Bitcoin Price Controversy: Is BTC Heading Lower or On the Verge of a Surge?

15 9 月, 2024 8:30 1 閱讀分鐘

Bitcoin sentiment has shifted slightly towards the positive after a recent dip, with the cryptocurrency testing the $60,000 mark. Despite this, technical analyst Alan Santana has voiced a bearish outlook, suggesting that Bitcoin’s price chart indicates a downward trend.

Santana, known for his technical analysis on TradingView, reiterated his short position in a September 14 update, emphasizing his belief that the market will decline based on current chart patterns.

Santana’s analysis highlights a history of market misjudgment, where widespread optimism did not align with technical indicators. He has opened short positions at $56,000, $58,000, and $60,000, setting a stop-loss at $66,000 and targeting a drop to as low as $39,000 for maximum profit.

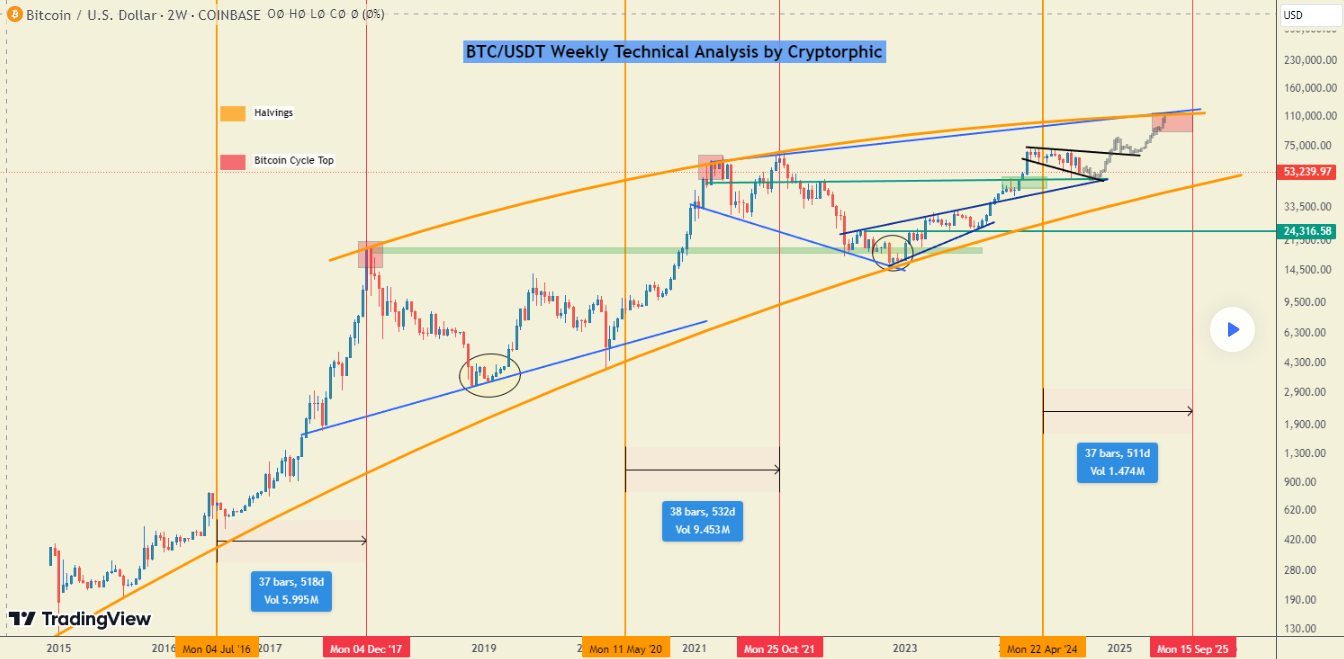

While Santana maintains a bearish stance, other analysts present a more optimistic view for Bitcoin’s long-term prospects. For instance, Credible Crypto has noted a bullish trend and is preparing for a significant upward movement. Similarly, AI predictions suggest Bitcoin could reach $90,000 by the end of 2024, a forecast also supported by Cryptorphic, which anticipates a price of $93,000.

The market remains volatile with contrasting opinions, reflecting its unpredictable nature. As Santana cautions, leveraged trading carries risks and requires careful strategy, underscoring the necessity for stop-loss measures in uncertain conditions.

Bitcoin Faces Risk of Major Decline After Months Without New Highs

Veteran trader Peter Brandt recently cautioned that Bit […]

Bitcoin: Is a Strong Q4 Ahead or Are Short Positions Looming?

Bitcoin (BTC) has made headlines by surpassing the crit […]

Bitcoin’s Price Could Skyrocked by Over 470%, According to Analyst

Gert van Lagen, a prominent technical analyst, predicts […]

Here’s When Bitcoin Could Leave the “Boring Zone” and Head for New Highs

A well-known crypto analyst believes that Bitcoin (BTC) […]

-

1

Bitcoin is Heading Towards $90,000 According to This Technical Model

24.05.2024 18:00 2 閱讀分鐘 -

2

Bitcoin’s RSI Signals Possible Buying Opportunity Amid Market Volatility

20.08.2024 7:00 1 閱讀分鐘 -

3

Here’s When Bitcoin Could Leave the “Boring Zone” and Head for New Highs

28.08.2024 21:00 2 閱讀分鐘 -

4

Bitcoin’s Price Could Skyrocked by Over 470%, According to Analyst

25.09.2024 14:30 2 閱讀分鐘 -

5

Bitcoin Price Controversy: Is BTC Heading Lower or On the Verge of a Surge?

15.09.2024 8:30 1 閱讀分鐘