Altcoins Drain Bitcoin Liquidity as Correlation Breakdown Sparks Caution

20.07.2025 20:00 1 min. read Kosta Gushterov

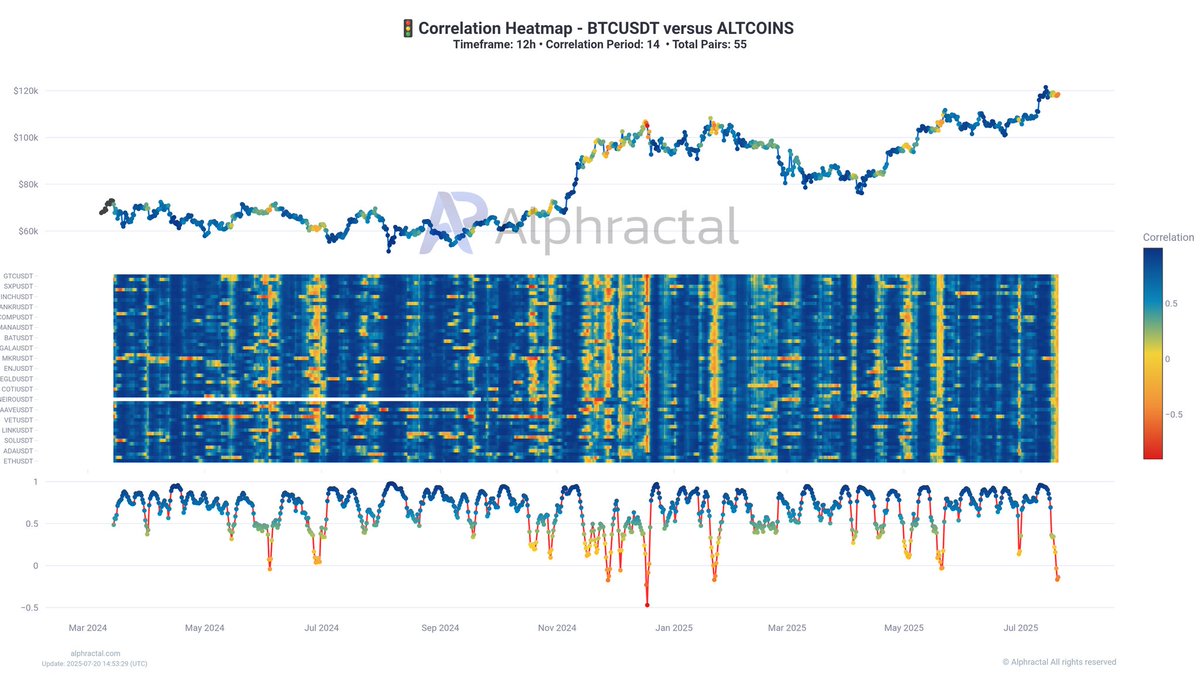

According to a new market update from Alphractal, altcoins have been outperforming Bitcoin in recent days—drawing liquidity away from the leading cryptocurrency and triggering key warning signals.

Traders are seeing more profitable opportunities in altcoins, but one critical indicator now suggests that this trend could be on unstable ground.

The latest Correlation Heatmap from Alphractal reveals that the average correlation between Bitcoin and altcoins has dropped sharply and may even be turning negative. This means altcoins are no longer following Bitcoin’s price movements—a potential red flag for market stability.

Historically, falling BTC-altcoin correlation has preceded periods of intense volatility and mass liquidations, regardless of whether traders are positioned long or short. When altcoins decouple from Bitcoin, it often indicates unsustainable market behavior or shifting capital that eventually corrects sharply.

Alphractal warns that traders should remain vigilant and use data-driven tools like correlation metrics to navigate current conditions. The charts included in the update illustrate a clear divergence between Bitcoin and altcoin positioning, reinforcing the view that short-term profits in altcoins may come with heightened risk.

As liquidity continues to migrate into the altcoin space, market participants should prepare for potential turbulence ahead.

-

1

Pepe Price Prediction: One-Month Trend Line Resistance Breakout Could Push PEPE to $0.000015

04.07.2025 18:41 3 min. read -

2

Bonk Price Prediction: Binance.US Mention Triggers 9% Jump – Can BONK Reach $1?

07.07.2025 16:29 3 min. read -

3

Top 10 Trending Cryptocurrencies Today, According to CoinGecko

04.07.2025 15:31 3 min. read -

4

Second Largest Bank in Spain Rolls out in-app Bitcoin and Ethereum Trading

07.07.2025 15:30 2 min. read -

5

How Much Profit Would you Make if you Invested $3,000 in Shiba Inu One Year Ago?

09.07.2025 22:00 2 min. read

Here is What New Crypto Traders Should Focus on, According to Top Analyst

Entering any fast-paced financial market can be overwhelming for newcomers. The promise of high returns often tempts beginners to jump into risky opportunities without fully understanding the dynamics at play.

Is the Crypto Market Topping Out? Key Signals to Watch

The crypto market is heating up as bullish momentum sweeps across altcoins, raising a critical question: is this rally sustainable, or is a correction looming?

Altcoin Season Nears as Bitcoin Dominance Slips

Altcoins are steadily gaining ground against Bitcoin, with signs pointing to the early stages of a broader market rotation.

Ethereum Surges 3.5% to Break Above $3,700

Ethereum posted a 3.48% 24-hour gain, climbing past $3,500 as a wave of regulatory clarity and institutional appetite accelerated inflows into ETH.

-

1

Pepe Price Prediction: One-Month Trend Line Resistance Breakout Could Push PEPE to $0.000015

04.07.2025 18:41 3 min. read -

2

Bonk Price Prediction: Binance.US Mention Triggers 9% Jump – Can BONK Reach $1?

07.07.2025 16:29 3 min. read -

3

Top 10 Trending Cryptocurrencies Today, According to CoinGecko

04.07.2025 15:31 3 min. read -

4

Second Largest Bank in Spain Rolls out in-app Bitcoin and Ethereum Trading

07.07.2025 15:30 2 min. read -

5

How Much Profit Would you Make if you Invested $3,000 in Shiba Inu One Year Ago?

09.07.2025 22:00 2 min. read