Ethereum Tops $3,285 for First Time Since January

17.07.2025 7:00 1 min. read Kosta Gushterov

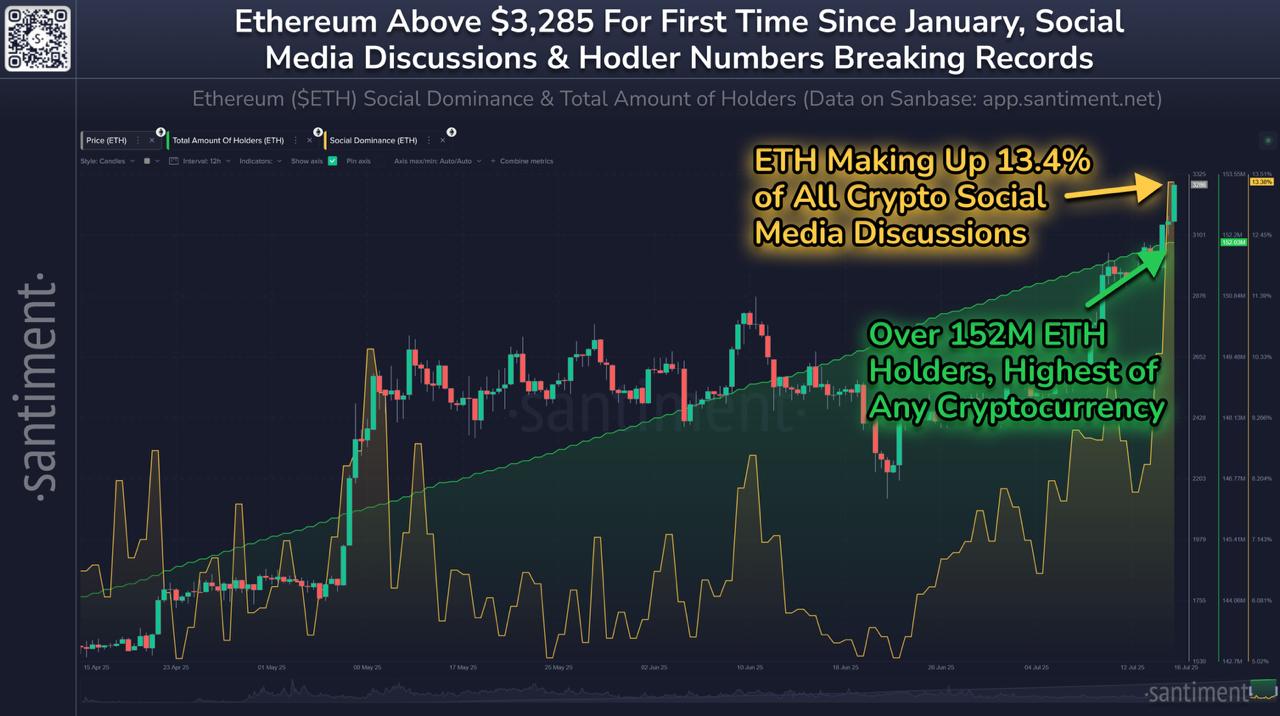

Ethereum has reclaimed the spotlight, surging past $3,285 for the first time since January amid a powerful rebound in both price and network engagement.

Since June 22nd, ETH has jumped more than 50%, driven by growing investor confidence and a sharp rise in on-chain activity.

Record wallet growth signals expanding user base

According to data from Santiment, the Ethereum network now hosts over 152 million non-empty wallets—more than any other cryptocurrency. This milestone highlights Ethereum’s growing adoption and long-term holder confidence, as the number of addresses continues climbing in tandem with price.

Social media interest at 13.4% dominance

Investor excitement isn’t limited to wallets. Ethereum now accounts for 13.4% of all crypto-related discussions across social media, reflecting its rising dominance in the public narrative. This level of engagement hasn’t been seen since the major price rally in May 2024, marking a strong resurgence in community interest.

READ MORE:

How Can You Tell When it’s Altcoin Season?

Market momentum building ahead of key events

The current price surge and wave of online attention may signal the start of a broader altcoin season, particularly if Ethereum maintains momentum above $3,200. Analysts are watching closely for continued ETF inflows and potential staking developments as key drivers for further upside.

Ethereum’s resurgence comes as attention shifts beyond Bitcoin, reaffirming its position as the dominant Layer 1 smart contract platform.

-

1

Pepe Price Prediction: One-Month Trend Line Resistance Breakout Could Push PEPE to $0.000015

04.07.2025 18:41 3 min. read -

2

Bonk Price Prediction: Binance.US Mention Triggers 9% Jump – Can BONK Reach $1?

07.07.2025 16:29 3 min. read -

3

Top 10 Trending Cryptocurrencies Today, According to CoinGecko

04.07.2025 15:31 3 min. read -

4

Second Largest Bank in Spain Rolls out in-app Bitcoin and Ethereum Trading

07.07.2025 15:30 2 min. read -

5

How Much Profit Would you Make if you Invested $3,000 in Shiba Inu One Year Ago?

09.07.2025 22:00 2 min. read

Is the Crypto Market Topping Out? Key Signals to Watch

The crypto market is heating up as bullish momentum sweeps across altcoins, raising a critical question: is this rally sustainable, or is a correction looming?

Altcoin Season Nears as Bitcoin Dominance Slips

Altcoins are steadily gaining ground against Bitcoin, with signs pointing to the early stages of a broader market rotation.

Ethereum Surges 3.5% to Break Above $3,700

Ethereum posted a 3.48% 24-hour gain, climbing past $3,500 as a wave of regulatory clarity and institutional appetite accelerated inflows into ETH.

Crypto’s Top Narratives in Focus, According to AI

A fresh breakdown from CoinMarketCap’s AI-powered narrative tracker reveals the four most influential crypto trends currently shaping the market: BTCFi & DePIN, U.S. regulatory breakthroughs, AI agent economies, and real-world asset (RWA) tokenization.

-

1

Pepe Price Prediction: One-Month Trend Line Resistance Breakout Could Push PEPE to $0.000015

04.07.2025 18:41 3 min. read -

2

Bonk Price Prediction: Binance.US Mention Triggers 9% Jump – Can BONK Reach $1?

07.07.2025 16:29 3 min. read -

3

Top 10 Trending Cryptocurrencies Today, According to CoinGecko

04.07.2025 15:31 3 min. read -

4

Second Largest Bank in Spain Rolls out in-app Bitcoin and Ethereum Trading

07.07.2025 15:30 2 min. read -

5

How Much Profit Would you Make if you Invested $3,000 in Shiba Inu One Year Ago?

09.07.2025 22:00 2 min. read