加密貨幣屬於高風險資產類別,投資涉及重大風險,包括可能損失部分或全部投資。本網站資訊僅供參考及教育之用,不構成財務、投資或交易建議。如需了解更多詳情,請閱讀我們的編輯政策。

Ethereum (ETH) Price Struggles With Key Resistance Levels

17 9 月, 2024 19:00 1 閱讀分鐘

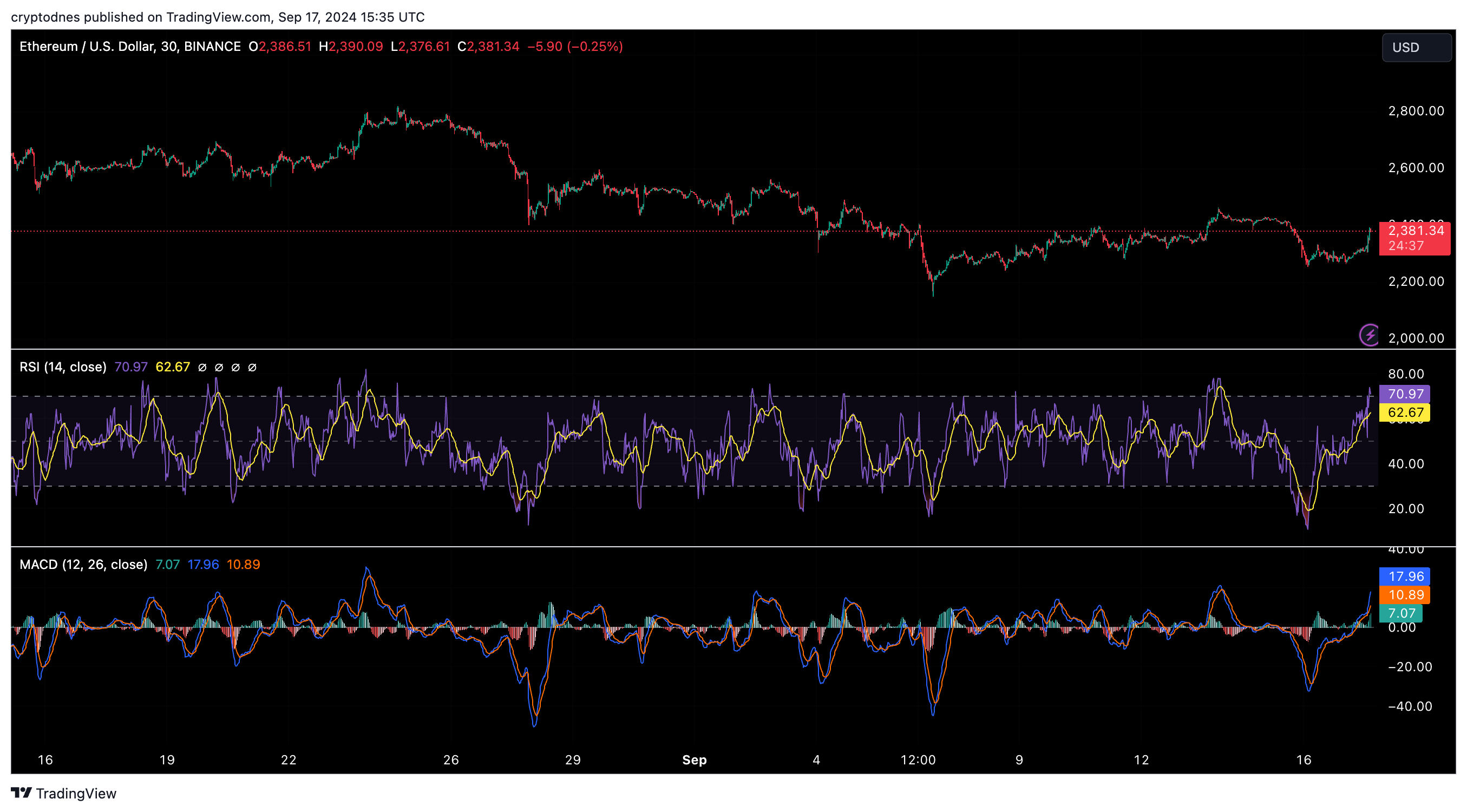

Recently, Ethereum failed to overcome the $2,450 resistance, which led to a drop below $2,400 and $2,350, with a short-term low of $2,253.

Although it has attempted a minor recovery above $2,285, it is still below the $2,310 level and its 100-hour simple moving average (SMA). Resistance is building at $2,300 and the major barrier is at $2,360.

A break above $2,360 could push Ethereum towards $2,420, but failure to overcome this resistance could lead to further declines, with support levels at $2,265 and $2,250. A drop below $2,250 could see prices fall to $2,200 or even $2,150.

Technical indicators, including the relative strength index (RSI) below 50, reflect weak buyer activity, indicating that sellers are still dominating. The moving average convergence divergence (MACD) remains in the bearish zone, suggesting limited potential for a strong recovery.

Overall, the near-term outlook for Ethereum remains bearish unless it can overcome the $2,360 resistance. Continued bearish signals from both the RSI and MACD suggest there is little likelihood of a significant rebound, with further declines possible.

以太坊價格預測: 分析師確認市場修正中的看跌趨勢

以太坊 近期的市場表現引起了分析師的警覺。ETH 從 10 月份的 2,400 美元開始,到 11 月份達到 […]

Ethereum Crash Alert: Analyst Predicts Potential Drop Below $1,200

Crypto analyst Benjamin Cowen has shared a cautious out […]

What Technical Indicators Show About the Price of Ethereum

Despite the approval of the Ethereum ETF, the ETH price […]

Ethereum: $2,500 the Bears’ Next Target?

Ethereum (ETH) has been in a downtrend since falling be […]

-

1

以太坊價格預測: 分析師確認市場修正中的看跌趨勢

01.11.2024 21:00 1 閱讀分鐘 -

2

Ethereum: $2,500 the Bears’ Next Target?

14.05.2024 18:30 2 閱讀分鐘 -

3

What Technical Indicators Show About the Price of Ethereum

06.06.2024 12:00 2 閱讀分鐘 -

4

Ethereum Crash Alert: Analyst Predicts Potential Drop Below $1,200

05.09.2024 13:30 1 閱讀分鐘 -

5

Ethereum (ETH) Price Struggles With Key Resistance Levels

17.09.2024 19:00 1 閱讀分鐘