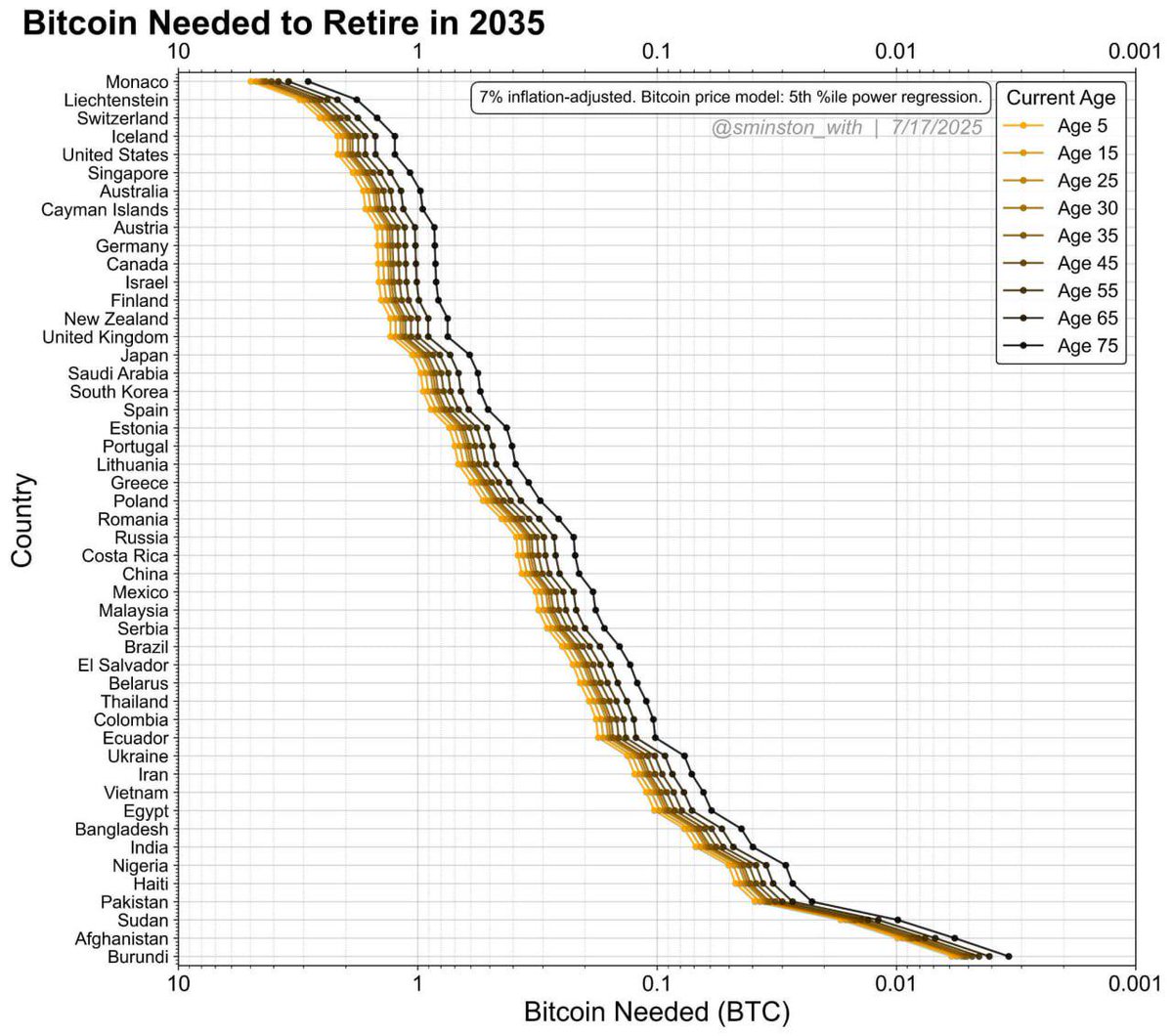

A new chart analysis offers a striking projection: how much Bitcoin one would need to retire comfortably by 2035 in different countries—assuming continued BTC price appreciation and 7% inflation adjustment.

The model uses a 5th percentile power regression for Bitcoin price growth and plots how much BTC residents of various countries might need to sustain retirement. The graph breaks down the data by age groups, ranging from age 5 to age 75, revealing how retirement targets change based on both geography and generational timing.

At the top of the list are ultra-wealthy nations like Monaco, Liechtenstein, Switzerland, and Iceland, where individuals may need between 1 and 5 BTC—or more—to retire in a decade. The United States also ranks among the most expensive retirement zones, closely followed by Singapore, Australia, and Germany. In these countries, even someone aged 25 today would require at least 1 BTC to secure a comfortable future.

Conversely, residents in developing nations like Afghanistan, Sudan, Haiti, and Burundi might only need fractions of a Bitcoin—sometimes as little as 0.001 BTC—to retire, due to significantly lower average living costs. Countries like India, Nigeria, and Pakistan fall somewhere in the middle, where between 0.01 and 0.1 BTC may suffice depending on current age.

The chart also highlights the dramatic shift in required Bitcoin as age increases. Younger individuals need considerably more BTC, reflecting the longer horizon they must fund. For example, a 5-year-old in Monaco would need nearly 10 BTC, while someone already aged 75 might require only a small fraction due to fewer remaining retirement years.

The analysis paints Bitcoin not just as a speculative asset, but as a potential long-term retirement hedge—particularly in high-income countries where fiat currencies may face erosion.

It also underscores the global wealth gap, showing how drastically retirement costs vary worldwide.

As Bitcoin adoption grows and institutional demand expands, projections like these could become vital tools for planning future financial security—especially in an increasingly digital economy.

-

1

Robert Kiyosaki Buys More Bitcoin, Says He’d Rather Be a ‘Sucker Than a Loser’

02.07.2025 22:00 1 min. read -

2

This Week in Crypto: Whale Accumulation, Ethereum Signals, and a Sentiment Shake-Up

05.07.2025 21:00 3 min. read -

3

BlackRock’s IBIT Bitcoin ETF Surpasses 700,000 BTC in Record Time

08.07.2025 19:00 2 min. read -

4

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

30.06.2025 15:00 2 min. read -

5

Bitcoin Tops Crypto Social Buzz as $110,000 Milestone Fuels Market Debate

04.07.2025 8:15 3 min. read

Strategy’s $71B in Bitcoin Now Ranks Among Top 10 S&P 500 Treasuries

Seems like Strategy has officially broken into the top 10 S&P 500 corporate treasuries with its massive $71 billion in Bitcoin holdings—ranking 9th overall and leapfrogging major firms like Exxon, NVIDIA, and PayPal.

Bitcoin ETFs Attract Over $2 billion in Weekly Inflows: What’s Driving the Gains?

Bitcoin ETFs in the U.S. recorded $2.39 billion in net inflows over the past week, according to data from Farside Investors, marking one of the strongest capital surges since their launch.

Weekly Crypto Roundup: Bitcoin Hits ATH, Ethereum Surges, Trump Advances Crypto Reforms

Analyzing the latest updates shared by Wu Blockchain, this past week underscored a pivotal shift in the crypto landscape. Bitcoin surged to a new all-time high of $123,226, pushing the overall crypto market cap beyond $4 trillion—a milestone reflecting renewed investor confidence and accelerating institutional flows.

Over $5.8 Billion in Ethereum and Bitcoin Options Expired Today: What to Expect?

According to data shared by Wu Blockchain, over $5.8 billion in crypto options expired today, with Ethereum leading the action.

-

1

Robert Kiyosaki Buys More Bitcoin, Says He’d Rather Be a ‘Sucker Than a Loser’

02.07.2025 22:00 1 min. read -

2

This Week in Crypto: Whale Accumulation, Ethereum Signals, and a Sentiment Shake-Up

05.07.2025 21:00 3 min. read -

3

BlackRock’s IBIT Bitcoin ETF Surpasses 700,000 BTC in Record Time

08.07.2025 19:00 2 min. read -

4

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

30.06.2025 15:00 2 min. read -

5

Bitcoin Tops Crypto Social Buzz as $110,000 Milestone Fuels Market Debate

04.07.2025 8:15 3 min. read