Bitcoin Faces Further Price Drop Amid Government Move

After starting the week strongly, Bitcoin has recently seen a downturn. Currently priced at $66,500, Bitcoin has slipped by 4.5% in the past 24 hours.

This decline may be linked to the U.S. government’s recent transfer of $2 billion in Bitcoin seized from the Silk Road operation.

Veteran trader Roman Trading forecasts that Bitcoin might drop further to around $60,000.

$BTC 1D

Eyeing price targets of 64 & 60k respectively.

Showing bear divs with a possible DT reversal setup.

My bet is sentiment gets ultra bearish at these levels then we full send up once again.#bitcoin #cryptocurrency #cryptonews pic.twitter.com/YWPA6kPRoY

— Roman (@Roman_Trading) July 29, 2024

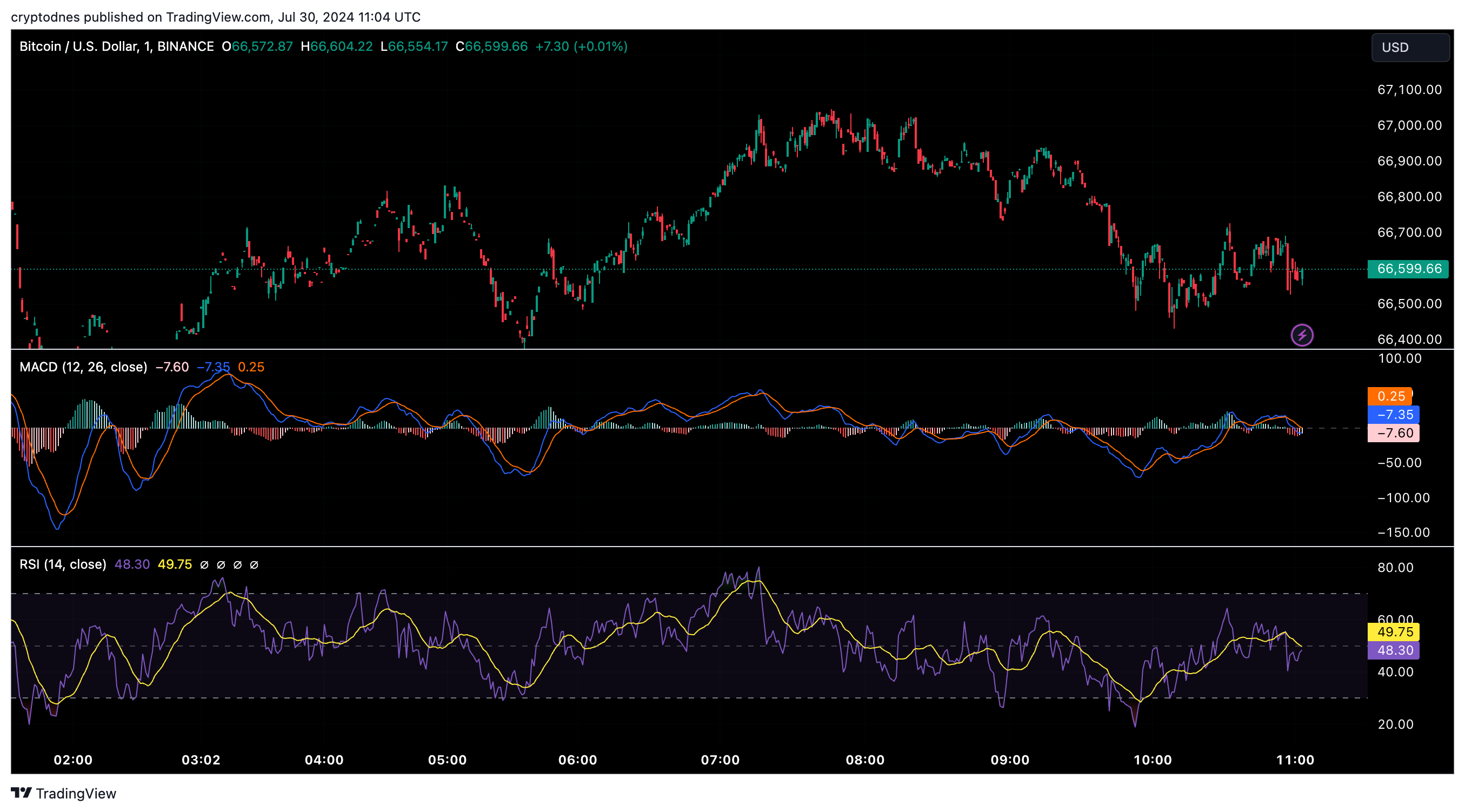

He points to bearish divergence on the 1-day chart, where despite price highs, momentum indicators like RSI and MACD are not aligning.

This pattern could signal a possible double-top reversal, suggesting Bitcoin might be on the verge of a correction.

The recent decline from $69,811 to around $66,500 adds weight to this bearish outlook. Roman Trading highlights that Bitcoin’s ability to hold the $66,000 resistance level is crucial. If it fails, attention will shift to potential support levels at $64,000 and $60,000.

Additionally, the U.S. government’s transfer of $2 billion in Bitcoin might have influenced the market. The transfer, involving 29,800 BTC moved to a new address and then dispersed further, followed Donald Trump’s recent announcement to acquire Bitcoin.

Despite the current negative sentiment, Roman Trading remains hopeful. He suggests that an overly pessimistic market could set the stage for a significant price rebound, as anxious traders might create favorable conditions for a future rally.

Bitcoin Faces Risk of Major Decline After Months Without New Highs

Veteran trader Peter Brandt recently cautioned that Bit […]

Bitcoin: Is a Strong Q4 Ahead or Are Short Positions Looming?

Bitcoin (BTC) has made headlines by surpassing the crit […]

Bitcoin’s Price Could Skyrocked by Over 470%, According to Analyst

Gert van Lagen, a prominent technical analyst, predicts […]

Bitcoin Price Controversy: Is BTC Heading Lower or On the Verge of a Surge?

Bitcoin sentiment has shifted slightly towards the posi […]

-

1

Bitcoin is Heading Towards $90,000 According to This Technical Model

24.05.2024 18:00 2 分鐘讀 -

2

Bitcoin’s RSI Signals Possible Buying Opportunity Amid Market Volatility

20.08.2024 7:00 1 分鐘讀 -

3

Here’s When Bitcoin Could Leave the “Boring Zone” and Head for New Highs

28.08.2024 21:00 2 分鐘讀 -

4

Bitcoin’s Price Could Skyrocked by Over 470%, According to Analyst

25.09.2024 14:30 2 分鐘讀 -

5

Bitcoin Price Controversy: Is BTC Heading Lower or On the Verge of a Surge?

15.09.2024 8:30 1 分鐘讀