Bitcoin Price Struggles with Resistance as Market Faces Volatility

Over the past week, the price of Bitcoin has fluctuated within a narrow range of $57,815 to $61,815, encountering persistent resistance at the 50-day simple moving average (SMA) of $61,662.

At the time of writing, the price of Bitcoin (BTC) is around $58,500, reflecting a slight 0.7% spike over the past day. This marks a decline of 4% from its price seven days ago.

According to data provided by analytics company Glassnode, the recent volatility in the price of Bitcoin can be attributed in part to “weakness in spot demand.”

Glassnode assessed the current net balance of buying and selling in the spot Bitcoin market by analyzing the cumulative volume delta (CVD), which helps identify any directional trend in market activity.

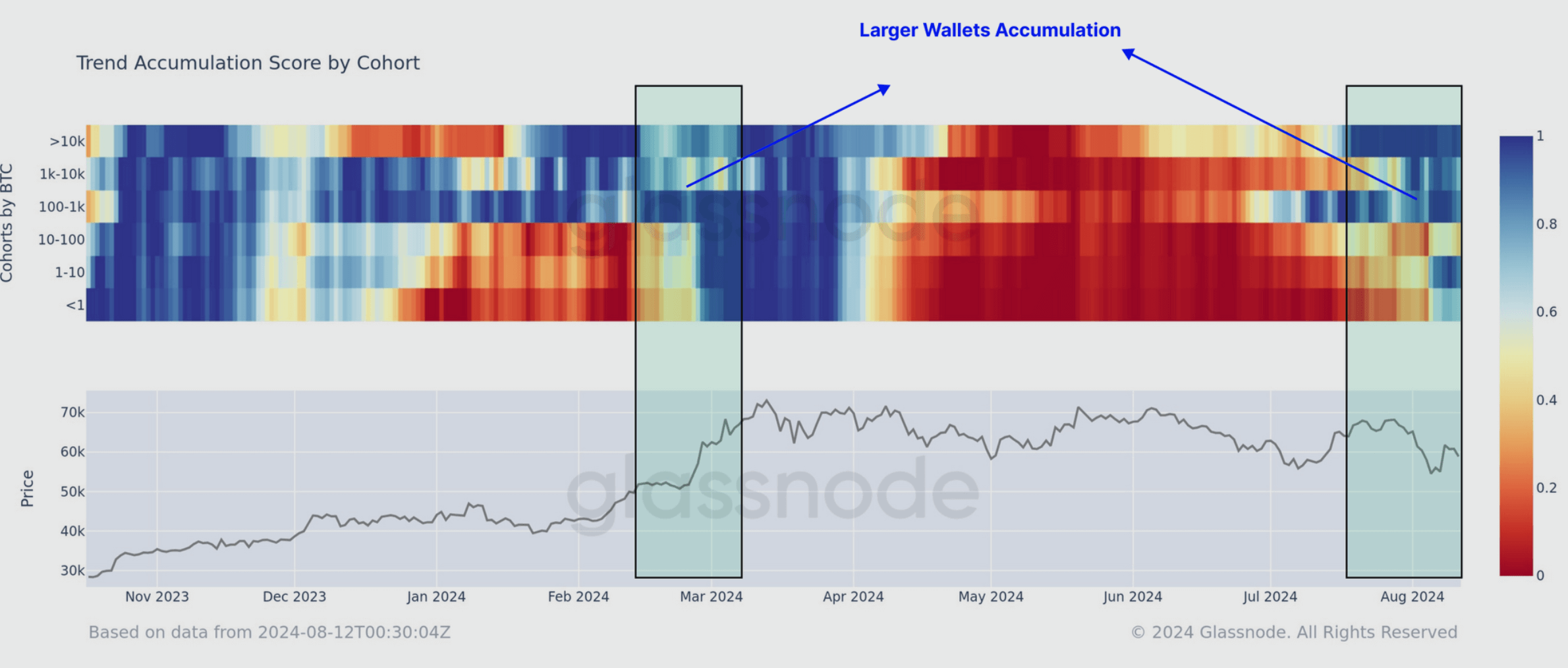

The company’s chain data shows that since Bitcoin reached an all-time high in March, the market has gone through a prolonged period of supply distribution, with portfolios of all sizes participating.

In recent weeks, however, there have been early signs of a reversal, particularly among the largest size portfolios, which are often associated with institutional investors such as ETFs. These large portfolios appear to be shifting back toward accumulation.

Glassnode experts suggest that spot market demand could resume if the adjusted CVD measure crosses the zero line and moves into positive territory. If that happens, Bitcoin could potentially break out of its current consolidation phase, to exceed the supply congestion zone of $70,000 to $72,000.

Bitcoin Faces Risk of Major Decline After Months Without New Highs

Veteran trader Peter Brandt recently cautioned that Bit […]

Bitcoin: Is a Strong Q4 Ahead or Are Short Positions Looming?

Bitcoin (BTC) has made headlines by surpassing the crit […]

Bitcoin’s Price Could Skyrocked by Over 470%, According to Analyst

Gert van Lagen, a prominent technical analyst, predicts […]

Bitcoin Price Controversy: Is BTC Heading Lower or On the Verge of a Surge?

Bitcoin sentiment has shifted slightly towards the posi […]

-

1

Bitcoin is Heading Towards $90,000 According to This Technical Model

24.05.2024 18:00 2 分鐘讀 -

2

Bitcoin’s RSI Signals Possible Buying Opportunity Amid Market Volatility

20.08.2024 7:00 1 分鐘讀 -

3

Here’s When Bitcoin Could Leave the “Boring Zone” and Head for New Highs

28.08.2024 21:00 2 分鐘讀 -

4

Bitcoin’s Price Could Skyrocked by Over 470%, According to Analyst

25.09.2024 14:30 2 分鐘讀 -

5

Bitcoin Price Controversy: Is BTC Heading Lower or On the Verge of a Surge?

15.09.2024 8:30 1 分鐘讀