Altcoin Season Nears as Bitcoin Dominance Slips

20.07.2025 12:00 2 min. read Kosta Gushterov

Altcoins are steadily gaining ground against Bitcoin, with signs pointing to the early stages of a broader market rotation.

Today’s CMC Altcoin Season Index reading of 47/100—still technically neutral—marks a 147% jump over the past month, reflecting growing investor appetite beyond BTC.

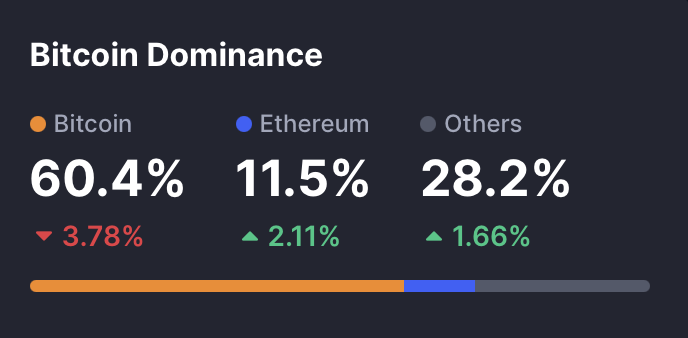

Bitcoin Dominance Retreats as Rotation Builds

Bitcoin dominance fell to 60.45%, down 0.6 points in the past 24 hours and 3.4 points since July 1. This steady decline aligns with a broader capital rotation trend, where investors begin to shift allocations toward altcoins. Though the Altcoin Season Index remains below the 75 threshold that would confirm a full-blown altcoin season, the momentum is unmistakable.

Ethereum Ecosystem Sparks Institutional Interest

Leading the charge is Ethereum and its surrounding ecosystem. ETH has surged 24.6% over the past week, while Chainlink (LINK) gained 23.1%. Together, they pushed the Ethereum ecosystem’s market cap to $734 billion—up 3.25% in just 24 hours. This rise coincides with bullish narratives around zkEVM upgrades and real-world asset (RWA) tokenization, which continue to attract institutional capital.

Speculative Alts and Narratives Fuel Gains

Speculative altcoins in the gaming and AI sectors are also catching wind. GameGPT posted a 43% weekly gain, while Tezos spiked 81.7%—both driven by renewed retail interest in high-risk narratives. While volatility remains high in this sector, the upside shows investors are eager to move beyond the conservative Bitcoin play.

Outlook

The data suggests that while Bitcoin remains dominant, altcoins—especially those tied to Ethereum and emerging tech themes—are gaining traction. If Bitcoin consolidates or pulls back further, capital rotation into altcoins could accelerate and push the Altcoin Season Index into full-season territory (>75). For now, Ethereum and Chainlink remain the clearest beneficiaries of this trend.

-

1

Pepe Price Prediction: One-Month Trend Line Resistance Breakout Could Push PEPE to $0.000015

04.07.2025 18:41 3 min. read -

2

Bonk Price Prediction: Binance.US Mention Triggers 9% Jump – Can BONK Reach $1?

07.07.2025 16:29 3 min. read -

3

Top 10 Trending Cryptocurrencies Today, According to CoinGecko

04.07.2025 15:31 3 min. read -

4

Second Largest Bank in Spain Rolls out in-app Bitcoin and Ethereum Trading

07.07.2025 15:30 2 min. read -

5

How Much Profit Would you Make if you Invested $3,000 in Shiba Inu One Year Ago?

09.07.2025 22:00 2 min. read

Ethereum Surges 3.5% to Break Above $3,700

Ethereum posted a 3.48% 24-hour gain, climbing past $3,500 as a wave of regulatory clarity and institutional appetite accelerated inflows into ETH.

Crypto’s Top Narratives in Focus, According to AI

A fresh breakdown from CoinMarketCap’s AI-powered narrative tracker reveals the four most influential crypto trends currently shaping the market: BTCFi & DePIN, U.S. regulatory breakthroughs, AI agent economies, and real-world asset (RWA) tokenization.

Top Trending Cryptos Right Now, According to CoinMarketCap

CoinMarketCap’s evolving momentum algorithm—powered by social, price, and news signals—has flagged three standout cryptocurrencies driving narrative and capital flows this week: OKZOO, Tagger, and Tezos.

Top 7 Crypto Project Updates This Week

The crypto industry saw major advancements this past week across DeFi, NFT, Layer 2, and AI-powered platforms.

-

1

Pepe Price Prediction: One-Month Trend Line Resistance Breakout Could Push PEPE to $0.000015

04.07.2025 18:41 3 min. read -

2

Bonk Price Prediction: Binance.US Mention Triggers 9% Jump – Can BONK Reach $1?

07.07.2025 16:29 3 min. read -

3

Top 10 Trending Cryptocurrencies Today, According to CoinGecko

04.07.2025 15:31 3 min. read -

4

Second Largest Bank in Spain Rolls out in-app Bitcoin and Ethereum Trading

07.07.2025 15:30 2 min. read -

5

How Much Profit Would you Make if you Invested $3,000 in Shiba Inu One Year Ago?

09.07.2025 22:00 2 min. read