加密貨幣屬於高風險資產類別,投資涉及重大風險,包括可能損失部分或全部投資。本網站資訊僅供參考及教育之用,不構成財務、投資或交易建議。如需了解更多詳情,請閱讀我們的編輯政策。

Bitcoin Price Struggles with Resistance as Market Faces Volatility

16 8 月, 2024 13:30 2 閱讀分鐘

Over the past week, the price of Bitcoin has fluctuated within a narrow range of $57,815 to $61,815, encountering persistent resistance at the 50-day simple moving average (SMA) of $61,662.

At the time of writing, the price of Bitcoin (BTC) is around $58,500, reflecting a slight 0.7% spike over the past day. This marks a decline of 4% from its price seven days ago.

According to data provided by analytics company Glassnode, the recent volatility in the price of Bitcoin can be attributed in part to “weakness in spot demand.”

Glassnode assessed the current net balance of buying and selling in the spot Bitcoin market by analyzing the cumulative volume delta (CVD), which helps identify any directional trend in market activity.

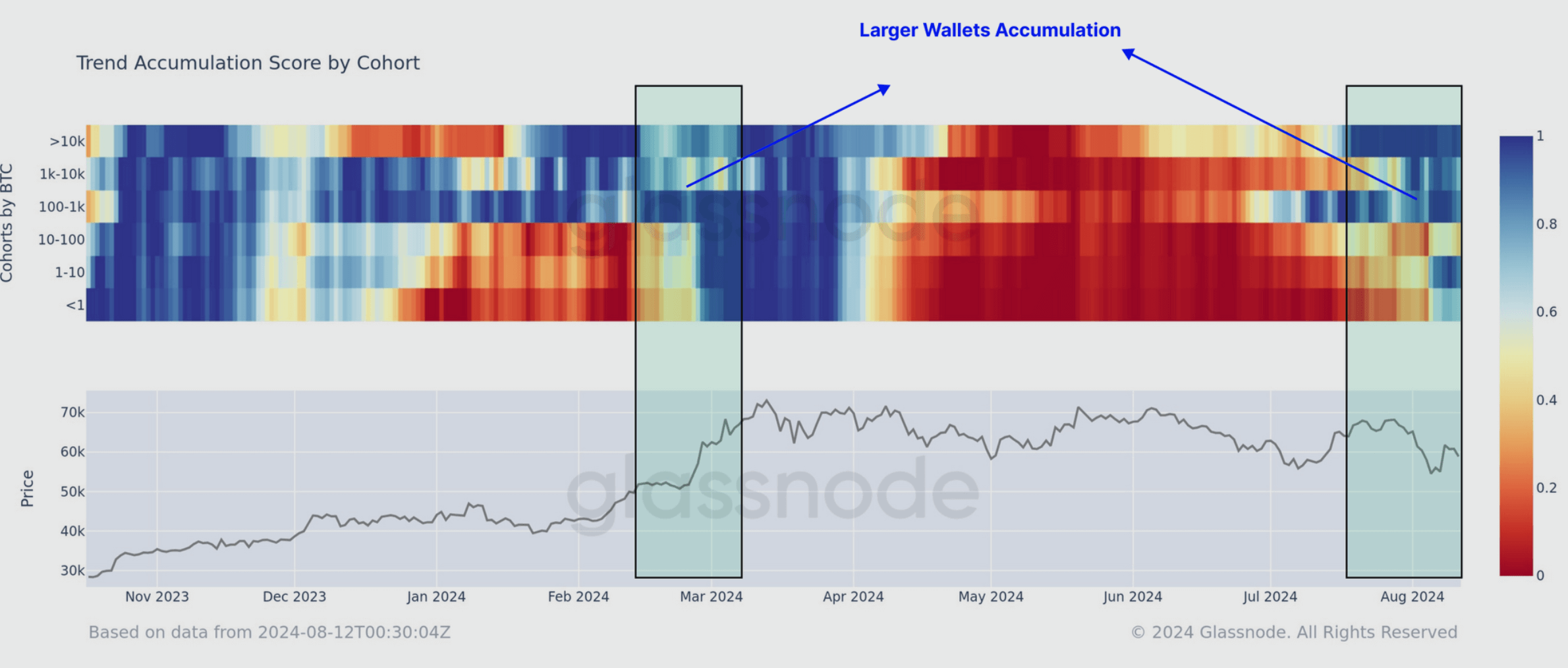

The company’s chain data shows that since Bitcoin reached an all-time high in March, the market has gone through a prolonged period of supply distribution, with portfolios of all sizes participating.

In recent weeks, however, there have been early signs of a reversal, particularly among the largest size portfolios, which are often associated with institutional investors such as ETFs. These large portfolios appear to be shifting back toward accumulation.

Glassnode experts suggest that spot market demand could resume if the adjusted CVD measure crosses the zero line and moves into positive territory. If that happens, Bitcoin could potentially break out of its current consolidation phase, to exceed the supply congestion zone of $70,000 to $72,000.

Bitcoin Faces Risk of Major Decline After Months Without New Highs

Veteran trader Peter Brandt recently cautioned that Bit […]

Bitcoin: Is a Strong Q4 Ahead or Are Short Positions Looming?

Bitcoin (BTC) has made headlines by surpassing the crit […]

Bitcoin’s Price Could Skyrocked by Over 470%, According to Analyst

Gert van Lagen, a prominent technical analyst, predicts […]

Bitcoin Price Controversy: Is BTC Heading Lower or On the Verge of a Surge?

Bitcoin sentiment has shifted slightly towards the posi […]

-

1

Bitcoin: Is a Strong Q4 Ahead or Are Short Positions Looming?

07.10.2024 17:15 2 閱讀分鐘 -

2

Bitcoin Price Analysis: Outlook for Continued Decline

08.07.2024 9:00 2 閱讀分鐘 -

3

Bitcoin Faces Further Price Drop Amid Government Move

30.07.2024 14:30 2 閱讀分鐘 -

4

Bitcoin Price Struggles with Resistance as Market Faces Volatility

16.08.2024 13:30 2 閱讀分鐘 -

5

Bitcoin Could be on the Verge of a Breakout – Here’s Why

19.06.2024 6:30 2 閱讀分鐘